Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

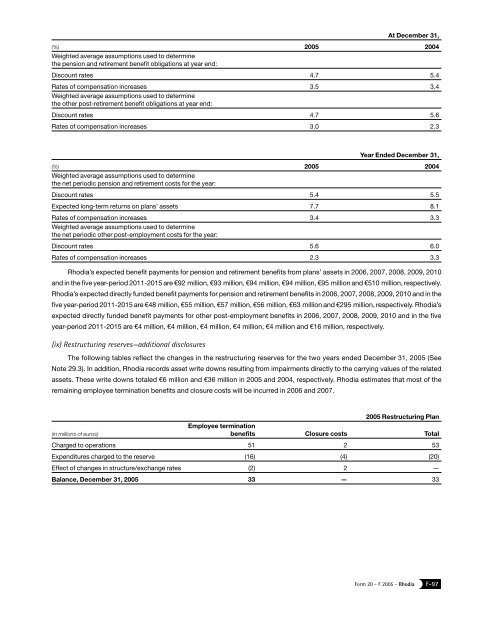

At December 31,<br />

(%) <strong>20</strong>05 <strong>20</strong>04<br />

Weighted average assumptions used to determine<br />

the pension and retirement benefit obligations at year end:<br />

Discount rates 4.7 5.4<br />

Rates of compensation increases 3.5 3.4<br />

Weighted average assumptions used to determine<br />

the other post-retirement benefit obligations at year end:<br />

Discount rates 4.7 5.6<br />

Rates of compensation increases 3.0 2.3<br />

Year Ended December 31,<br />

(%) <strong>20</strong>05 <strong>20</strong>04<br />

Weighted average assumptions used to determine<br />

the net periodic pension and retirement costs for the year:<br />

Discount rates 5.4 5.5<br />

Expected long-term returns on plans’ assets 7.7 8.1<br />

Rates of compensation increases 3.4 3.3<br />

Weighted average assumptions used to determine<br />

the net periodic other post-employment costs for the year:<br />

Discount rates 5.6 6.0<br />

Rates of compensation increases 2.3 3.3<br />

Rhodia’s expected benefit payments for pension and retirement benefits from plans’ assets in <strong>20</strong>06, <strong>20</strong>07, <strong>20</strong>08, <strong>20</strong>09, <strong>20</strong>10<br />

and in the five year-period <strong>20</strong>11-<strong>20</strong>15 are €92 million, €93 million, €94 million, €94 million, €95 million and €510 million, respectively.<br />

Rhodia’s expected directly funded benefit payments for pension and retirement benefits in <strong>20</strong>06, <strong>20</strong>07, <strong>20</strong>08, <strong>20</strong>09, <strong>20</strong>10 and in the<br />

five year-period <strong>20</strong>11-<strong>20</strong>15 are €48 million, €55 million, €57 million, €56 million, €63 million and €295 million, respectively. Rhodia’s<br />

expected directly funded benefit payments for other post-employment benefits in <strong>20</strong>06, <strong>20</strong>07, <strong>20</strong>08, <strong>20</strong>09, <strong>20</strong>10 and in the five<br />

year-period <strong>20</strong>11-<strong>20</strong>15 are €4 million, €4 million, €4 million, €4 million, €4 million and €16 million, respectively.<br />

(ix) Restructuring reserves—additional disclosures<br />

The following tables reflect the changes in the restructuring reserves for the two years ended December 31, <strong>20</strong>05 (See<br />

Note 29.3). In addition, Rhodia records asset write downs resulting from impairments directly to the carrying values of the related<br />

assets. These write downs totaled €6 million and €36 million in <strong>20</strong>05 and <strong>20</strong>04, respectively. Rhodia estimates that most of the<br />

remaining employee termination benefits and closure costs will be incurred in <strong>20</strong>06 and <strong>20</strong>07.<br />

(in millions of euros)<br />

<strong>20</strong>05 Restructuring Plan<br />

Employee termination<br />

benefits Closure costs Total<br />

Charged to operations 51 2 53<br />

Expenditures charged to the reserve (16) (4) (<strong>20</strong>)<br />

Effect of changes in structure/exchange rates (2) 2 —<br />

Balance, December 31, <strong>20</strong>05 33 — 33<br />

<strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia<br />

F-97