Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

NOTES<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

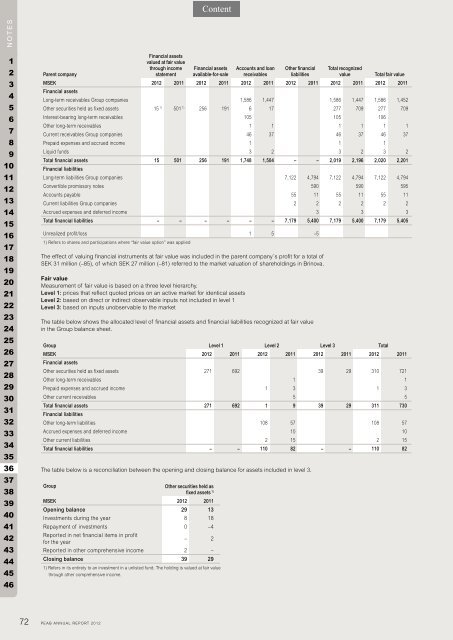

Parent company<br />

Financial assets<br />

valued at fair value<br />

through income<br />

statement<br />

Financial assets<br />

available-for-sale<br />

Accounts and loan<br />

receivables<br />

Other financial<br />

liabilities<br />

Total recognized<br />

value Total fair value<br />

MSEK <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Financial assets<br />

Long-term receivables Group companies 1,586 1,447 1,586 1,447 1,586 1,452<br />

Other securities held as fixed assets 15 1) 501 1) 256 191 6 17 277 709 277 709<br />

Interest-bearing long-term receivables 105 105 106<br />

Other long-term receivables 1 1 1 1 1 1<br />

Current receivables Group companies 46 37 46 37 46 37<br />

Prepaid expenses and accrued income 1 1 1<br />

Liquid funds 3 2 3 2 3 2<br />

Total financial assets<br />

Financial liabilities<br />

15 501 256 191 1,748 1,504 – – 2,019 2,196 2,020 2,201<br />

Long-term liabilities Group companies 7,122 4,794 7,122 4,794 7,122 4,794<br />

Convertible promissory notes 590 590 595<br />

Accounts payable 55 11 55 11 55 11<br />

Current liabilities Group companies 2 2 2 2 2 2<br />

Accrued expenses and deferred income 3 3 3<br />

Total financial liabilities – – – – – – 7,179 5,400 7,179 5,400 7,179 5,405<br />

Unrealized profit/loss<br />

1) Refers to shares and participations where “fair value option” was applied<br />

1 5 –5<br />

The effect of valuing financial instruments at fair value was included in the parent company´s profit for a total of<br />

SEK 31 million (–85), of which SEK 27 million (–81) referred to the market valuation of shareholdings in Brinova.<br />

Fair value<br />

Measurement of fair value is based on a three level hierarchy.<br />

Level 1: prices that reflect quoted prices on an active market for identical assets<br />

Level 2: based on direct or indirect observable inputs not included in level 1<br />

Level 3: based on inputs unobservable to the market<br />

The table below shows the allocated level of financial assets and financial liabilities recognized at fair value<br />

in the Group balance sheet.<br />

Group Level 1 Level 2 Level 3 Total<br />

MSEK<br />

Financial assets<br />

<strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011 <strong>2012</strong> 2011<br />

Other securities held as fixed assets 271 692 39 29 310 721<br />

Other long-term receivables 1 1<br />

Prepaid expenses and accrued income 1 3 1 3<br />

Other current receivables 5 5<br />

Total financial assets<br />

Financial liabilities<br />

271 692 1 9 39 29 311 730<br />

Other long-term liabilities 108 57 108 57<br />

Accrued expenses and deferred income 10 10<br />

Other current liabilities 2 15 2 15<br />

Total financial liabilities – – 110 82 – – 110 82<br />

The table below is a reconciliation between the opening and closing balance for assets included in level 3.<br />

Group Other securities held as<br />

fixed assets 1)<br />

MSEK <strong>2012</strong> 2011<br />

Opening balance 29 13<br />

Investments during the year 8 18<br />

Repayment of investments 0 –4<br />

Reported in net financial items in profit<br />

for the year<br />

– 2<br />

Reported in other comprehensive income 2 –<br />

Closing balance 39 29<br />

1) Refers in its entirety to an investment in a unlisted fund. The holding is valued at fair value<br />

through other comprehensive income.<br />

72 PEAB ANNUAL REPORT <strong>2012</strong>