Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

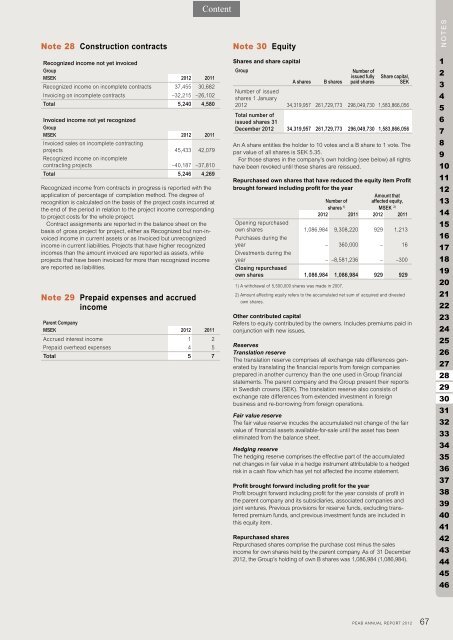

Note 28 Construction contracts<br />

Recognized income not yet invoiced<br />

Group<br />

MSEK <strong>2012</strong> 2011<br />

Recognized income on incomplete contracts 37,455 30,682<br />

Invoicing on incomplete contracts –32,215 –26,102<br />

Total 5,240 4,580<br />

Invoiced income not yet recognized<br />

Group<br />

MSEK<br />

Invoiced sales on incomplete contracting<br />

<strong>2012</strong> 2011<br />

projects<br />

Recognized income on incomplete<br />

45,433 42,079<br />

contracting projects –40,187 –37,810<br />

Total 5,246 4,269<br />

Recognized income from contracts in progress is <strong>report</strong>ed with the<br />

application of percentage of completion method. The degree of<br />

recognition is calculated on the basis of the project costs incurred at<br />

the end of the period in relation to the project income corresponding<br />

to project costs for the whole project.<br />

Contract assignments are <strong>report</strong>ed in the balance sheet on the<br />

basis of gross project for project, either as Recognized but non-invoiced<br />

income in current assets or as Invoiced but unrecognized<br />

income in current liabilities. Projects that have higher recognized<br />

incomes than the amount invoiced are <strong>report</strong>ed as assets, while<br />

projects that have been invoiced for more than recognized income<br />

are <strong>report</strong>ed as liabilities.<br />

Note 29 Prepaid expenses and accrued<br />

income<br />

Parent Company<br />

MSEK <strong>2012</strong> 2011<br />

Accrued interest income 1 2<br />

Prepaid overhead expenses 4 5<br />

Total 5 7<br />

Note 30 Equity<br />

Shares and share capital<br />

Group<br />

A shares B shares<br />

Number of<br />

issued fully<br />

paid shares<br />

Share capital,<br />

SEK<br />

Number of issued<br />

shares 1 January<br />

<strong>2012</strong><br />

Total number of<br />

issued shares 31<br />

34,319,957 261,729,773 296,049,730 1,583,866,056<br />

December <strong>2012</strong> 34,319,957 261,729,773 296,049,730 1,583,866,056<br />

An A share entitles the holder to 10 votes and a B share to 1 vote. The<br />

par value of all shares is SEK 5.35.<br />

For those shares in the company’s own holding (see below) all rights<br />

have been revoked until these shares are reissued.<br />

Repurchased own shares that have reduced the equity item Profit<br />

brought forward including profit for the year<br />

Number of<br />

shares 1)<br />

Amount that<br />

affected equity,<br />

MSEK 2)<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Opening repurchased<br />

own shares<br />

Purchases during the<br />

1,086,984 9,308,220 929 1,213<br />

year<br />

Divestments during the<br />

– 360,000 – 16<br />

year<br />

Closing repurchased<br />

– –8,581,236 – –300<br />

own shares 1,086,984 1,086,984 929 929<br />

1) A withdrawal of 5,500,000 shares was made in 2007.<br />

2) Amount affecting equity refers to the accumulated net sum of acquired and divested<br />

own shares.<br />

Other contributed capital<br />

Refers to equity contributed by the owners. Includes premiums paid in<br />

conjunction with new issues.<br />

Reserves<br />

Translation reserve<br />

The translation reserve comprises all exchange rate differences generated<br />

by translating the financial <strong>report</strong>s from foreign companies<br />

prepared in another currency than the one used in Group financial<br />

statements. The parent company and the Group present their <strong>report</strong>s<br />

in Swedish crowns (SEK). The translation reserve also consists of<br />

exchange rate differences from extended investment in foreign<br />

business and re-borrowing from foreign operations.<br />

Fair value reserve<br />

The fair value reserve incudes the accumulated net change of the fair<br />

value of financial assets available-for-sale until the asset has been<br />

eliminated from the balance sheet.<br />

Hedging reserve<br />

The hedging reserve comprises the effective part of the accumulated<br />

net changes in fair value in a hedge instrument attributable to a hedged<br />

risk in a cash flow which has yet not affected the income statement.<br />

Profit brought forward including profit for the year<br />

Profit brought forward including profit for the year consists of profit in<br />

the parent company and its subsidiaries, associated companies and<br />

joint ventures. Previous provisions for reserve funds, excluding transferred<br />

premium funds, and previous investment funds are included in<br />

this equity item.<br />

Repurchased shares<br />

Repurchased shares comprise the purchase cost minus the sales<br />

income for own shares held by the parent company. As of 31 December<br />

<strong>2012</strong>, the Group’s holding of own B shares was 1,086,984 (1,086,984).<br />

PEAB ANNUAL REPORT <strong>2012</strong><br />

67<br />

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46