Leon County Fiscal Year 2013 Tentative Budget Municipal Services (140) Fund Type: Special Revenue The Municipal Services Fund is a special revenue fund established in support of various municipal services provided in the unincorporated area of Leon County. These services include: parks and recreation, and animal control. The major revenue sources for the Municipal Services Fund are transfers from the Non-Restricted Revenue Fund (i.e. State revenue sharing, the local cent sales tax, etc.) and the Public Services Tax. Revenue Sources Acct # Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Public Service Tax - Electric 314100 4,955,507 5,137,600 5,386,000 5,116,700 5,219,300 5,323,800 5,430,200 Public Service Tax - Water 314300 888,739 847,400 935,000 888,250 896,800 906,300 914,850 Public Service Tax - Gas 314400 575,455 545,300 590,000 560,500 569,050 577,600 586,150 Public Service Tax - Fuel Oil 314700 3,136 2,850 3,000 2,850 2,850 2,850 2,850 Public Service Tax - 2% Discount 314999 (29,017) (29,450) (30,000) (28,500) (28,500) (28,500) (28,500) DOT-Reimbursement Route 27 343913 5,352 5,352 - - - - - Parks And Recreation 347200 5,765 5,700 5,500 5,225 5,225 5,225 5,225 Coe's Landing Park 347201 18,499 16,720 20,600 19,570 19,760 19,950 20,140 Animal Control Education 351310 680 - - - - - - Interest Income - Investment 361110 270 - - - - - - Pool Interest Allocation 361111 48,910 53,105 54,600 51,870 52,648 53,438 54,239 Net Incr(decr) In Fmv Of Investment 361300 2,287 - - - - - - Tax Collector F.S. 125.315 361320 12 - - - - - - Other Miscellaneous Revenue 369900 1,421 - - - - - - Transfer From Fund 125 381125 15,000 - - - - - - Appropriated Fund Balance 399900 - 300,000 - - - - - Appropriations by Department/Division Total Revenues Acct # 5,538,500 924,350 594,700 2,850 (28,500) - 5,225 20,330 - - 55,053 6,492,015 6,884,577 6,964,700 6,616,465 6,737,133 6,860,663 6,985,154 7,112,508 Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Animal Services 201-562 945,099 1,086,294 1,165,688 1,165,688 1,169,101 1,172,641 1,174,964 Parks and Recreation Services 436-572 2,276,583 2,391,513 2,485,013 2,447,979 2,474,140 2,505,542 2,514,119 MIS Automation - Animal Control 470-562 1,541 1,541 1,240 1,240 1,240 1,240 1,240 MIS Automation - Parks and Recreation 470-572 1,565 1,311 1,240 1,240 1,240 1,240 1,240 Municipal Services - Risk 495-572 70,330 67,408 64,338 64,338 64,338 64,338 64,338 Indirect Costs - Municipal Services (Animal Control) 499-562 130,247 137,433 116,983 116,983 120,492 124,107 127,830 Indirect Costs - Municipal Services (Parks & Recreation) 499-572 534,860 486,221 464,947 464,947 478,895 493,262 508,060 Payment to City- Parks & Recreation 838-572 992,164 1,076,498 1,122,249 1,122,249 1,169,944 1,219,666 1,219,666 Transfers 950-581 1,066,361 1,596,358 1,178,783 1,178,783 906,146 926,947 1,021,931 Budgeted Reserves - Municipal Service Total Appropriations Revenues Less Appropriations Attachment #2 Page 31 of 65 990-599 - 40,000 53,018 53,018 351,597 351,680 351,766 - - - - - 1,177,337 2,522,902 1,240 1,240 64,338 131,665 523,302 1,219,666 1,118,966 351,852 6,018,750 6,884,577 6,653,499 6,616,465 6,737,133 6,860,663 6,985,154 7,112,508 473,265 - 311,201 - - - - - Fiscal Year 2013 Budget By Fund Page 240 of 282 Posted at 5:00 p.m. on August 31, 2012

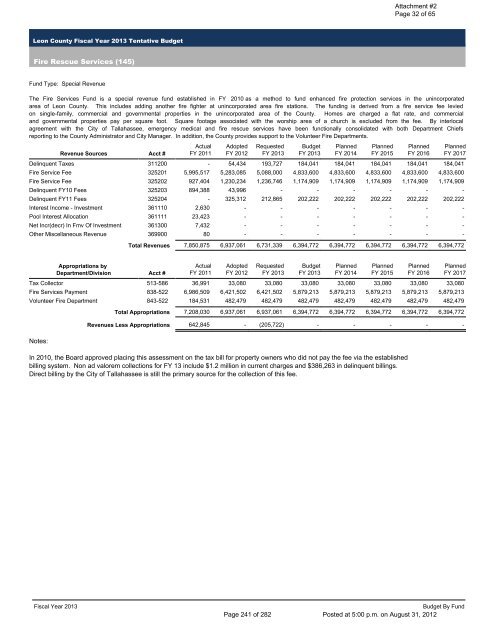

Leon County Fiscal Year 2013 Tentative Budget Fire Rescue Services (145) Fund Type: Special Revenue The Fire Services Fund is a special revenue fund established in FY 2010 as a method to fund enhanced fire protection services in the unincorporated area of Leon County. This includes adding another fire fighter at unincorporated area fire stations. The funding is derived from a fire service fee levied on single-family, commercial and governmental properties in the unincorporated area of the County. Homes are charged a flat rate, and commercial and governmental properties pay per square foot. Square footage associated with the worship area of a church is excluded from the fee. By interlocal agreement with the City of Tallahassee, emergency medical and fire rescue services have been functionally consolidated with both Department Chiefs reporting to the County Administrator and City Manager. In addition, the County provides support to the Volunteer Fire Departments. Revenue Sources Acct # Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Delinquent Taxes 311200 - 54,434 193,727 184,041 184,041 184,041 184,041 Fire Service Fee 325201 5,995,517 5,283,085 5,088,000 4,833,600 4,833,600 4,833,600 4,833,600 Fire Service Fee 325202 927,404 1,230,234 1,236,746 1,174,909 1,174,909 1,174,909 1,174,909 Delinquent FY10 Fees 325203 894,388 43,996 - - - - - Delinquent FY11 Fees 325204 - 325,312 212,865 202,222 202,222 202,222 202,222 Interest Income - Investment 361110 2,630 - - - - - - Pool Interest Allocation 361111 23,423 - - - - - - Net Incr(decr) In Fmv Of Investment 361300 7,432 - - - - - - Other Miscellaneous Revenue 369900 80 - - - - - - Appropriations by Department/Division Total Revenues Acct # 184,041 4,833,600 1,174,909 - 202,222 7,850,875 6,937,061 6,731,339 6,394,772 6,394,772 6,394,772 6,394,772 6,394,772 Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Tax Collector 513-586 36,991 33,080 33,080 33,080 33,080 33,080 33,080 Fire Services Payment 838-522 6,986,509 6,421,502 6,421,502 5,879,213 5,879,213 5,879,213 5,879,213 Volunteer Fire Department 843-522 184,531 482,479 482,479 482,479 482,479 482,479 482,479 Notes: Total Appropriations Revenues Less Appropriations - - - - 33,080 5,879,213 482,479 7,208,030 6,937,061 6,937,061 6,394,772 6,394,772 6,394,772 6,394,772 6,394,772 642,845 - (205,722) - - - - - In 2010, the Board approved placing this assessment on the tax bill for property owners who did not pay the fee via the established billing system. Non ad valorem collections for FY 13 include $1.2 million in current charges and $386,263 in delinquent billings. Direct billing by the City of Tallahassee is still the primary source for the collection of this fee. Attachment #2 Page 32 of 65 Fiscal Year 2013 Budget By Fund Page 241 of 282 Posted at 5:00 p.m. on August 31, 2012

- Page 1 and 2:

BOARD OF COUNTY COMMISSIONERS LEON

- Page 3 and 4:

Board of County Commissioners Regul

- Page 5 and 6:

Board of County Commissioners Regul

- Page 7 and 8:

Board of County Commissioners Regul

- Page 9 and 10:

Leon County Board of County Commiss

- Page 11 and 12:

Title: Approval of Payment of Bills

- Page 13 and 14:

To: Leon County Board of County Com

- Page 15 and 16:

Title: Acceptance of Fiscal Year 20

- Page 17 and 18:

28173 POWER EDGE 220S DONATED TO GO

- Page 19 and 20:

32918 MOBILE RADIO MODEM RETURNED 3

- Page 21 and 22:

Leon County Board of County Commiss

- Page 23 and 24:

Title: Approval of an Agreement Awa

- Page 25 and 26:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 27 and 28:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 29 and 30:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 31 and 32:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 33 and 34:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 35 and 36:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 37 and 38:

Bid Title: Installation & Maintenan

- Page 39 and 40:

Bid Title: Installation & Maintenan

- Page 41 and 42:

Bid Title: Installation & Maintenan

- Page 43 and 44:

Bid Title: Installation & Maintenan

- Page 45 and 46:

Bid Title: Installation & Maintenan

- Page 47 and 48:

Bid Title: Installation & Maintenan

- Page 49 and 50:

Bid Title: Installation & Maintenan

- Page 51 and 52:

Bid Title: Installation & Maintenan

- Page 53:

Bid Title: Installation & Maintenan

- Page 64 and 65:

To: Leon County Board of County Com

- Page 66 and 67:

This document was prepared by: Leon

- Page 68 and 69:

significance. Attachment #1 Page 3

- Page 73:

Exhibit "A" NEW CYPRESS LANDING CON

- Page 82:

Exhibit "A" NEW CYPRESS LANDING CON

- Page 86 and 87:

SPECIFIC LOCATION MAP RO CO CO ROCO

- Page 88 and 89:

To: Leon County Board of County Com

- Page 90 and 91:

Title: Consideration of Funding a M

- Page 92 and 93:

To: From: Title: Leon County Board

- Page 94 and 95:

Title: Consideration of Funding for

- Page 96 and 97:

Title: Consideration of Funding for

- Page 98 and 99:

To: From: Title: County Administrat

- Page 100 and 101:

Report and Discussion Attachment #2

- Page 102 and 103:

Attachment #2 Page 5 of 7 10. Works

- Page 106 and 107:

Leon County Board of County Commiss

- Page 108 and 109:

Title: Approval of the Appointments

- Page 110 and 111:

Title: Approval of the Appointments

- Page 112 and 113:

In the space below briefly describe

- Page 114 and 115:

Mr. Leon Carl Adams ‘70 DPL, Pres

- Page 116 and 117:

In the space below briefly describe

- Page 118 and 119:

October 6, 2011 Shington Lamy Assis

- Page 120 and 121:

proactive sales lists and develops

- Page 122 and 123:

ADVISORY COMMITTEE APPLICATION FOR

- Page 124 and 125:

Resumé Walter L. Cofer Address: 40

- Page 126:

Resumé Walter L. Cofer PROFESSIONA

- Page 130 and 131:

BACKGROUND President, CNL Real Esta

- Page 134 and 135:

118 N. Gadsden Street Tallahassee,

- Page 136 and 137:

It is the applicant’s responsibil

- Page 138 and 139:

All statements and information prov

- Page 140:

Attachment #7 Page 1 of 5 ADVISORY

- Page 143 and 144:

American Bar Association Business L

- Page 145 and 146:

It is the applicant’s responsibil

- Page 147 and 148:

Page 1 BETH ANN MATUGA Emphases Bet

- Page 149 and 150:

Page 3 BETH ANN MATUGA League of Wo

- Page 151 and 152:

Page 5 BETH ANN MATUGA Wrote and e

- Page 153 and 154:

Page 7 BETH ANN MATUGA League of Wo

- Page 157 and 158:

Will Messer Executive Profile Skill

- Page 159 and 160:

RECEIVED AUG 2 6 2010 Attachment #1

- Page 162 and 163:

CURRICULUM VITAE Robert W- Newburgh

- Page 164:

American Society of Biochemists and

- Page 168 and 169:

Board Memberships: Past Attachment

- Page 170 and 171:

In the space below briefly describe

- Page 172 and 173:

Florida State University -- 1973 to

- Page 174 and 175:

In the space below briefly describe

- Page 176 and 177:

Traylor Management, Inc., 600 Three

- Page 178 and 179:

It is the applicant’s responsibil

- Page 180 and 181:

Leon County Board of County Commiss

- Page 182 and 183:

• Update and maintain databases f

- Page 184 and 185:

Attachment #14 Page 7 of 10 August

- Page 186 and 187:

facilitated a support group specifi

- Page 189 and 190: Attachment #15 Page 2 of 5 In the s

- Page 191 and 192: TERRY WILLIAMS, MS, MA, PMP Senior

- Page 193 and 194: It is the applicant’s responsibil

- Page 195 and 196: Fred H. Williams 793 Litchfield Roa

- Page 197 and 198: It is the applicant’s responsibil

- Page 199: Hugh H. (Hamp) Wilson 5663 Bradford

- Page 203 and 204: Represented the Federal Deposit Ins

- Page 205 and 206: Leon County Board of County Commiss

- Page 207 and 208: Title: First of Two Public Hearings

- Page 209 and 210: RESOLUTION NO. _____ WHEREAS, the B

- Page 211 and 212: EXHIBIT A Attachment #2 Page 2 of 6

- Page 213 and 214: EXHIBIT B Attachment #2 Page 4 of 6

- Page 215 and 216: Leon County Fiscal Year 2013 Tentat

- Page 217 and 218: Leon County Fiscal Year 2013 Tentat

- Page 219 and 220: Leon County Fiscal Year 2013 Tentat

- Page 221 and 222: Leon County Fiscal Year 2013 Tentat

- Page 223 and 224: Leon County Fiscal Year 2013 Tentat

- Page 225 and 226: Leon County Fiscal Year 2013 Tentat

- Page 227 and 228: Leon County Fiscal Year 2013 Tentat

- Page 229 and 230: Leon County Fiscal Year 2013 Tentat

- Page 231 and 232: Leon County Fiscal Year 2013 Tentat

- Page 233 and 234: Leon County Fiscal Year 2013 Tentat

- Page 235 and 236: Leon County Fiscal Year 2013 Tentat

- Page 237 and 238: Leon County Fiscal Year 2013 Tentat

- Page 239: Leon County Fiscal Year 2013 Tentat

- Page 243 and 244: Leon County Fiscal Year 2013 Tentat

- Page 245 and 246: Leon County Fiscal Year 2013 Tentat

- Page 247 and 248: Leon County Fiscal Year 2013 Tentat

- Page 249 and 250: Leon County Fiscal Year 2013 Tentat

- Page 251 and 252: Leon County Fiscal Year 2013 Tentat

- Page 253 and 254: Leon County Fiscal Year 2013 Tentat

- Page 255 and 256: Leon County Fiscal Year 2013 Tentat

- Page 257 and 258: Leon County Fiscal Year 2013 Tentat

- Page 259 and 260: Leon County Fiscal Year 2013 Tentat

- Page 261 and 262: Leon County Fiscal Year 2013 Tentat

- Page 263 and 264: Leon County Fiscal Year 2013 Tentat

- Page 265 and 266: Leon County Fiscal Year 2013 Tentat

- Page 267 and 268: Leon County Fiscal Year 2013 Tentat

- Page 269 and 270: Leon County Fiscal Year 2013 Tentat

- Page 271 and 272: Leon County Fiscal Year 2013 Tentat

- Page 273 and 274: Leon County Fiscal Year 2013 Tentat

- Page 275 and 276: RESOLUTION NO. _____ WHEREAS, the B

- Page 277 and 278: EXHIBIT A Attachment #4 Page 2 of 3

- Page 279 and 280: RESOLUTION NO. _____ WHEREAS, the B

- Page 281 and 282: EXHIBIT A Attachment #6 Page 2 of 3