Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

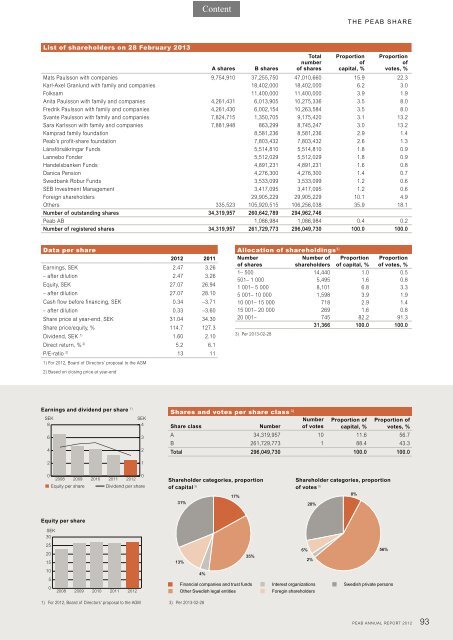

List of shareholders on 28 February 2013<br />

A shares B shares<br />

Total<br />

number<br />

of shares<br />

THE PEAB SHARE<br />

Proportion<br />

of<br />

capital, %<br />

Proportion<br />

of<br />

votes, %<br />

Mats Paulsson with companies 9,754,910 37,255,750 47,010,660 15.9 22.3<br />

Karl-Axel Granlund with family and companies 18,402,000 18,402,000 6.2 3.0<br />

Folksam 11,400,000 11,400,000 3.9 1.9<br />

Anita Paulsson with family and companies 4,261,431 6,013,905 10,275,336 3.5 8.0<br />

Fredrik Paulsson with family and companies 4,261,430 6,002,154 10,263,584 3.5 8.0<br />

Svante Paulsson with family and companies 7,824,715 1,350,705 9,175,420 3.1 13.2<br />

Sara Karlsson with family and companies 7,881,948 863,299 8,745,247 3.0 13.2<br />

Kamprad family foundation 8,581,236 8,581,236 2.9 1.4<br />

<strong>Peab</strong>’s profit-share foundation 7,803,432 7,803,432 2.6 1.3<br />

Länsförsäkringar Funds 5,514,810 5,514,810 1.8 0.9<br />

Lannebo Fonder 5,512,029 5,512,029 1.8 0.9<br />

Handelsbanken Funds 4,891,231 4,891,231 1.6 0.8<br />

Danica Pension 4,276,300 4,276,300 1.4 0.7<br />

Swedbank Robur Funds 3,533,099 3,533,099 1.2 0.6<br />

SEB Investment Management 3,417,095 3,417,095 1.2 0.6<br />

Foreign shareholders 29,905,229 29,905,229 10.1 4.9<br />

Others 335,523 105,920,515 106,256,038 35.9 18.1<br />

Number of outstanding shares 34,319,957 260,642,789 294,962,746<br />

<strong>Peab</strong> AB 1,086,984 1,086,984 0.4 0.2<br />

Number of registered shares 34,319,957 261,729,773 296,049,730 100.0 100.0<br />

Data per share<br />

<strong>2012</strong> 2011<br />

Earnings, SEK 2.47 3.26<br />

– after dilution 2.47 3.26<br />

Equity, SEK 27.07 26.94<br />

– after dilution 27.07 28.10<br />

Cash flow before financing, SEK 0.34 –3.71<br />

– after dilution 0.33 –3.60<br />

Share price at year-end, SEK 31.04 34.30<br />

Share price/equity, % 114.7 127.3<br />

Dividend, SEK 1) 1.60 2.10<br />

Direct return, % 2) 5.2 6.1<br />

P/E-ratio 2) 1) For <strong>2012</strong>, Board of Directors’ proposal to the AGM<br />

2) Based on closing price at year-end<br />

13 11<br />

Earnings and dividend per share<br />

SEK SEK<br />

8<br />

4<br />

1)<br />

6<br />

4<br />

2<br />

0<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Equity per share Dividend per share<br />

Equity per share<br />

SEK<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

2008<br />

2009<br />

2010<br />

2011<br />

<strong>2012</strong><br />

Shares and votes per share class 3)<br />

Share class Number<br />

Shareholder categories, proportion<br />

of capital 3)<br />

31%<br />

13%<br />

1) For <strong>2012</strong>, Board of Directors’ proposal to the AGM 3) Per 2013-02-28<br />

3<br />

2<br />

1<br />

0<br />

4%<br />

17%<br />

35%<br />

Number<br />

of votes<br />

Shareholder categories, proportion<br />

of votes 3)<br />

6%<br />

28%<br />

2%<br />

Proportion of<br />

capital, %<br />

8%<br />

Proportion of<br />

votes, %<br />

A 34,319,957 10 11.6 56.7<br />

B 261,729,773 1 88.4 43.3<br />

Total 296,049,730 100.0 100.0<br />

Financial companies and trust funds<br />

Other Swedish legal entities<br />

Allocation of shareholdings3) Number<br />

Number of Proportion<br />

of shares<br />

shareholders of capital, %<br />

Interest organizations<br />

Foregin shareholders<br />

Proportion<br />

of votes, %<br />

1– 500 14,440 1.0 0.5<br />

501– 1 000 5,495 1.6 0.8<br />

1 001– 5 000 8,101 6.8 3.3<br />

5 001– 10 000 1,598 3.9 1.9<br />

10 001– 15 000 718 2.9 1.4<br />

15 001– 20 000 269 1.6 0.8<br />

20 001– 745 82.2 91.3<br />

31,366 100.0 100.0<br />

3) Per 2013-02-28<br />

56%<br />

Swedish private persons<br />

PEAB ANNUAL REPORT <strong>2012</strong><br />

93