You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

Dividend<br />

After the balance sheet day the Board of Directors and the CEO<br />

proposed the following dividend; A cash dividend of SEK 1.60 (2.10)<br />

per share totalling SEK 473,679,568 (621,704,433), calculated on the<br />

number of registered shares. Total dividends are calculated on outstanding<br />

shares at the time of distribution.<br />

The dividend will be proposed for adoption by the AGM on 14 May<br />

2013.<br />

The parent company<br />

Restricted reserves<br />

Restricted reserves may not be reduced by the distribution of dividends.<br />

Reserve fund<br />

The purpose of the reserve fund is to retain a part of the net profit<br />

which is not allocated to cover balanced losses. The reserve also<br />

includes amounts transferred to the share premium reserve before<br />

1 January 2006.<br />

Unrestricted equity<br />

Together with profit for the year the following funds make up unrestricted<br />

equity, i.e. the amount available for dividends to the shareholders.<br />

Premium reserve<br />

When shares are issued at a premium, i.e. when more must be paid<br />

for the shares than their nominal price, an amount equivalent to the<br />

amount received in excess of the share’s nominal value is transferred<br />

to the share premium reserve. The amount transferred to the share<br />

premium reserve starting 1 January 2006 is included in unrestricted<br />

capital.<br />

Special reserves<br />

Refers to allocations to reserves upon the reduction of share capital<br />

for use as resolved by the AGM.<br />

Reserve for fair value<br />

The company uses the <strong>Annual</strong> Accounts Act rules for the valuation of<br />

financial instruments at fair value according to chapter 4 paragraph<br />

14a-e. A change in value is recognized in the reserve for fair value<br />

when it refers to a hedging instrument and the principles applied for<br />

hedge accounting allow for a portion or the entire change in value to<br />

be recognized in equity. A change in value caused by an exchange<br />

rate change on a monetary item which is part of the company’s net<br />

investment in a foreign unit is recognized in equity.<br />

Profit brought forward<br />

Consists of the previous year’s profit brought forward after the distribution<br />

of profits.<br />

68 PEAB ANNUAL REPORT <strong>2012</strong><br />

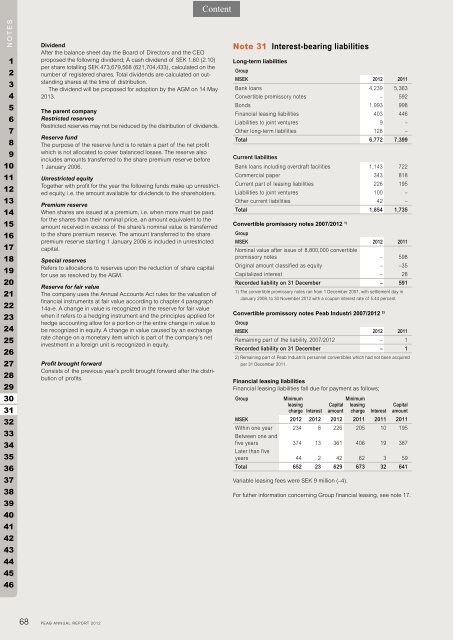

Note 31 Interest-bearing liabilities<br />

Long-term liabilities<br />

Group<br />

MSEK <strong>2012</strong> 2011<br />

Bank loans 4,239 5,363<br />

Convertible promissory notes – 592<br />

Bonds 1,993 998<br />

Financial leasing liabilities 403 446<br />

Liabilities to joint ventures 9 –<br />

Other long-term liabilities 128 –<br />

Total 6,772 7,399<br />

Current liabilities<br />

Bank loans including overdraft facilities 1,143 722<br />

Commercial paper 343 818<br />

Current part of leasing liabilities 226 195<br />

Liabilities to joint ventures 100 –<br />

Other current liabilities 42 –<br />

Total 1,854 1,735<br />

Convertible promissory notes 2007/<strong>2012</strong> 1)<br />

Group<br />

MSEK <strong>2012</strong> 2011<br />

Nominal value after issue of 8,800,000 convertible<br />

promissory notes – 598<br />

Original amount classified as equity – –35<br />

Capitalized interest – 28<br />

Recorded liability on 31 December – 591<br />

1) The convertible promissory notes ran from 1 December 2007, with settlement day in<br />

January 2008, to 30 November <strong>2012</strong> with a coupon interest rate of 5.44 percent.<br />

Convertible promissory notes <strong>Peab</strong> Industri 2007/<strong>2012</strong> 2)<br />

Group<br />

MSEK <strong>2012</strong> 2011<br />

Remaining part of the liability, 2007/<strong>2012</strong> – 1<br />

Recorded liability on 31 December – 1<br />

2) Remaining part of <strong>Peab</strong> Industri’s personnel convertibles which had not been acquired<br />

per 31 December 2011.<br />

Financial leasing liabilities<br />

Financial leasing liabilities fall due for payment as follows;<br />

Group Minimum<br />

leasing<br />

charge Interest<br />

Capital<br />

Minimum<br />

leasing<br />

amount charge Interest<br />

Capital<br />

amount<br />

MSEK <strong>2012</strong> <strong>2012</strong> <strong>2012</strong> 2011 2011 2011<br />

Within one year<br />

Between one and<br />

234 8 226 205 10 195<br />

five years<br />

Later than five<br />

374 13 361 406 19 387<br />

years 44 2 42 62 3 59<br />

Total 652 23 629 673 32 641<br />

Variable leasing fees were SEK 9 million (–4).<br />

For futher information concerning Group financial leasing, see note 17.