Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

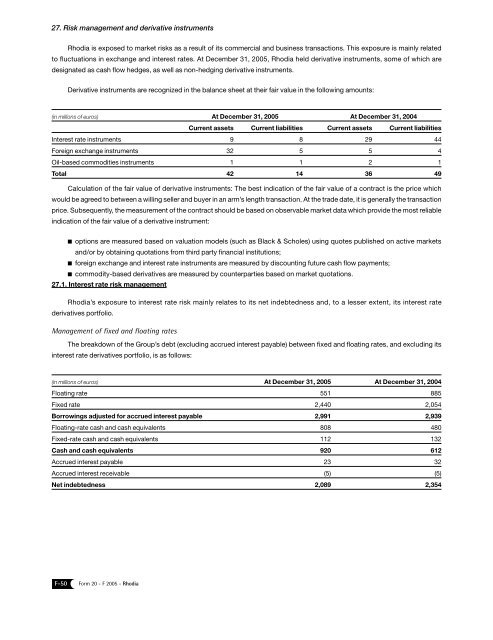

27. Risk management and derivative instruments<br />

Rhodia is exposed to market risks as a result of its commercial and business transactions. This exposure is mainly related<br />

to fluctuations in exchange and interest rates. At December 31, <strong>20</strong>05, Rhodia held derivative instruments, some of which are<br />

designated as cash flow hedges, as well as non-hedging derivative instruments.<br />

Derivative instruments are recognized in the balance sheet at their fair value in the following amounts:<br />

(in millions of euros) At December 31, <strong>20</strong>05 At December 31, <strong>20</strong>04<br />

Current assets Current liabilities Current assets Current liabilities<br />

Interest rate instruments 9 8 29 44<br />

Foreign exchange instruments 32 5 5 4<br />

Oil-based commodities instruments 1 1 2 1<br />

Total 42 14 36 49<br />

Calculation of the fair value of derivative instruments: The best indication of the fair value of a contract is the price which<br />

would be agreed to between a willing seller and buyer in an arm’s length transaction. At the trade date, it is generally the transaction<br />

price. Subsequently, the measurement of the contract should be based on observable market data which provide the most reliable<br />

indication of the fair value of a derivative instrument:<br />

options are measured based on valuation models (such as Black & Scholes) using quotes published on active markets<br />

and/or by obtaining quotations from third party financial institutions;<br />

foreign exchange and interest rate instruments are measured by discounting future cash flow payments;<br />

commodity-based derivatives are measured by counterparties based on market quotations.<br />

27.1. Interest rate risk management<br />

Rhodia’s exposure to interest rate risk mainly relates to its net indebtedness and, to a lesser extent, its interest rate<br />

derivatives portfolio.<br />

Management of fixed and floating rates<br />

The breakdown of the Group’s debt (excluding accrued interest payable) between fixed and floating rates, and excluding its<br />

interest rate derivatives portfolio, is as follows:<br />

(in millions of euros) At December 31, <strong>20</strong>05 At December 31, <strong>20</strong>04<br />

Floating rate 551 885<br />

Fixed rate 2,440 2,054<br />

Borrowings adjusted for accrued interest payable 2,991 2,939<br />

Floating-rate cash and cash equivalents 808 480<br />

Fixed-rate cash and cash equivalents 112 132<br />

Cash and cash equivalents 9<strong>20</strong> 612<br />

Accrued interest payable 23 32<br />

Accrued interest receivable (5) (5)<br />

Net indebtedness 2,089 2,354<br />

F-50 <strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia