KAMDHENU ISPAT LIMITED - Securities and Exchange Board of India

KAMDHENU ISPAT LIMITED - Securities and Exchange Board of India

KAMDHENU ISPAT LIMITED - Securities and Exchange Board of India

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OTHER REGULATORY AND STATUTORY DISCLOSURES<br />

Authority for the Issue <strong>and</strong> Details <strong>of</strong> the Resolution Passed for the Issue<br />

Present Issue <strong>of</strong> Equity Shares has been authorized by shareholders vide a Special Resolution passed at the Extra<br />

Ordinary General Meeting <strong>of</strong> the Company held on October 5, 2005. The <strong>Board</strong> <strong>of</strong> Directors <strong>of</strong> the Company had<br />

approved the present Issue <strong>of</strong> Equity Shares vide a resolution passed at their meeting held on September 10,<br />

2005.<br />

Prohibition by SEBI<br />

The Company, its directors, any <strong>of</strong> the Company’s Associates or Group Companies, <strong>and</strong> Companies with which the<br />

directors <strong>of</strong> Issuer are associated, as directors or promoter, have not been prohibited from accessing the capital<br />

market under any order or directions passed by SEBI. The listing <strong>of</strong> any securities <strong>of</strong> the Issuer has never been<br />

refused at anytime by any <strong>of</strong> the stock exchanges in <strong>India</strong>.<br />

Eligibility for the Issue<br />

Our Company is eligible for the Issue in accordance with Clause 2.2.1 <strong>of</strong> the SEBI Guidelines as explained under<br />

with eligibility criteria calculated in accordance with financial statements under <strong>India</strong>n GAAP:<br />

Our Company has net tangible assets <strong>of</strong> at least Rs. 300 lakhs in each <strong>of</strong> the preceding three full years <strong>of</strong> which not<br />

more than 50% is held in monetary assets <strong>and</strong> is compliant with Clause 2.2.1(a) <strong>of</strong> the SEBI Guidelines;<br />

Our Company has a track record <strong>of</strong> distributable pr<strong>of</strong>its in accordance with Section 205 <strong>of</strong> Companies Act, for at<br />

least three <strong>of</strong> the immediately preceding five years <strong>and</strong> is compliant with Clause 2.2.1(b) <strong>of</strong> the SEBI Guidelines;<br />

Our Company has a net worth <strong>of</strong> at least Rs. 100 lakhs in each <strong>of</strong> the three preceding full years; <strong>and</strong> is compliant<br />

with Clause 2.2.1(c) <strong>of</strong> the SEBI Guidelines;<br />

The proposed Issue size is not expected to exceed five times the pre-Issue net worth <strong>of</strong> our Company <strong>and</strong> is<br />

compliant with Clause 2.2.1(e) <strong>of</strong> the SEBI Guidelines;<br />

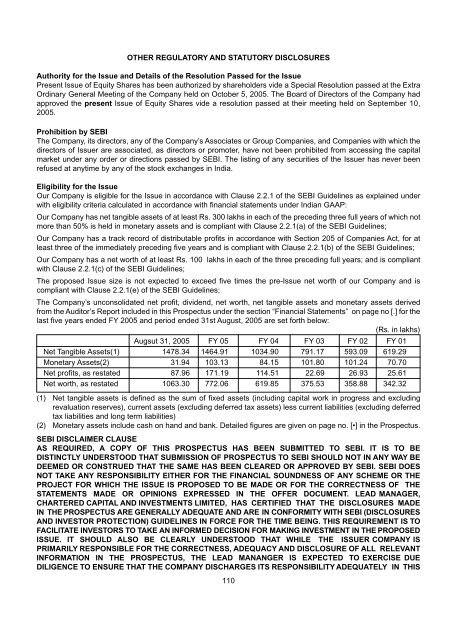

The Company’s unconsolidated net pr<strong>of</strong>it, dividend, net worth, net tangible assets <strong>and</strong> monetary assets derived<br />

from the Auditor’s Report included in this Prospectus under the section “Financial Statements” on page no [.] for the<br />

last five years ended FY 2005 <strong>and</strong> period ended 31st August, 2005 are set forth below:<br />

(Rs. in lakhs)<br />

Augsut 31, 2005 FY 05 FY 04 FY 03 FY 02 FY 01<br />

Net Tangible Assets(1) 1478.34 1464.91 1034.90 791.17 593.09 619.29<br />

Monetary Assets(2) 31.94 103.13 84.15 101.80 101.24 70.70<br />

Net pr<strong>of</strong>its, as restated 87.96 171.19 114.51 22.69 26.93 25.61<br />

Net worth, as restated 1063.30 772.06 619.85 375.53 358.88 342.32<br />

(1) Net tangible assets is defined as the sum <strong>of</strong> fixed assets (including capital work in progress <strong>and</strong> excluding<br />

revaluation reserves), current assets (excluding deferred tax assets) less current liabilities (excluding deferred<br />

tax liabilities <strong>and</strong> long term liabilities)<br />

(2) Monetary assets include cash on h<strong>and</strong> <strong>and</strong> bank. Detailed figures are given on page no. [] in the Prospectus.<br />

SEBI DISCLAIMER CLAUSE<br />

AS REQUIRED, A COPY OF THIS PROSPECTUS HAS BEEN SUBMITTED TO SEBI. IT IS TO BE<br />

DISTINCTLY UNDERSTOOD THAT SUBMISSION OF PROSPECTUS TO SEBI SHOULD NOT IN ANY WAY BE<br />

DEEMED OR CONSTRUED THAT THE SAME HAS BEEN CLEARED OR APPROVED BY SEBI. SEBI DOES<br />

NOT TAKE ANY RESPONSIBILITY EITHER FOR THE FINANCIAL SOUNDNESS OF ANY SCHEME OR THE<br />

PROJECT FOR WHICH THE ISSUE IS PROPOSED TO BE MADE OR FOR THE CORRECTNESS OF THE<br />

STATEMENTS MADE OR OPINIONS EXPRESSED IN THE OFFER DOCUMENT. LEAD MANAGER,<br />

CHARTERED CAPITAL AND INVESTMENTS <strong>LIMITED</strong>, HAS CERTIFIED THAT THE DISCLOSURES MADE<br />

IN THE PROSPECTUS ARE GENERALLY ADEQUATE AND ARE IN CONFORMITY WITH SEBI (DISCLOSURES<br />

AND INVESTOR PROTECTION) GUIDELINES IN FORCE FOR THE TIME BEING. THIS REQUIREMENT IS TO<br />

FACILITATE INVESTORS TO TAKE AN INFORMED DECISION FOR MAKING INVESTMENT IN THE PROPOSED<br />

ISSUE. IT SHOULD ALSO BE CLEARLY UNDERSTOOD THAT WHILE THE ISSUER COMPANY IS<br />

PRIMARILY RESPONSIBLE FOR THE CORRECTNESS, ADEQUACY AND DISCLOSURE OF ALL RELEVANT<br />

INFORMATION IN THE PROSPECTUS, THE LEAD MANANGER IS EXPECTED TO EXERCISE DUE<br />

DILIGENCE TO ENSURE THAT THE COMPANY DISCHARGES ITS RESPONSIBILITY ADEQUATELY IN THIS<br />

110