Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

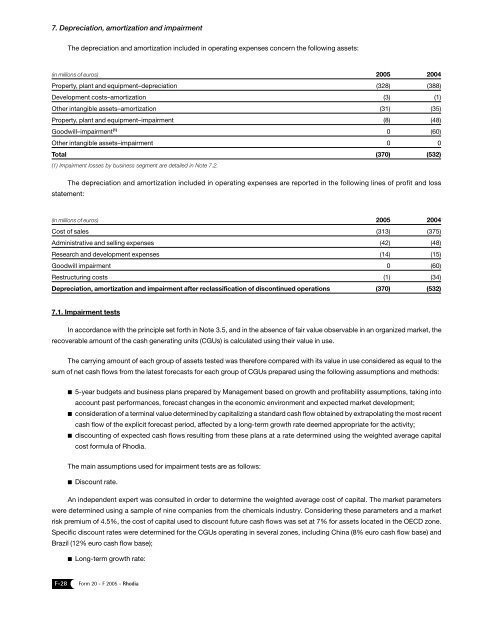

7. Depreciation, amortization and impairment<br />

The depreciation and amortization included in operating expenses concern the following assets:<br />

(in millions of euros) <strong>20</strong>05 <strong>20</strong>04<br />

Property, plant and equipment–depreciation (328) (388)<br />

Development costs–amortization (3) (1)<br />

Other intangible assets–amortization (31) (35)<br />

Property, plant and equipment–impairment (8) (48)<br />

Goodwill–impairment (1) 0 (60)<br />

Other intangible assets–impairment 0 0<br />

Total (370) (532)<br />

(1) Impairment losses by business segment are detailed in Note 7.2.<br />

The depreciation and amortization included in operating expenses are reported in the following lines of profit and loss<br />

statement:<br />

(in millions of euros) <strong>20</strong>05 <strong>20</strong>04<br />

Cost of sales (313) (375)<br />

Administrative and selling expenses (42) (48)<br />

Research and development expenses (14) (15)<br />

Goodwill impairment 0 (60)<br />

Restructuring costs (1) (34)<br />

Depreciation, amortization and impairment after reclassification of discontinued operations (370) (532)<br />

7.1. Impairment tests<br />

In accordance with the principle set forth in Note 3.5, and in the absence of fair value observable in an organized market, the<br />

recoverable amount of the cash generating units (CGUs) is calculated using their value in use.<br />

The carrying amount of each group of assets tested was therefore compared with its value in use considered as equal to the<br />

sum of net cash flows from the latest forecasts for each group of CGUs prepared using the following assumptions and methods:<br />

5-year budgets and business plans prepared by Management based on growth and profitability assumptions, taking into<br />

account past performances, forecast changes in the economic environment and expected market development;<br />

consideration of a terminal value determined by capitalizing a standard cash flow obtained by extrapolating the most recent<br />

cash flow of the explicit forecast period, affected by a long-term growth rate deemed appropriate for the activity;<br />

discounting of expected cash flows resulting from these plans at a rate determined using the weighted average capital<br />

cost formula of Rhodia.<br />

The main assumptions used for impairment tests are as follows:<br />

Discount rate.<br />

An independent expert was consulted in order to determine the weighted average cost of capital. The market parameters<br />

were determined using a sample of nine companies from the chemicals industry. Considering these parameters and a market<br />

risk premium of 4.5%, the cost of capital used to discount future cash flows was set at 7% for assets located in the OECD zone.<br />

Specific discount rates were determined for the CGUs operating in several zones, including China (8% euro cash flow base) and<br />

Brazil (12% euro cash flow base);<br />

Long-term growth rate:<br />

F-28 <strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia