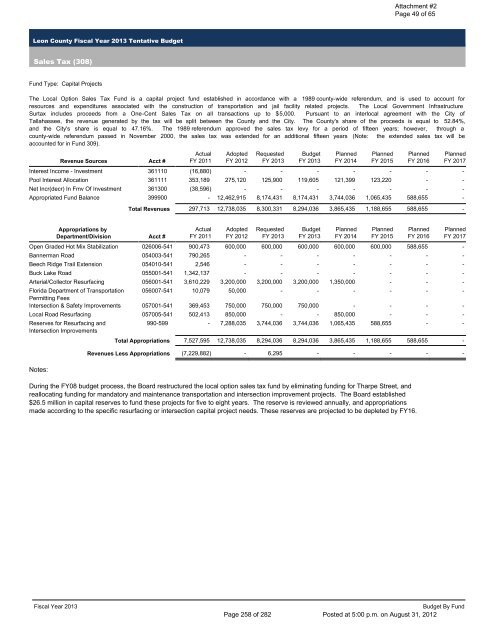

Leon County Fiscal Year 2013 Tentative Budget Sales Tax (308) Fund Type: Capital Projects The Local Option Sales Tax Fund is a capital project fund established in accordance with a 1989 county-wide referendum, and is used to account for resources and expenditures associated with the construction of transportation and jail facility related projects. The Local Government Infrastructure Surtax includes proceeds from a One-Cent Sales Tax on all transactions up to $5,000. Pursuant to an interlocal agreement with the City of Tallahassee, the revenue generated by the tax will be split between the County and the City. The County's share of the proceeds is equal to 52.84%, and the City's share is equal to 47.16%. The 1989 referendum approved the sales tax levy for a period of fifteen years; however, through a county-wide referendum passed in November 2000, the sales tax was extended for an additional fifteen years (Note: the extended sales tax will be accounted for in Fund 309). Revenue Sources Acct # Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Interest Income - Investment 361110 (16,880) - - - - - - Pool Interest Allocation 361111 353,189 275,120 125,900 119,605 121,399 123,220 - Net Incr(decr) In Fmv Of Investment 361300 (38,596) - - - - - - Appropriated Fund Balance 399900 - 12,462,915 8,174,431 8,174,431 3,744,036 1,065,435 588,655 Appropriations by Department/Division Total Revenues Acct # 297,713 12,738,035 8,300,331 8,294,036 3,865,435 1,188,655 588,655 - Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Open Graded Hot Mix Stabilization 026006-541 900,473 600,000 600,000 600,000 600,000 600,000 588,655 Bannerman Road 054003-541 790,265 - - - - - - Beech Ridge Trail Extension 054010-541 2,546 - - - - - - Buck Lake Road 055001-541 1,342,137 - - - - - - Arterial/Collector Resurfacing 056001-541 3,610,229 3,200,000 3,200,000 3,200,000 1,350,000 - - Florida Department of Transportation Permitting Fees 056007-541 10,079 50,000 - - - - - Intersection & Safety Improvements 057001-541 369,453 750,000 750,000 750,000 - - - Local Road Resurfacing 057005-541 502,413 850,000 - - 850,000 - - Reserves for Resurfacing and Intersection Improvements Notes: Total Appropriations Revenues Less Appropriations Attachment #2 Page 49 of 65 990-599 - 7,288,035 3,744,036 3,744,036 1,065,435 588,655 - 7,527,595 12,738,035 8,294,036 8,294,036 3,865,435 1,188,655 588,655 - (7,229,882) - 6,295 - - - - - During the FY08 budget process, the Board restructured the local option sales tax fund by eliminating funding for Tharpe Street, and reallocating funding for mandatory and maintenance transportation and intersection improvement projects. The Board established $26.5 million in capital reserves to fund these projects for five to eight years. The reserve is reviewed annually, and appropriations made according to the specific resurfacing or intersection capital project needs. These reserves are projected to be depleted by FY16. Fiscal Year 2013 Budget By Fund Page 258 of 282 Posted at 5:00 p.m. on August 31, 2012 - - - - - - - - - - - - -

Leon County Fiscal Year 2013 Tentative Budget Sales Tax - Extension (309) Fund Type: Capital Projects In November of 2000, Leon County residents approved a referendum extending the imposition of the 1-Cent Local Option Sales Tax beginning in FY 2004 for 15 years. The extension commits 80% of the revenues to Blueprint 2000 projects and will be jointly administered and funded by Leon County and the City of Tallahassee. The remaining 20% will be split evenly between the County and the City. The County's share will be used for various road, stormwater and park improvements. The Blueprint 2000 Joint Participation Agreement Revenue supports County projects funded through the County's share of the $50 million water quality/flooding funding. Appropriated fund balance is actually internal borrowings to advance fund certain projects. The transfer account is the corresponding repayment. Revenue Sources Acct # Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 1 Cent Sales Tax 312600 3,439,956 3,296,405 3,569,200 3,390,740 3,458,570 3,527,730 3,598,315 BP2000 JPA Revenue 343916 455,538 1,980,000 - - 3,542,253 - - Interest Income - Investment 361110 (9,357) - - - - - - Pool Interest Allocation 361111 121,496 87,400 51,000 48,450 49,177 49,914 50,663 Net Incr(decr) In Fmv Of Investment 361300 (19,292) - - - - - - Appropriated Fund Balance 399900 - 113,049 - - - - - Appropriations by Department/Division Total Revenues Acct # 3,688,280 - - 51,423 3,988,341 5,476,854 3,620,200 3,439,190 7,050,000 3,577,644 3,648,978 3,739,703 Actual Adopted Requested Budget Planned Planned Planned Planned FY 2011 FY 2012 FY 2013 FY 2013 FY 2014 FY 2015 FY 2016 FY 2017 Gaines Street 051005-541 2,542,238 1,796,854 - - - - - Natural Bridge Road 051006-541 2,086 - - - - - - Springhill Road Bridge 051007-541 1,484 - - - - - - Talpeco Road & Highway 27 North 053005-541 66,087 - - - - - - Arterial/Collector Resurfacing 056001-541 - - - - 1,850,000 1,827,644 2,073,006 Community Safety & Mobility 056005-541 1,219,912 500,000 500,000 500,000 750,000 750,000 750,000 Intersection & Safety Improvements 057001-541 - - - - 750,000 750,000 575,972 Lake Munson Restoration 062001-538 3,179 - - - - - - Lakeview Bridge 062002-538 1,620 - - - - - - Longwood Outfall Retrofit 062004-538 100 - - - - - - Gum Road Target Planning Area 062005-538 1,985 1,980,000 - - 3,200,000 - - Lexington Pond Retrofit 063005-538 162,964 - - - - - - Killearn Acres Flood Mitigation 064001-538 81,127 200,000 - - - - - Killearn Lakes Plantation Stormwater 064006-538 35,360 1,000,000 - - 500,000 250,000 250,000 Lafayette Street Stormwater 065001-538 43,071 - - - - - - Blue Print 2000 Water Quality Enhancements Budgeted Reserves - Local Opt. Sales Tax. Notes: 067002-538 324,578 - - - - - - Total Appropriations Revenues Less Appropriations Attachment #2 Page 50 of 65 990-599 - - 2,939,190 2,939,190 - - - - - - - - - 2,239,703 750,000 750,000 4,485,791 5,476,854 3,439,190 3,439,190 7,050,000 3,577,644 3,648,978 3,739,703 (497,451) - 181,010 - - - - - Beginning in FY14, with the depletion of capital reserves in the original sales tax fund (Fund 308), the sales tax extension will begin to assist in funding the Arterial Road Resurfacing, Community Safety and Mobility, Local Road Resurfacing, and Intersection Safety and Improvement projects. This fund will be the sole source of funding for these projects in FY15. Fiscal Year 2013 Budget By Fund Page 259 of 282 Posted at 5:00 p.m. on August 31, 2012 - - - - - - - - - -

- Page 1 and 2:

BOARD OF COUNTY COMMISSIONERS LEON

- Page 3 and 4:

Board of County Commissioners Regul

- Page 5 and 6:

Board of County Commissioners Regul

- Page 7 and 8:

Board of County Commissioners Regul

- Page 9 and 10:

Leon County Board of County Commiss

- Page 11 and 12:

Title: Approval of Payment of Bills

- Page 13 and 14:

To: Leon County Board of County Com

- Page 15 and 16:

Title: Acceptance of Fiscal Year 20

- Page 17 and 18:

28173 POWER EDGE 220S DONATED TO GO

- Page 19 and 20:

32918 MOBILE RADIO MODEM RETURNED 3

- Page 21 and 22:

Leon County Board of County Commiss

- Page 23 and 24:

Title: Approval of an Agreement Awa

- Page 25 and 26:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 27 and 28:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 29 and 30:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 31 and 32:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 33 and 34:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 35 and 36:

AGREEMENT BETWEEN LEON COUNTY AND O

- Page 37 and 38:

Bid Title: Installation & Maintenan

- Page 39 and 40:

Bid Title: Installation & Maintenan

- Page 41 and 42:

Bid Title: Installation & Maintenan

- Page 43 and 44:

Bid Title: Installation & Maintenan

- Page 45 and 46:

Bid Title: Installation & Maintenan

- Page 47 and 48:

Bid Title: Installation & Maintenan

- Page 49 and 50:

Bid Title: Installation & Maintenan

- Page 51 and 52:

Bid Title: Installation & Maintenan

- Page 53:

Bid Title: Installation & Maintenan

- Page 64 and 65:

To: Leon County Board of County Com

- Page 66 and 67:

This document was prepared by: Leon

- Page 68 and 69:

significance. Attachment #1 Page 3

- Page 73:

Exhibit "A" NEW CYPRESS LANDING CON

- Page 82:

Exhibit "A" NEW CYPRESS LANDING CON

- Page 86 and 87:

SPECIFIC LOCATION MAP RO CO CO ROCO

- Page 88 and 89:

To: Leon County Board of County Com

- Page 90 and 91:

Title: Consideration of Funding a M

- Page 92 and 93:

To: From: Title: Leon County Board

- Page 94 and 95:

Title: Consideration of Funding for

- Page 96 and 97:

Title: Consideration of Funding for

- Page 98 and 99:

To: From: Title: County Administrat

- Page 100 and 101:

Report and Discussion Attachment #2

- Page 102 and 103:

Attachment #2 Page 5 of 7 10. Works

- Page 106 and 107:

Leon County Board of County Commiss

- Page 108 and 109:

Title: Approval of the Appointments

- Page 110 and 111:

Title: Approval of the Appointments

- Page 112 and 113:

In the space below briefly describe

- Page 114 and 115:

Mr. Leon Carl Adams ‘70 DPL, Pres

- Page 116 and 117:

In the space below briefly describe

- Page 118 and 119:

October 6, 2011 Shington Lamy Assis

- Page 120 and 121:

proactive sales lists and develops

- Page 122 and 123:

ADVISORY COMMITTEE APPLICATION FOR

- Page 124 and 125:

Resumé Walter L. Cofer Address: 40

- Page 126:

Resumé Walter L. Cofer PROFESSIONA

- Page 130 and 131:

BACKGROUND President, CNL Real Esta

- Page 134 and 135:

118 N. Gadsden Street Tallahassee,

- Page 136 and 137:

It is the applicant’s responsibil

- Page 138 and 139:

All statements and information prov

- Page 140:

Attachment #7 Page 1 of 5 ADVISORY

- Page 143 and 144:

American Bar Association Business L

- Page 145 and 146:

It is the applicant’s responsibil

- Page 147 and 148:

Page 1 BETH ANN MATUGA Emphases Bet

- Page 149 and 150:

Page 3 BETH ANN MATUGA League of Wo

- Page 151 and 152:

Page 5 BETH ANN MATUGA Wrote and e

- Page 153 and 154:

Page 7 BETH ANN MATUGA League of Wo

- Page 157 and 158:

Will Messer Executive Profile Skill

- Page 159 and 160:

RECEIVED AUG 2 6 2010 Attachment #1

- Page 162 and 163:

CURRICULUM VITAE Robert W- Newburgh

- Page 164:

American Society of Biochemists and

- Page 168 and 169:

Board Memberships: Past Attachment

- Page 170 and 171:

In the space below briefly describe

- Page 172 and 173:

Florida State University -- 1973 to

- Page 174 and 175:

In the space below briefly describe

- Page 176 and 177:

Traylor Management, Inc., 600 Three

- Page 178 and 179:

It is the applicant’s responsibil

- Page 180 and 181:

Leon County Board of County Commiss

- Page 182 and 183:

• Update and maintain databases f

- Page 184 and 185:

Attachment #14 Page 7 of 10 August

- Page 186 and 187:

facilitated a support group specifi

- Page 189 and 190:

Attachment #15 Page 2 of 5 In the s

- Page 191 and 192:

TERRY WILLIAMS, MS, MA, PMP Senior

- Page 193 and 194:

It is the applicant’s responsibil

- Page 195 and 196:

Fred H. Williams 793 Litchfield Roa

- Page 197 and 198:

It is the applicant’s responsibil

- Page 199:

Hugh H. (Hamp) Wilson 5663 Bradford

- Page 203 and 204:

Represented the Federal Deposit Ins

- Page 205 and 206:

Leon County Board of County Commiss

- Page 207 and 208: Title: First of Two Public Hearings

- Page 209 and 210: RESOLUTION NO. _____ WHEREAS, the B

- Page 211 and 212: EXHIBIT A Attachment #2 Page 2 of 6

- Page 213 and 214: EXHIBIT B Attachment #2 Page 4 of 6

- Page 215 and 216: Leon County Fiscal Year 2013 Tentat

- Page 217 and 218: Leon County Fiscal Year 2013 Tentat

- Page 219 and 220: Leon County Fiscal Year 2013 Tentat

- Page 221 and 222: Leon County Fiscal Year 2013 Tentat

- Page 223 and 224: Leon County Fiscal Year 2013 Tentat

- Page 225 and 226: Leon County Fiscal Year 2013 Tentat

- Page 227 and 228: Leon County Fiscal Year 2013 Tentat

- Page 229 and 230: Leon County Fiscal Year 2013 Tentat

- Page 231 and 232: Leon County Fiscal Year 2013 Tentat

- Page 233 and 234: Leon County Fiscal Year 2013 Tentat

- Page 235 and 236: Leon County Fiscal Year 2013 Tentat

- Page 237 and 238: Leon County Fiscal Year 2013 Tentat

- Page 239 and 240: Leon County Fiscal Year 2013 Tentat

- Page 241 and 242: Leon County Fiscal Year 2013 Tentat

- Page 243 and 244: Leon County Fiscal Year 2013 Tentat

- Page 245 and 246: Leon County Fiscal Year 2013 Tentat

- Page 247 and 248: Leon County Fiscal Year 2013 Tentat

- Page 249 and 250: Leon County Fiscal Year 2013 Tentat

- Page 251 and 252: Leon County Fiscal Year 2013 Tentat

- Page 253 and 254: Leon County Fiscal Year 2013 Tentat

- Page 255 and 256: Leon County Fiscal Year 2013 Tentat

- Page 257: Leon County Fiscal Year 2013 Tentat

- Page 261 and 262: Leon County Fiscal Year 2013 Tentat

- Page 263 and 264: Leon County Fiscal Year 2013 Tentat

- Page 265 and 266: Leon County Fiscal Year 2013 Tentat

- Page 267 and 268: Leon County Fiscal Year 2013 Tentat

- Page 269 and 270: Leon County Fiscal Year 2013 Tentat

- Page 271 and 272: Leon County Fiscal Year 2013 Tentat

- Page 273 and 274: Leon County Fiscal Year 2013 Tentat

- Page 275 and 276: RESOLUTION NO. _____ WHEREAS, the B

- Page 277 and 278: EXHIBIT A Attachment #4 Page 2 of 3

- Page 279 and 280: RESOLUTION NO. _____ WHEREAS, the B

- Page 281 and 282: EXHIBIT A Attachment #6 Page 2 of 3