You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

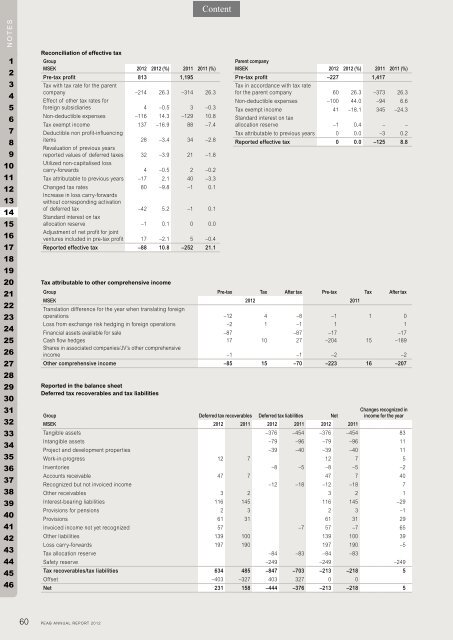

Reconciliation of effective tax<br />

Group<br />

MSEK <strong>2012</strong> <strong>2012</strong> (%) 2011 2011 (%)<br />

Pretax profit<br />

Tax with tax rate for the parent<br />

813 1,195<br />

company<br />

Effect of other tax rates for<br />

–214 26.3 –314 26.3<br />

foreign subsidiaries 4 –0.5 3 –0.3<br />

Non-deductible expenses –116 14.3 –129 10.8<br />

Tax exempt income<br />

Deductible non profit-influencing<br />

137 –16.9 88 –7.4<br />

items<br />

Revaluation of previous years<br />

28 –3.4 34 –2.8<br />

<strong>report</strong>ed values of deferred taxes<br />

Utilized non-capitalised loss<br />

32 –3.9 21 –1.8<br />

carry-forwards 4 –0.5 2 –0.2<br />

Tax attributable to previous years –17 2.1 40 –3.3<br />

Changed tax rates<br />

Increase in loss carry-forwards<br />

without corresponding activation<br />

80 –9.8 –1 0.1<br />

of deferred tax<br />

Standard interest on tax<br />

–42 5.2 –1 0.1<br />

allocation reserve<br />

Adjustment of net profit for joint<br />

–1 0.1 0 0.0<br />

ventures included in pre-tax profit 17 –2.1 5 –0.4<br />

Reported effective tax –88 10.8 –252 21.1<br />

Tax attributable to other comprehensive income<br />

Group Pretax Tax After tax Pretax Tax After tax<br />

MSEK <strong>2012</strong> 2011<br />

Translation difference for the year when translating foreign<br />

operations –12 4 –8 –1 1 0<br />

Loss from exchange risk hedging in foreign operations –2 1 –1 1 1<br />

Financial assets available for sale –87 –87 –17 –17<br />

Cash flow hedges<br />

Shares in associated companies/JV’s other comprehensive<br />

17 10 27 –204 15 –189<br />

income –1 –1 –2 –2<br />

Other comprehensive income –85 15 –70 –223 16 –207<br />

Reported in the balance sheet<br />

Deferred tax recoverables and tax liabilities<br />

Parent company<br />

MSEK <strong>2012</strong> <strong>2012</strong> (%) 2011 2011 (%)<br />

Pretax profit<br />

Tax in accordance with tax rate<br />

–227 1,417<br />

for the parent company 60 26.3 –373 26.3<br />

Non-deductible expenses –100 44.0 –94 6.6<br />

Tax exempt income<br />

Standard interest on tax<br />

41 –18.1 345 –24.3<br />

allocation reserve –1 0.4 – –<br />

Tax attributable to previous years 0 0.0 –3 0.2<br />

Reported effective tax 0 0.0 –125 8.8<br />

Group Deferred tax recoverables Deferred tax liabilities Net<br />

Changes recognized in<br />

income for the year<br />

MSEK <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Tangible assets –376 –454 –376 –454 83<br />

Intangible assets –79 –96 –79 –96 11<br />

Project and development properties –39 –40 –39 –40 11<br />

Work-in-progress 12 7 12 7 5<br />

Inventories –8 –5 –8 –5 –2<br />

Accounts receivable 47 7 47 7 40<br />

Recognized but not invoiced income –12 –18 –12 –18 7<br />

Other receivables 3 2 3 2 1<br />

Interest-bearing liabilities 116 145 116 145 –29<br />

Provisions for pensions 2 3 2 3 –1<br />

Provisions 61 31 61 31 29<br />

Invoiced income not yet recognized 57 –7 57 –7 65<br />

Other liabilities 139 100 139 100 39<br />

Loss carry-forwards 197 190 197 190 –5<br />

Tax allocation reserve –84 –83 –84 –83<br />

Safety reserve –249 –249 –249<br />

Tax recoverables/tax liabilities 634 485 –847 –703 –213 –218 5<br />

Offset –403 –327 403 327 0 0<br />

Net 231 158 –444 –376 –213 –218 5<br />

60 PEAB ANNUAL REPORT <strong>2012</strong>