Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

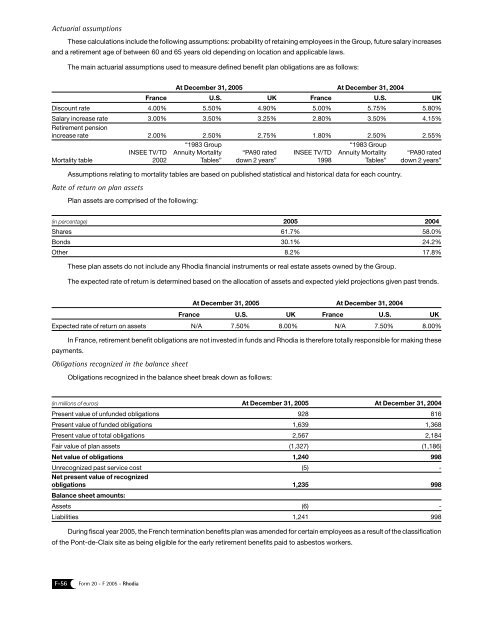

Actuarial assumptions<br />

These calculations include the following assumptions: probability of retaining employees in the Group, future salary increases<br />

and a retirement age of between 60 and 65 years old depending on location and applicable laws.<br />

The main actuarial assumptions used to measure defined benefit plan obligations are as follows:<br />

At December 31, <strong>20</strong>05 At December 31, <strong>20</strong>04<br />

France U.S. UK France U.S. UK<br />

Discount rate 4.00% 5.50% 4.90% 5.00% 5.75% 5.80%<br />

Salary increase rate 3.00% 3.50% 3.25% 2.80% 3.50% 4.15%<br />

Retirement pension<br />

increase rate 2.00% 2.50% 2.75% 1.80% 2.50% 2.55%<br />

Mortality table<br />

INSEE TV/TD<br />

<strong>20</strong>02<br />

“1983 Group<br />

Annuity Mortality<br />

Tables”<br />

“PA90 rated<br />

down 2 years”<br />

INSEE TV/TD<br />

1998<br />

“1983 Group<br />

Annuity Mortality<br />

Tables”<br />

Assumptions relating to mortality tables are based on published statistical and historical data for each country.<br />

Rate of return on plan assets<br />

Plan assets are comprised of the following:<br />

“PA90 rated<br />

down 2 years”<br />

(in percentage) <strong>20</strong>05 <strong>20</strong>04<br />

Shares 61.7% 58.0%<br />

Bonds 30.1% 24.2%<br />

Other 8.2% 17.8%<br />

These plan assets do not include any Rhodia financial instruments or real estate assets owned by the Group.<br />

The expected rate of return is determined based on the allocation of assets and expected yield projections given past trends.<br />

At December 31, <strong>20</strong>05 At December 31, <strong>20</strong>04<br />

France U.S. UK France U.S. UK<br />

Expected rate of return on assets N/A 7.50% 8.00% N/A 7.50% 8.00%<br />

In France, retirement benefit obligations are not invested in funds and Rhodia is therefore totally responsible for making these<br />

payments.<br />

Obligations recognized in the balance sheet<br />

Obligations recognized in the balance sheet break down as follows:<br />

(in millions of euros) At December 31, <strong>20</strong>05 At December 31, <strong>20</strong>04<br />

Present value of unfunded obligations 928 816<br />

Present value of funded obligations 1,639 1,368<br />

Present value of total obligations 2,567 2,184<br />

Fair value of plan assets (1,327) (1,186)<br />

Net value of obligations 1,240 998<br />

Unrecognized past service cost (5) -<br />

Net present value of recognized<br />

obligations 1,235 998<br />

Balance sheet amounts:<br />

Assets (6) -<br />

Liabilities 1,241 998<br />

During fiscal year <strong>20</strong>05, the French termination benefits plan was amended for certain employees as a result of the classification<br />

of the Pont-de-Claix site as being eligible for the early retirement benefits paid to asbestos workers.<br />

F-56 <strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia