Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The actual rate of return on plan assets amounted to €105 million and €141 million for <strong>20</strong>04 and <strong>20</strong>05, respectively.<br />

The expected rate of return was €90 million for <strong>20</strong>04 and €91 million for <strong>20</strong>05. Actuarial gains have been recognized to account for<br />

the difference between these two amounts, i.e. €15 million for <strong>20</strong>04 and €50 million for <strong>20</strong>05.<br />

The amount disbursed by the Group with respect to defined benefit plans corresponds to benefits paid to employees<br />

(€166 million in <strong>20</strong>05), to Rhodia’s contributions to funds (€34 million in <strong>20</strong>05), less the benefits paid directly by these funds<br />

(€114 million in <strong>20</strong>05). This amount totaled €86 million in <strong>20</strong>05 and €70 million in <strong>20</strong>04 and is estimated at €96 million with<br />

respect to <strong>20</strong>06.<br />

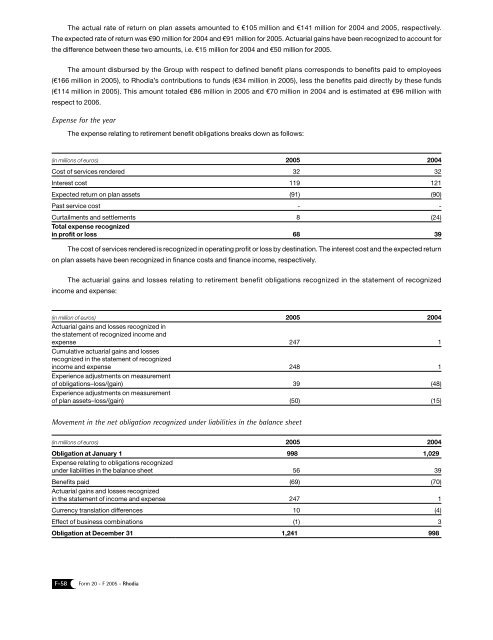

Expense for the year<br />

The expense relating to retirement benefit obligations breaks down as follows:<br />

(in millions of euros) <strong>20</strong>05 <strong>20</strong>04<br />

Cost of services rendered 32 32<br />

Interest cost 119 121<br />

Expected return on plan assets (91) (90)<br />

Past service cost - -<br />

Curtailments and settlements 8 (24)<br />

Total expense recognized<br />

in profit or loss 68 39<br />

The cost of services rendered is recognized in operating profit or loss by destination. The interest cost and the expected return<br />

on plan assets have been recognized in finance costs and finance income, respectively.<br />

The actuarial gains and losses relating to retirement benefit obligations recognized in the statement of recognized<br />

income and expense:<br />

(in million of euros) <strong>20</strong>05 <strong>20</strong>04<br />

Actuarial gains and losses recognized in<br />

the statement of recognized income and<br />

expense 247 1<br />

Cumulative actuarial gains and losses<br />

recognized in the statement of recognized<br />

income and expense 248 1<br />

Experience adjustments on measurement<br />

of obligations–loss/(gain) 39 (48)<br />

Experience adjustments on measurement<br />

of plan assets–loss/(gain) (50) (15)<br />

Movement in the net obligation recognized under liabilities in the balance sheet<br />

(in millions of euros) <strong>20</strong>05 <strong>20</strong>04<br />

Obligation at January 1 998 1,029<br />

Expense relating to obligations recognized<br />

under liabilities in the balance sheet 56 39<br />

Benefits paid (69) (70)<br />

Actuarial gains and losses recognized<br />

in the statement of income and expense 247 1<br />

Currency translation differences 10 (4)<br />

Effect of business combinations (1) 3<br />

Obligation at December 31 1,241 998<br />

F-58 <strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia