Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Note 37 Financial risks and financial policy<br />

Finance and treasury<br />

The Group is exposed to various types of financial risks through its<br />

operations. The term financial risk refers to fluctuations in the company’s<br />

profits and cash flow resulting from changes in exchange rates,<br />

interest rates, refinancing and credit risks. Group finance and treasury<br />

is governed by the financial policy established by <strong>Peab</strong>’s Board of<br />

Directors. The policy is a framework of guidelines and regulations in<br />

the form of a risk mandate and limitations in finance and treasury. The<br />

Board has appointed a finance and treasury committee which is<br />

chaired by the Chairman of the Board. It is authorised to take decisions<br />

that follow the financial policy in between meetings of the<br />

Board. The finance and treasury committee must <strong>report</strong> any such<br />

decisions at the next meeting of the Board. The Group staff Finance<br />

and treasury and the Group’s internal bank <strong>Peab</strong> Finans AB manage<br />

coordination of Group finance and treasury. The overall responsibility<br />

of the finance and treasury function is to provide cost-effective funding<br />

and to minimise the negative effects on Group profit due to the<br />

price of financial risks.<br />

The liquidity risk refers to the risk of <strong>Peab</strong> having difficulties in meeting<br />

its payment obligations as a result of a lack of liquidity or problems<br />

in converting or recieving new loans. The Group has a rolling<br />

one month liquidity plan for all the units in the Group. Plans are updated<br />

each week. Group forecasts also comprise liquidity planning in the<br />

medium term. Liquidity planning is used to handle the liquidity risk<br />

and the cost of Group financing. The objective is for the Group to be<br />

able to meet its financial obligations in favourable and unfavourable<br />

market conditions without running into significant unforeseen costs.<br />

Liquidity risks are managed centrally for the entire Group by the<br />

central Finance and treasury function and at year-end liquid funds<br />

were available as shown below.<br />

The financial policy dictates that Group net debt should mainly be<br />

covered by loan commitments that mature between 1 and 7 years. At<br />

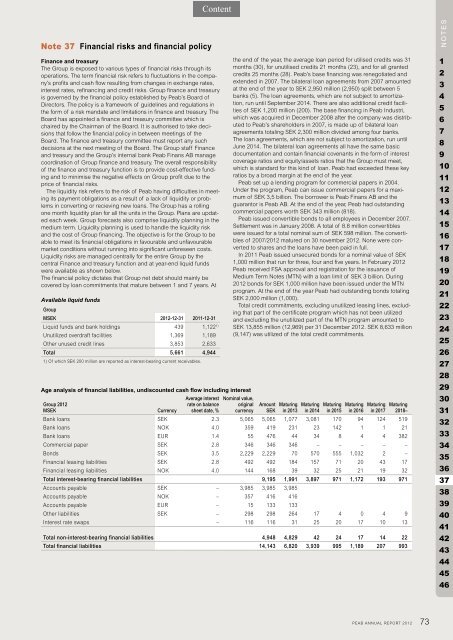

Available liquid funds<br />

Group<br />

MSEK <strong>2012</strong>-12-31 2011-12-31<br />

Liquid funds and bank holdings 439 1,1221) Unutilized overdraft facilities 1,369 1,189<br />

Other unused credit lines 3,853 2,633<br />

Total 5,661 4,944<br />

1) Of which SEK 200 million are <strong>report</strong>ed as interest-bearing current receivables.<br />

Age analysis of financial liabilities, undiscounted cash flow including interest<br />

Group <strong>2012</strong><br />

MSEK Currency<br />

Average interest<br />

rate on balance<br />

sheet date, %<br />

the end of the year, the average loan period for utilised credits was 31<br />

months (30), for unutilised credits 21 months (23), and for all granted<br />

credits 25 months (28). <strong>Peab</strong>’s base financing was renegotiated and<br />

extended in 2007. The bilateral loan agreements from 2007 amounted<br />

at the end of the year to SEK 2,950 million (2,950) split between 5<br />

banks (5). The loan agreements, which are not subject to amortization,<br />

run until September 2014. There are also additional credit facilities<br />

of SEK 1,200 million (200). The base financing in <strong>Peab</strong> Industri,<br />

which was acquired in December 2008 after the company was distributed<br />

to <strong>Peab</strong>’s shareholders in 2007, is made up of bilateral loan<br />

agreements totaling SEK 2,300 million divided among four banks.<br />

The loan agreements, which are not subject to amortization, run until<br />

June 2014. The bilateral loan agreements all have the same basic<br />

documentation and contain financial covenants in the form of interest<br />

coverage ratios and equity/assets ratios that the Group must meet,<br />

which is standard for this kind of loan. <strong>Peab</strong> had exceeded these key<br />

ratios by a broad margin at the end of the year.<br />

<strong>Peab</strong> set up a lending program for commercial papers in 2004.<br />

Under the program, <strong>Peab</strong> can issue commercial papers for a maximum<br />

of SEK 3,5 billion. The borrower is <strong>Peab</strong> Finans AB and the<br />

guarantor is <strong>Peab</strong> AB. At the end of the year, <strong>Peab</strong> had outstanding<br />

commercial papers worth SEK 343 million (818).<br />

<strong>Peab</strong> issued convertible bonds to all employees in December 2007.<br />

Settlement was in January 2008. A total of 8.8 million convertibles<br />

were issued for a total nominal sum of SEK 598 million. The convertibles<br />

of 2007/<strong>2012</strong> matured on 30 november <strong>2012</strong>. None were converted<br />

to shares and the loans have been paid in full.<br />

In 2011 <strong>Peab</strong> issued unsecured bonds for a nominal value of SEK<br />

1,000 million that run for three, four and five years. In February <strong>2012</strong><br />

<strong>Peab</strong> received FSA approval and registration for the issuance of<br />

Medium Term Notes (MTN) with a loan limit of SEK 3 billion. During<br />

<strong>2012</strong> bonds for SEK 1,000 million have been issued under the MTN<br />

program. At the end of the year <strong>Peab</strong> had outstanding bonds totaling<br />

SEK 2,000 million (1,000).<br />

Total credit commitments, excluding unutilized leasing lines, excluding<br />

that part of the certificate program which has not been utilized<br />

and excluding the unutilized part of the MTN program amounted to<br />

SEK 13,855 million (12,969) per 31 December <strong>2012</strong>. SEK 8,633 million<br />

(9,147) was utilized of the total credit commitments.<br />

Nominal value,<br />

original<br />

currency<br />

Amount<br />

SEK<br />

Maturing<br />

in 2013<br />

Maturing<br />

in 2014<br />

Maturing<br />

in 2015<br />

Maturing<br />

in 2016<br />

Maturing<br />

in 2017<br />

Maturing<br />

2018–<br />

Bank loans SEK 2.3 5,065 5,065 1,077 3,081 170 94 124 519<br />

Bank loans NOK 4.0 359 419 231 23 142 1 1 21<br />

Bank loans EUR 1.4 55 476 44 34 8 4 4 382<br />

Commercial paper SEK 2.8 346 346 346 – – – – –<br />

Bonds SEK 3.5 2,229 2,229 70 570 555 1,032 2 –<br />

Financial leasing liabilities SEK 2.8 492 492 184 157 71 20 43 17<br />

Financial leasing liabilities NOK 4.0 144 168 39 32 25 21 19 32<br />

Total interest-bearing financial liabilities 9,195 1,991 3,897 971 1,172 193 971<br />

Accounts payable SEK – 3,985 3,985 3,985<br />

Accounts payable NOK – 357 416 416<br />

Accounts payable EUR – 15 133 133<br />

Other liabilities SEK – 298 298 264 17 4 0 4 9<br />

Interest rate swaps – 116 116 31 25 20 17 10 13<br />

Total non-interest-bearing financial liabilities 4,948 4,829 42 24 17 14 22<br />

Total financial liabilities 14,143 6,820 3,939 995 1,189 207 993<br />

PEAB ANNUAL REPORT <strong>2012</strong><br />

73<br />

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46