Bilansi uspjeha - Raiffeisen Bank

Bilansi uspjeha - Raiffeisen Bank

Bilansi uspjeha - Raiffeisen Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Notes to the financial statements<br />

31 December 2005 and 2004<br />

(all amounts are expressed in thousands of KM)<br />

Financial assets and liabilities (continued)<br />

Objective evidence of impairment for financial assets assessed collectively for impairment are the adverse changes<br />

in the payment status of borrowers in the group (e.g. an increased number of delayed payments) or national or local<br />

economic conditions that correlate with defaults on the assets in the group.<br />

When a loan is uncollectible, it is written off against the related allowance for impairment; subsequent recoveries are<br />

credited to the ‘Impairment losses on loans and advances’ line in the income statement.<br />

The <strong>Bank</strong> charges penalty interest to borrowers when a portion of the loan falls overdue. Penalty interest is accounted<br />

for on a cash received basis in the caption ‘Interest income’.<br />

Purchased loans held to maturity<br />

Purchased loans held to maturity comprise the loan portfolio purchased from USAID Business Finance as described in<br />

Note 18. The <strong>Bank</strong> has intention and ability to hold this portfolio till maturity of each loan. Assets held to maturity are<br />

recognized at cost and carried at amortized cost using the effective yield method, less any provision for impairment.<br />

Property and equipment<br />

Property and equipment are started at cost less accumulated depreciation and accumulated impairment losses, if<br />

any. Cost includes the purchase price and directly associated cost of bringing the asset to a working condition for<br />

its intended use. Maintenance and repairs, replacements and improvements of minor importance are expensed as<br />

incurred. Significant improvements and replacement of assets are capitalised. Gains or losses on the retirement or<br />

disposal of property and equipment are included in the statement of income in the period in which they occur.<br />

Properties in the course of construction are carried at cost, less impairment loss, if any. Depreciation commences when<br />

the assets are ready for their intended use. Depreciation is calculated on a straight-line basis over the estimated useful<br />

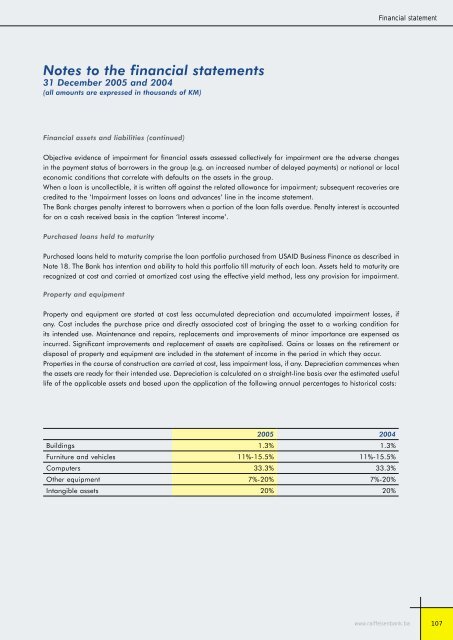

life of the applicable assets and based upon the application of the following annual percentages to historical costs:<br />

2005 2004<br />

Buildings 1.3% 1.3%<br />

Furniture and vehicles 11%-15.5% 11%-15.5%<br />

Computers 33.3% 33.3%<br />

Other equipment 7%-20% 7%-20%<br />

Intangible assets 20% 20%<br />

Financial statement<br />

www.raiffeisenbank.ba<br />

107