Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

At December 31, <strong>20</strong>05, a sudden 10% increase in the U.S. dollar compared with these reporting currencies would generate<br />

an exchange loss of €107 million.<br />

As part of the hedging of its long-term debt denominated in U.S. dollars, Rhodia has entered into foreign exchange option<br />

contracts maturing in May <strong>20</strong>07. These contracts are not recognized as hedges for accounting purposes, even if they are used for<br />

hedging purposes.<br />

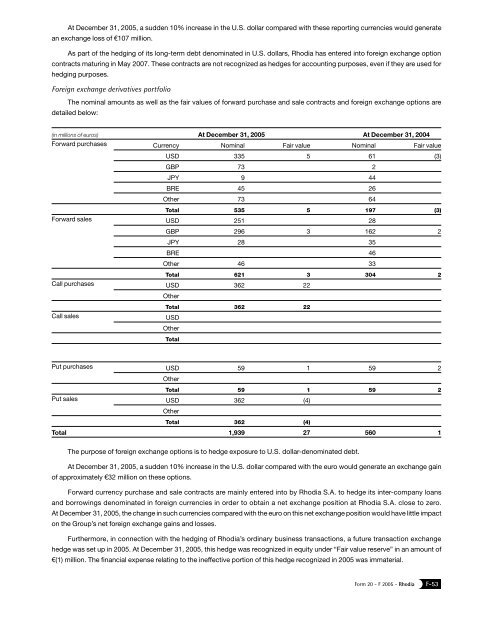

Foreign exchange derivatives portfolio<br />

The nominal amounts as well as the fair values of forward purchase and sale contracts and foreign exchange options are<br />

detailed below:<br />

(in millions of euros) At December 31, <strong>20</strong>05 At December 31, <strong>20</strong>04<br />

Forward purchases Currency Nominal Fair value Nominal Fair value<br />

USD 335 5 61 (3)<br />

GBP 73 2<br />

JPY 9 44<br />

BRE 45 26<br />

Other 73 64<br />

Total 535 5 197 (3)<br />

Forward sales USD 251 28<br />

GBP 296 3 162 2<br />

JPY 28 35<br />

BRE 46<br />

Other 46 33<br />

Total 621 3 304 2<br />

Call purchases USD 362 22<br />

Other<br />

Call sales<br />

Total 362 22<br />

USD<br />

Other<br />

Total<br />

Put purchases USD 59 1 59 2<br />

Other<br />

Total 59 1 59 2<br />

Put sales USD 362 (4)<br />

Other<br />

Total 362 (4)<br />

Total 1,939 27 560 1<br />

The purpose of foreign exchange options is to hedge exposure to U.S. dollar-denominated debt.<br />

At December 31, <strong>20</strong>05, a sudden 10% increase in the U.S. dollar compared with the euro would generate an exchange gain<br />

of approximately €32 million on these options.<br />

Forward currency purchase and sale contracts are mainly entered into by Rhodia S.A. to hedge its inter-company loans<br />

and borrowings denominated in foreign currencies in order to obtain a net exchange position at Rhodia S.A. close to zero.<br />

At December 31, <strong>20</strong>05, the change in such currencies compared with the euro on this net exchange position would have little impact<br />

on the Group’s net foreign exchange gains and losses.<br />

Furthermore, in connection with the hedging of Rhodia’s ordinary business transactions, a future transaction exchange<br />

hedge was set up in <strong>20</strong>05. At December 31, <strong>20</strong>05, this hedge was recognized in equity under “Fair value reserve” in an amount of<br />

€(1) million. The financial expense relating to the ineffective portion of this hedge recognized in <strong>20</strong>05 was immaterial.<br />

<strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia<br />

F-53