Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

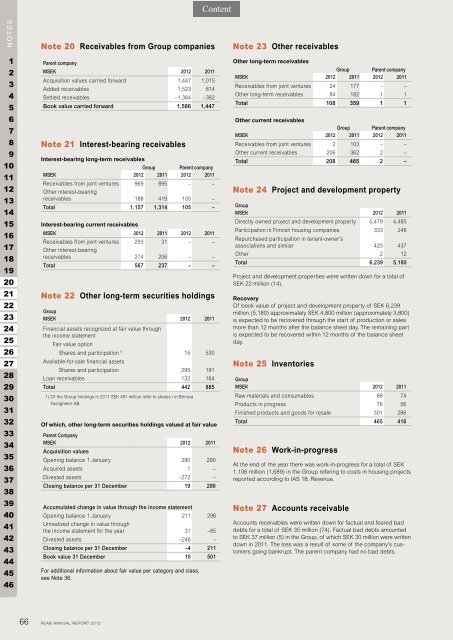

Note 20 Receivables from Group companies<br />

Parent company<br />

MSEK <strong>2012</strong> 2011<br />

Acquisition values carried forward 1,447 1,015<br />

Added receivables 1,523 814<br />

Settled receivables –1,384 –382<br />

Book value carried forward 1,586 1,447<br />

Note 21 Interest-bearing receivables<br />

Interest-bearing long-term receivables<br />

Group Parent company<br />

MSEK <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Receivables from joint ventures<br />

Other interest-bearing<br />

969 895 – –<br />

receivables 188 419 105 –<br />

Total 1,157 1,314 105 –<br />

Interest-bearing current receivables<br />

MSEK <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Receivables from joint ventures<br />

Other interest-bearing<br />

293 31 – –<br />

receivables 274 206 – –<br />

Total 567 237 – –<br />

Note 22 Other long-term securities holdings<br />

Group<br />

MSEK<br />

Financial assets recognized at fair value through<br />

the income statement<br />

Fair value option<br />

<strong>2012</strong> 2011<br />

Shares and participation 1) Available-for-sale financial assets<br />

15 530<br />

Shares and participation 295 191<br />

Loan receivables 132 164<br />

Total 442 885<br />

1) Of the Group holdings in 2011 SEK 491 million refer to shares i in Brinova<br />

Fastigheter AB.<br />

Of which, other long-term securities holdings valued at fair value<br />

Parent Company<br />

MSEK<br />

Acquisition values<br />

<strong>2012</strong> 2011<br />

Opening balance 1 January 290 290<br />

Acquired assets 1 –<br />

Divested assets –272 –<br />

Closing balance per 31 December 19 290<br />

Accumulated change in value through the income statement<br />

Opening balance 1 January<br />

Unrealized change in value through<br />

211 296<br />

the income statement for the year 31 –85<br />

Divested assets –246 –<br />

Closing balance per 31 December –4 211<br />

Book value 31 December 15 501<br />

For additional information about fair value per category and class,<br />

see Note 36.<br />

66 PEAB ANNUAL REPORT <strong>2012</strong><br />

Note 23 Other receivables<br />

Other long-term receivables<br />

Group Parent company<br />

MSEK <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Receivables from joint ventures 24 177 – –<br />

Other long-term receivables 84 182 1 1<br />

Total 108 359 1 1<br />

Other current receivables<br />

Group Parent company<br />

MSEK <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Receivables from joint ventures 2 103 – –<br />

Other current receivables 206 362 2 –<br />

Total 208 465 2 –<br />

Note 24 Project and development property<br />

Group<br />

MSEK <strong>2012</strong> 2011<br />

Directly owned project and development property 5,479 4,485<br />

Participation in Finnish housing companies<br />

Repurchased participation in tenant-owner's<br />

333 246<br />

associations and similar 425 437<br />

Other 2 12<br />

Total 6,239 5,180<br />

Project and development properties were written down for a total of<br />

SEK 22 million (14).<br />

Recovery<br />

Of book value of project and development property of SEK 6,239<br />

million (5,180) approximately SEK 4,800 million (approximately 3,800)<br />

is expected to be recovered through the start of production or sales<br />

more than 12 months after the balance sheet day. The remaining part<br />

is expected to be recovered within 12 months of the balance sheet<br />

day.<br />

Note 25 Inventories<br />

Group<br />

MSEK <strong>2012</strong> 2011<br />

Raw materials and consumables 88 74<br />

Products in progress 76 56<br />

Finished products and goods for resale 301 286<br />

Total 465 416<br />

Note 26 Work-in-progress<br />

At the end of the year there was work-in-progress for a total of SEK<br />

1,106 million (1,689) in the Group refering to costs in housing projects<br />

<strong>report</strong>ed according to IAS 18, Revenue.<br />

Note 27 Accounts receivable<br />

Accounts receivables were written down for factual and feared bad<br />

debts for a total of SEK 35 million (74). Factual bad debts amounted<br />

to SEK 37 million (5) in the Group, of which SEK 30 million were written<br />

down in 2011. The loss was a result of some of the company’s customers<br />

going bankrupt. The parent company had no bad debts.