Research 350 - NZ Transport Agency

Research 350 - NZ Transport Agency

Research 350 - NZ Transport Agency

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

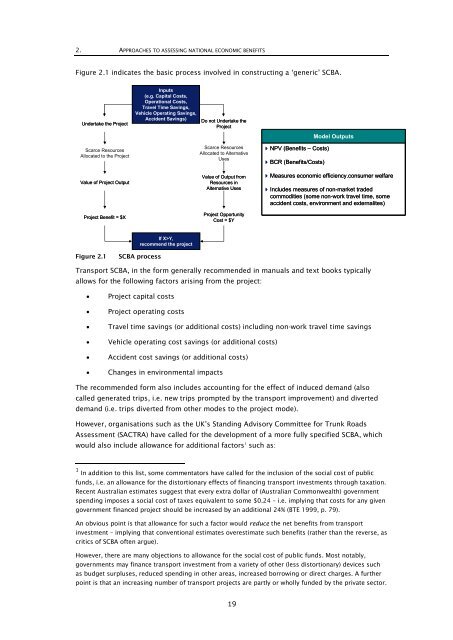

2. APPROACHES TO ASSESSING NATIONAL ECONOMIC BENEFITS<br />

Figure 2.1 indicates the basic process involved in constructing a ‘generic’ SCBA.<br />

Undertake the Project<br />

Scarce Resources<br />

Allocated to the Project<br />

Value of Project Output<br />

Project Benefit = $X<br />

Inputs<br />

(e.g. Capital Costs,<br />

Operational Costs,<br />

Travel Time Savings,<br />

Vehicle Operating Savings,<br />

Accident Savings)<br />

Do not Undertake the<br />

Project<br />

Scarce Resources<br />

Allocated to Alternative<br />

Uses<br />

Value of Output from<br />

Resources in<br />

Alternative Uses<br />

Project Opportunity<br />

Cost = $Y<br />

Model Outputs<br />

NPV (Benefits – Costs)<br />

BCR (Benefits/Costs)<br />

Measures economic efficiency.consumer welfare<br />

Includes measures of non-market traded<br />

commodities (some non-work travel time, some<br />

accident costs, environment and externalites)<br />

If X>Y,<br />

recommend the project<br />

Figure 2.1<br />

SCBA process<br />

<strong>Transport</strong> SCBA, in the form generally recommended in manuals and text books typically<br />

allows for the following factors arising from the project:<br />

• Project capital costs<br />

• Project operating costs<br />

• Travel time savings (or additional costs) including non-work travel time savings<br />

• Vehicle operating cost savings (or additional costs)<br />

• Accident cost savings (or additional costs)<br />

• Changes in environmental impacts<br />

The recommended form also includes accounting for the effect of induced demand (also<br />

called generated trips, i.e. new trips prompted by the transport improvement) and diverted<br />

demand (i.e. trips diverted from other modes to the project mode).<br />

However, organisations such as the UK’s Standing Advisory Committee for Trunk Roads<br />

Assessment (SACTRA) have called for the development of a more fully specified SCBA, which<br />

would also include allowance for additional factors 1 such as:<br />

1 In addition to this list, some commentators have called for the inclusion of the social cost of public<br />

funds, i.e. an allowance for the distortionary effects of financing transport investments through taxation.<br />

Recent Australian estimates suggest that every extra dollar of (Australian Commonwealth) government<br />

spending imposes a social cost of taxes equivalent to some $0.24 – i.e. implying that costs for any given<br />

government financed project should be increased by an additional 24% (BTE 1999, p. 79).<br />

An obvious point is that allowance for such a factor would reduce the net benefits from transport<br />

investment – implying that conventional estimates overestimate such benefits (rather than the reverse, as<br />

critics of SCBA often argue).<br />

However, there are many objections to allowance for the social cost of public funds. Most notably,<br />

governments may finance transport investment from a variety of other (less distortionary) devices such<br />

as budget surpluses, reduced spending in other areas, increased borrowing or direct charges. A further<br />

point is that an increasing number of transport projects are partly or wholly funded by the private sector.<br />

19