Bilansi uspjeha - Raiffeisen Bank

Bilansi uspjeha - Raiffeisen Bank

Bilansi uspjeha - Raiffeisen Bank

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

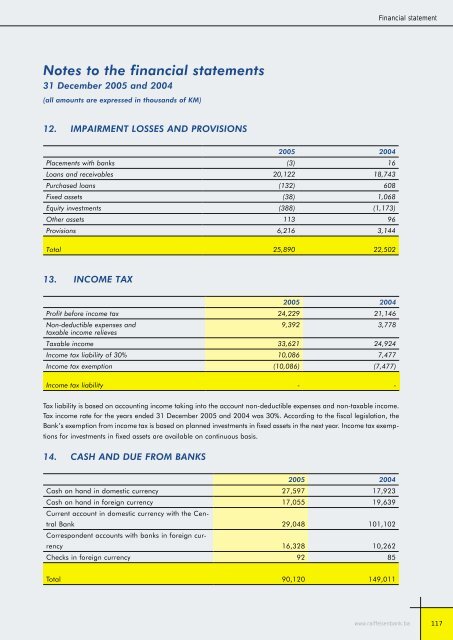

Notes to the financial statements<br />

31 December 2005 and 2004<br />

(all amounts are expressed in thousands of KM)<br />

12. IMPAIRMENT LOSSES AND PROVISIONS<br />

2005 2004<br />

Placements with banks (3) 16<br />

Loans and receivables 20,122 18,743<br />

Purchased loans (132) 608<br />

Fixed assets (38) 1,068<br />

Equity investments (388) (1,173)<br />

Other assets 113 96<br />

Provisions 6,216 3,144<br />

Total 25,890 22,502<br />

13. INCOME TAX<br />

2005 2004<br />

Profit before income tax 24,229 21,146<br />

Non-deductible expenses and<br />

taxable income relieves<br />

9,392 3,778<br />

Taxable income 33,621 24,924<br />

Income tax liability of 30% 10,086 7,477<br />

Income tax exemption (10,086) (7,477)<br />

Income tax liability - -<br />

Tax liability is based on accounting income taking into the account non-deductible expenses and non-taxable income.<br />

Tax income rate for the years ended 31 December 2005 and 2004 was 30%. According to the fiscal legislation, the<br />

<strong>Bank</strong>’s exemption from income tax is based on planned investments in fixed assets in the next year. Income tax exemp-<br />

tions for investments in fixed assets are available on continuous basis.<br />

14. CASH AND DUE FROM BANKS<br />

2005 2004<br />

Cash on hand in domestic currency 27,597 17,923<br />

Cash on hand in foreign currency 17,055 19,639<br />

Current account in domestic currency with the Cen-<br />

tral <strong>Bank</strong> 29,048 101,102<br />

Correspondent accounts with banks in foreign cur-<br />

rency 16,328 10,262<br />

Checks in foreign currency 92 85<br />

Total 90,120 149,011<br />

Financial statement<br />

www.raiffeisenbank.ba<br />

117