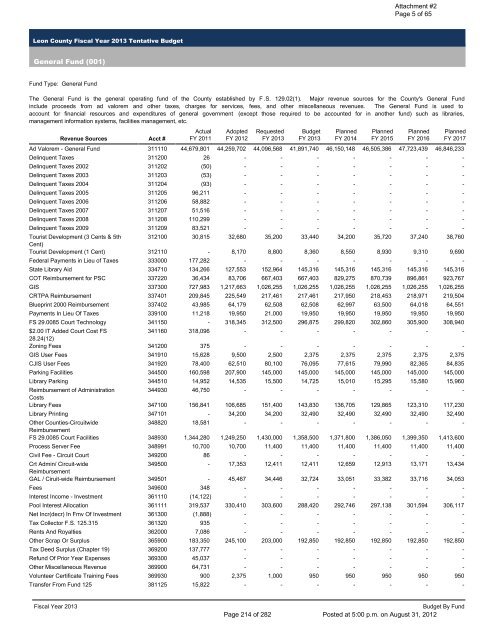

Leon County Fiscal Year 2013 Tentative Budget General Fund (001) Fund Type: General Fund The General Fund is the general operating fund of the County established by F .S. 129.02(1). Major revenue sources for the County's General Fund include proceeds from ad valorem and other taxes, charges for services, fees, and other miscellaneous revenues. The General Fund is used to account for financial resources and expenditures of general government (except those required to be accounted for in another fund) such as libraries, management information systems, facilities management, etc. Revenue Sources Acct # Attachment #2 Page 5 of 65 Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Ad Valorem - General Fund 311110 44,679,801 44,259,702 44,096,568 41,891,740 46,150,148 46,505,386 47,723,439 Delinquent Taxes 311200 26 - - - - - - Delinquent Taxes 2002 311202 (50) - - - - - - Delinquent Taxes 2003 311203 (53) - - - - - - Delinquent Taxes 2004 311204 (93) - - - - - - Delinquent Taxes 2005 311205 96,211 - - - - - - Delinquent Taxes 2006 311206 58,882 - - - - - - Delinquent Taxes 2007 311207 51,516 - - - - - - Delinquent Taxes 2008 311208 110,299 - - - - - - Delinquent Taxes 2009 311209 83,521 - - - - - - Tourist Development (3 Cents & 5th Cent) 312100 30,815 32,680 35,200 33,440 34,200 35,720 37,240 Tourist Development (1 Cent) 312110 - 8,170 8,800 8,360 8,550 8,930 9,310 Federal Payments in Lieu of Taxes 333000 177,282 - - - - - - State Library Aid 334710 134,266 127,553 152,964 145,316 145,316 145,316 145,316 COT Reimbursement for PSC 337220 36,434 83,706 667,403 667,403 829,275 870,739 896,861 GIS 337300 727,983 1,217,663 1,026,255 1,026,255 1,026,255 1,026,255 1,026,255 CRTPA Reimbursement 337401 209,845 225,549 217,461 217,461 217,950 218,453 218,971 Blueprint 2000 Reimbursement 337402 43,985 64,179 62,508 62,508 62,997 63,500 64,018 Payments In Lieu Of Taxes 339100 11,218 19,950 21,000 19,950 19,950 19,950 19,950 FS 29.0085 Court Technology 341150 - 318,345 312,500 296,875 299,820 302,860 305,900 $2.00 IT Added Court Cost FS 28.24(12) 341160 318,096 - - - - - - Zoning Fees 341200 375 - - - - - - GIS User Fees 341910 15,628 9,500 2,500 2,375 2,375 2,375 2,375 CJIS User Fees 341920 78,400 62,510 80,100 76,095 77,615 79,990 82,365 Parking Facilities 344500 160,598 207,900 145,000 145,000 145,000 145,000 145,000 Library Parking 344510 14,952 14,535 15,500 14,725 15,010 15,295 15,580 Reimbursement of Administration Costs 344930 46,750 - - - - - - Library Fees 347100 156,841 106,685 151,400 143,830 136,705 129,865 123,310 Library Printing 347101 - 34,200 34,200 32,490 32,490 32,490 32,490 Other Counties-Circuitwide Reimbursement 348820 18,581 - - - - - - FS 29.0085 Court Facilities 348930 1,344,280 1,249,250 1,430,000 1,358,500 1,371,800 1,386,050 1,399,350 Process Server Fee 348991 10,700 10,700 11,400 11,400 11,400 11,400 11,400 Civil Fee - Circuit Court 349200 86 - - - - - - Crt Admin/ Circuit-wide Reimbursement 349500 - 17,353 12,411 12,411 12,659 12,913 13,171 GAL / Ciruit-wide Reimbursement 349501 - 45,467 34,446 32,724 33,051 33,382 33,716 Fees 349600 348 - - - - - - Interest Income - Investment 361110 (14,122) - - - - - - Pool Interest Allocation 361111 319,537 330,410 303,600 288,420 292,746 297,138 301,594 Net Incr(decr) In Fmv Of Investment 361300 (1,888) - - - - - - Tax Collector F.S. 125.315 361320 935 - - - - - - Rents And Royalties 362000 7,086 - - - - - - Other Scrap Or Surplus 365900 183,350 245,100 203,000 192,850 192,850 192,850 192,850 Tax Deed Surplus (Chapter 19) 369200 137,777 - - - - - - Refund Of Prior Year Expenses 369300 45,037 - - - - - - Other Miscellaneous Revenue 369900 64,731 - - - - - - Volunteer Certificate Training Fees 369930 900 2,375 1,000 950 950 950 950 Transfer From Fund 125 381125 15,822 - - - - - - 46,846,233 - - - - - - - - - 38,760 9,690 - 145,316 923,767 1,026,255 219,504 64,551 19,950 308,940 - - 2,375 84,835 145,000 15,960 - 117,230 32,490 - 1,413,600 Fiscal Year 2013 Budget By Fund Page 214 of 282 Posted at 5:00 p.m. on August 31, 2012 11,400 - 13,434 34,053 - - 306,117 - - - 192,850 - - - 950 -

Leon County Fiscal Year 2013 Tentative Budget General Fund (001) Revenue Sources Acct # Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Transfer From Fund 126 381126 2,427,751 3,487,699 2,086,375 2,086,375 2,123,653 2,286,971 2,083,349 Transfer From Fund 135 381135 - - 155,984 155,984 - - - Transfer From Fund 140 381140 - - 648,500 648,500 - - - Transfer From Fund 162 381162 140,000 - - - - - - Transfer From Fund 163 381163 29,576 - - - - - - Transfer From Fund 218 381218 943 - - - - - - Transfer From Fund 420 381420 1,487,709 - - - - - - Pensacola Care Lease 383001 48,872 146,616 146,616 146,616 146,616 146,616 146,616 Clerk Excess Fees 386100 99,221 - - - - - - Property Appraiser 386600 117,542 - - - - - - Tax Collector 386700 570,983 340,000 350,000 350,000 - - - Tax Collector 386701 - 250,000 - - - - - Supervisor Of Elections 386800 557,052 - - - - - - Appropriated Fund Balance 399900 - 2,750,000 4,961,915 4,961,915 4,000,000 4,000,000 4,000,000 Appropriations by Department/Division Total Revenues Acct # Attachment #2 Page 6 of 65 2,879,781 - - - - - - 146,616 - - - - - 4,000,000 54,856,336 55,667,797 57,374,607 55,030,468 57,389,381 57,970,394 59,031,376 58,999,657 Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 County Commission 100-511 1,348,537 1,241,050 1,216,253 1,214,235 1,217,698 1,221,268 1,224,939 Commission District 1 101-511 9,500 9,500 9,500 9,500 9,500 9,500 9,500 Commission District 2 102-511 3,555 9,500 85,507 9,500 9,500 9,500 9,500 Commission District 3 103-511 6,864 9,500 9,500 9,500 9,500 9,500 9,500 Commission District 4 104-511 9,500 9,500 9,500 9,500 9,500 9,500 9,500 Commission District 5 105-511 9,500 9,500 9,500 9,500 9,500 9,500 9,500 Commission At-Large (Group 1) 106-511 9,500 9,500 9,500 9,500 9,500 9,500 9,500 Commission At-Large (Group 2) 107-511 8,834 9,500 9,500 9,500 9,500 9,500 9,500 Commissioners' Account 108-511 23,348 24,202 24,065 24,065 24,065 24,065 24,065 County Administration 110-512 830,879 519,046 533,160 533,160 534,454 535,777 537,144 Minority/Women Small Business Enterprise 112-513 196,755 230,130 232,911 231,804 232,403 233,020 233,654 Volunteer Center 113-513 160,791 161,192 162,643 161,077 161,758 162,461 163,184 Economic Development/Intergovernmental Affairs 114-512 1,101,951 477,874 508,483 508,483 509,236 510,012 510,809 Strategic Initiatives 115-513 - 711,604 820,719 820,719 823,299 825,954 828,687 County Attorney 120-514 1,708,354 1,647,042 1,760,315 1,670,718 1,673,973 1,677,315 1,680,756 Office of Sustainability 127-513 177,873 265,318 263,270 261,604 262,384 263,188 264,016 Office of Management & Budget 130-513 674,846 606,533 579,333 576,090 580,572 585,286 590,223 Clerk - Finance Administration 132-586 1,520,587 1,456,481 1,437,334 1,403,766 1,480,021 1,523,989 1,569,276 Procurement 140-513 326,347 333,249 311,530 230,626 231,222 231,836 232,467 Warehouse 141-513 189,750 123,920 123,931 123,144 123,659 124,189 124,734 Property Control 142-513 45,338 47,066 47,026 47,026 47,050 47,074 47,099 Facilities Management 150-519 6,526,402 6,738,675 7,176,783 7,176,783 7,223,461 7,311,757 7,344,338 Facilities Management: Judicial Security 150-711 99,904 - - - - - - Facilities Management: Judicial Maintenance 150-712 1,058,339 - - - - - - Real Estate Management 156-519 - 76,015 218,907 217,248 218,106 218,990 219,900 Human Resources 160-513 1,079,925 1,139,122 1,153,253 1,150,518 1,223,411 1,156,392 1,159,436 Management Information Services 171-513 4,342,264 5,313,496 5,336,864 5,258,278 5,314,096 5,334,492 5,346,219 Article V MIS 171-713 1,020,761 - - - - - - Health Department 190-562 237,345 237,345 237,345 237,345 237,345 237,345 237,345 Mosquito Control 216-562 - - 581,411 577,067 580,487 583,990 587,576 Lib - Policy, Planning, & Operations 240-571 842,230 879,136 891,862 889,927 902,826 916,686 918,213 Library Public Services 241-571 2,419,517 2,598,262 2,497,708 2,482,313 2,491,313 2,500,585 2,510,102 Library Collection Services 242-571 874,062 836,782 834,924 814,986 818,596 822,320 826,146 Library Extension Services 243-571 1,988,385 2,438,441 2,344,303 2,332,415 2,340,688 2,349,215 2,357,695 1,228,724 9,500 9,500 9,500 9,500 9,500 9,500 9,500 24,065 538,543 234,300 163,916 511,632 831,499 1,684,271 264,868 592,338 1,569,276 233,113 125,271 47,116 7,362,384 - - 220,838 1,162,576 5,358,244 - 237,345 591,240 919,768 2,518,940 830,049 2,366,347 Fiscal Year 2013 Budget By Fund Page 215 of 282 Posted at 5:00 p.m. on August 31, 2012

- Page 1 and 2:

BOARD OF COUNTY COMMISSIONERS LEON

- Page 3 and 4:

Board of County Commissioners Regul

- Page 5 and 6:

Board of County Commissioners Regul

- Page 7 and 8:

Board of County Commissioners Regul

- Page 9 and 10:

Leon County Board of County Commiss

- Page 11 and 12:

Title: Approval of Payment of Bills

- Page 13 and 14:

To: Leon County Board of County Com

- Page 15 and 16:

Title: Acceptance of Fiscal Year 20

- Page 17 and 18:

28173 POWER EDGE 220S DONATED TO GO

- Page 19 and 20:

32918 MOBILE RADIO MODEM RETURNED 3

- Page 21 and 22:

Leon County Board of County Commiss

- Page 23 and 24:

Title: Approval of an Agreement Awa

- Page 25 and 26:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 27 and 28:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 29 and 30:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 31 and 32:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 33 and 34:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 35 and 36:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 37 and 38:

Bid Title: Installation & Maintenan

- Page 39 and 40:

Bid Title: Installation & Maintenan

- Page 41 and 42:

Bid Title: Installation & Maintenan

- Page 43 and 44:

Bid Title: Installation & Maintenan

- Page 45 and 46:

Bid Title: Installation & Maintenan

- Page 47 and 48:

Bid Title: Installation & Maintenan

- Page 49 and 50:

Bid Title: Installation & Maintenan

- Page 51 and 52:

Bid Title: Installation & Maintenan

- Page 53:

Bid Title: Installation & Maintenan

- Page 64 and 65:

To: Leon County Board of County Com

- Page 66 and 67:

This document was prepared by: Leon

- Page 68 and 69:

significance. Attachment #1 Page 3

- Page 73:

Exhibit "A" NEW CYPRESS LANDING CON

- Page 82:

Exhibit "A" NEW CYPRESS LANDING CON

- Page 86 and 87:

SPECIFIC LOCATION MAP RO CO CO ROCO

- Page 88 and 89:

To: Leon County Board of County Com

- Page 90 and 91:

Title: Consideration of Funding a M

- Page 92 and 93:

To: From: Title: Leon County Board

- Page 94 and 95:

Title: Consideration of Funding for

- Page 96 and 97:

Title: Consideration of Funding for

- Page 98 and 99:

To: From: Title: County Administrat

- Page 100 and 101:

Report and Discussion Attachment #2

- Page 102 and 103:

Attachment #2 Page 5 of 7 10. Works

- Page 106 and 107:

Leon County Board of County Commiss

- Page 108 and 109:

Title: Approval of the Appointments

- Page 110 and 111:

Title: Approval of the Appointments

- Page 112 and 113:

In the space below briefly describe

- Page 114 and 115:

Mr. Leon Carl Adams ‘70 DPL, Pres

- Page 116 and 117:

In the space below briefly describe

- Page 118 and 119:

October 6, 2011 Shington Lamy Assis

- Page 120 and 121:

proactive sales lists and develops

- Page 122 and 123:

ADVISORY COMMITTEE APPLICATION FOR

- Page 124 and 125:

Resumé Walter L. Cofer Address: 40

- Page 126:

Resumé Walter L. Cofer PROFESSIONA

- Page 130 and 131:

BACKGROUND President, CNL Real Esta

- Page 134 and 135:

118 N. Gadsden Street Tallahassee,

- Page 136 and 137:

It is the applicant’s responsibil

- Page 138 and 139:

All statements and information prov

- Page 140:

Attachment #7 Page 1 of 5 ADVISORY

- Page 143 and 144:

American Bar Association Business L

- Page 145 and 146:

It is the applicant’s responsibil

- Page 147 and 148:

Page 1 BETH ANN MATUGA Emphases Bet

- Page 149 and 150:

Page 3 BETH ANN MATUGA League of Wo

- Page 151 and 152:

Page 5 BETH ANN MATUGA Wrote and e

- Page 153 and 154:

Page 7 BETH ANN MATUGA League of Wo

- Page 157 and 158:

Will Messer Executive Profile Skill

- Page 159 and 160:

RECEIVED AUG 2 6 2010 Attachment #1

- Page 162 and 163:

CURRICULUM VITAE Robert W- Newburgh

- Page 164: American Society of Biochemists and

- Page 168 and 169: Board Memberships: Past Attachment

- Page 170 and 171: In the space below briefly describe

- Page 172 and 173: Florida State University -- 1973 to

- Page 174 and 175: In the space below briefly describe

- Page 176 and 177: Traylor Management, Inc., 600 Three

- Page 178 and 179: It is the applicant’s responsibil

- Page 180 and 181: Leon County Board of County Commiss

- Page 182 and 183: • Update and maintain databases f

- Page 184 and 185: Attachment #14 Page 7 of 10 August

- Page 186 and 187: facilitated a support group specifi

- Page 189 and 190: Attachment #15 Page 2 of 5 In the s

- Page 191 and 192: TERRY WILLIAMS, MS, MA, PMP Senior

- Page 193 and 194: It is the applicant’s responsibil

- Page 195 and 196: Fred H. Williams 793 Litchfield Roa

- Page 197 and 198: It is the applicant’s responsibil

- Page 199: Hugh H. (Hamp) Wilson 5663 Bradford

- Page 203 and 204: Represented the Federal Deposit Ins

- Page 205 and 206: Leon County Board of County Commiss

- Page 207 and 208: Title: First of Two Public Hearings

- Page 209 and 210: RESOLUTION NO. _____ WHEREAS, the B

- Page 211 and 212: EXHIBIT A Attachment #2 Page 2 of 6

- Page 213: EXHIBIT B Attachment #2 Page 4 of 6

- Page 217 and 218: Leon County Fiscal Year 2013 Tentat

- Page 219 and 220: Leon County Fiscal Year 2013 Tentat

- Page 221 and 222: Leon County Fiscal Year 2013 Tentat

- Page 223 and 224: Leon County Fiscal Year 2013 Tentat

- Page 225 and 226: Leon County Fiscal Year 2013 Tentat

- Page 227 and 228: Leon County Fiscal Year 2013 Tentat

- Page 229 and 230: Leon County Fiscal Year 2013 Tentat

- Page 231 and 232: Leon County Fiscal Year 2013 Tentat

- Page 233 and 234: Leon County Fiscal Year 2013 Tentat

- Page 235 and 236: Leon County Fiscal Year 2013 Tentat

- Page 237 and 238: Leon County Fiscal Year 2013 Tentat

- Page 239 and 240: Leon County Fiscal Year 2013 Tentat

- Page 241 and 242: Leon County Fiscal Year 2013 Tentat

- Page 243 and 244: Leon County Fiscal Year 2013 Tentat

- Page 245 and 246: Leon County Fiscal Year 2013 Tentat

- Page 247 and 248: Leon County Fiscal Year 2013 Tentat

- Page 249 and 250: Leon County Fiscal Year 2013 Tentat

- Page 251 and 252: Leon County Fiscal Year 2013 Tentat

- Page 253 and 254: Leon County Fiscal Year 2013 Tentat

- Page 255 and 256: Leon County Fiscal Year 2013 Tentat

- Page 257 and 258: Leon County Fiscal Year 2013 Tentat

- Page 259 and 260: Leon County Fiscal Year 2013 Tentat

- Page 261 and 262: Leon County Fiscal Year 2013 Tentat

- Page 263 and 264: Leon County Fiscal Year 2013 Tentat

- Page 265 and 266:

Leon County Fiscal Year 2013 Tentat

- Page 267 and 268:

Leon County Fiscal Year 2013 Tentat

- Page 269 and 270:

Leon County Fiscal Year 2013 Tentat

- Page 271 and 272:

Leon County Fiscal Year 2013 Tentat

- Page 273 and 274:

Leon County Fiscal Year 2013 Tentat

- Page 275 and 276:

RESOLUTION NO. _____ WHEREAS, the B

- Page 277 and 278:

EXHIBIT A Attachment #4 Page 2 of 3

- Page 279 and 280:

RESOLUTION NO. _____ WHEREAS, the B

- Page 281 and 282:

EXHIBIT A Attachment #6 Page 2 of 3