Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

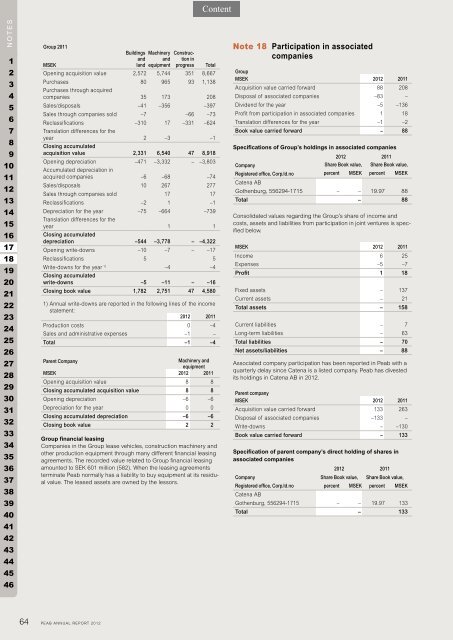

Group 2011<br />

MSEK<br />

Buildings Machinery Construc-<br />

and and tion in<br />

land equipment progress Total<br />

Opening acquisition value 2,572 5,744 351 8,667<br />

Purchases 80 965 93 1,138<br />

Purchases through acquired<br />

companies 35 173 208<br />

Sales/disposals –41 –356 –397<br />

Sales through companies sold –7 –66 –73<br />

Reclassifications<br />

Translation differences for the<br />

–310 17 –331 –624<br />

year<br />

Closing accumulated<br />

2 –3 –1<br />

acquisition value 2,331 6,540 47 8,918<br />

Opening depreciation<br />

Accumulated depreciation in<br />

–471 –3,332 – –3,803<br />

acquired companies –6 –68 –74<br />

Sales/disposals 10 267 277<br />

Sales through companies sold 17 17<br />

Reclassifications –2 1 –1<br />

Depreciation for the year<br />

Translation differences for the<br />

–75 –664 –739<br />

year<br />

Closing accumulated<br />

1 1<br />

depreciation –544 –3,778 – –4,322<br />

Opening write-downs –10 –7 – –17<br />

Reclassifications 5 5<br />

Write-downs for the year 1) Closing accumulated<br />

–4 –4<br />

write-downs –5 –11 – –16<br />

Closing book value 1,782 2,751 47 4,580<br />

1) <strong>Annual</strong> write-downs are <strong>report</strong>ed in the following lines of the income<br />

statement:<br />

<strong>2012</strong> 2011<br />

Production costs 0 –4<br />

Sales and administrative expenses –1 –<br />

Total –1 –4<br />

Parent Company<br />

Machinery and<br />

equipment<br />

MSEK <strong>2012</strong> 2011<br />

Opening acquisition value 8 8<br />

Closing accumulated acquisition value 8 8<br />

Opening depreciation –6 –6<br />

Depreciation for the year 0 0<br />

Closing accumulated depreciation –6 –6<br />

Closing book value 2 2<br />

Group financial leasing<br />

Companies in the Group lease vehicles, construction machinery and<br />

other production equipment through many different financial leasing<br />

agreements. The recorded value related to Group financial leasing<br />

amounted to SEK 601 million (582). When the leasing agreements<br />

terminate <strong>Peab</strong> normally has a liability to buy equipment at its residual<br />

value. The leased assets are owned by the lessors.<br />

64 PEAB ANNUAL REPORT <strong>2012</strong><br />

Note 18 Participation in associated<br />

companies<br />

Group<br />

MSEK <strong>2012</strong> 2011<br />

Acquisition value carried forward 88 208<br />

Disposal of associated companies –83 –<br />

Dividend for the year –5 –136<br />

Profit from participation in associated companies 1 18<br />

Translation differences for the year –1 –2<br />

Book value carried forward – 88<br />

Specifications of Group’s holdings in associated companies<br />

<strong>2012</strong> 2011<br />

Company Share Book value, Share Book value,<br />

Registered office, Corp.Id.no<br />

Catena AB<br />

percent MSEK percent MSEK<br />

Gothenburg, 556294-1715 – – 19.97 88<br />

Total – 88<br />

Consolidated values regarding the Group’s share of income and<br />

costs, assets and liabilities from participation in joint ventures is specified<br />

below.<br />

MSEK <strong>2012</strong> 2011<br />

Income 6 25<br />

Expenses –5 –7<br />

Profit 1 18<br />

Fixed assets – 137<br />

Current assets – 21<br />

Total assets – 158<br />

Current liabilities – 7<br />

Long-term liabilities – 63<br />

Total liabilities – 70<br />

Net assets/liabilities – 88<br />

Associated company participation has been <strong>report</strong>ed in <strong>Peab</strong> with a<br />

quarterly delay since Catena is a listed company. <strong>Peab</strong> has divested<br />

its holdings in Catena AB in <strong>2012</strong>.<br />

Parent company<br />

MSEK <strong>2012</strong> 2011<br />

Acquisition value carried forward 133 263<br />

Disposal of associated companies –133 –<br />

Write-downs – –130<br />

Book value carried forward – 133<br />

Specification of parent company’s direct holding of shares in<br />

associated companies<br />

<strong>2012</strong> 2011<br />

Company Share Book value, Share Book value,<br />

Registered office, Corp.Id.no<br />

Catena AB<br />

percent MSEK percent MSEK<br />

Gothenburg, 556294-1715 – – 19.97 133<br />

Total – 133