Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

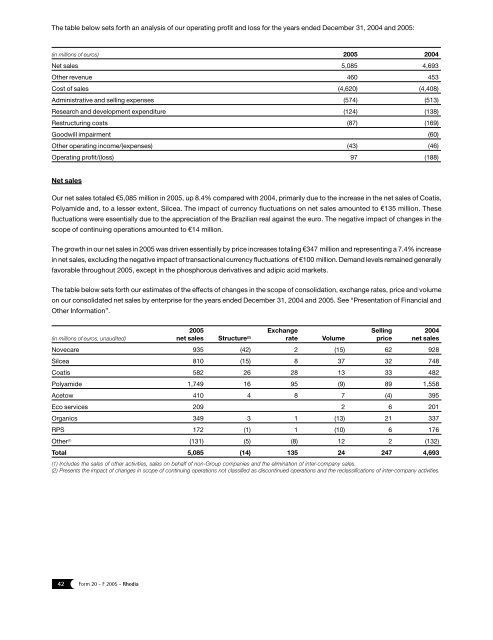

The table below sets forth an analysis of our operating profit and loss for the years ended December 31, <strong>20</strong>04 and <strong>20</strong>05:<br />

(in millions of euros) <strong>20</strong>05 <strong>20</strong>04<br />

Net sales 5,085 4,693<br />

Other revenue 460 453<br />

Cost of sales (4,6<strong>20</strong>) (4,408)<br />

Administrative and selling expenses (574) (513)<br />

Research and development expenditure (124) (138)<br />

Restructuring costs (87) (169)<br />

Goodwill impairment (60)<br />

Other operating income/(expenses) (43) (46)<br />

Operating profit/(loss) 97 (188)<br />

Net sales<br />

Our net sales totaled €5,085 million in <strong>20</strong>05, up 8.4% compared with <strong>20</strong>04, primarily due to the increase in the net sales of Coatis,<br />

Polyamide and, to a lesser extent, Silcea. The impact of currency fluctuations on net sales amounted to €135 million. These<br />

fluctuations were essentially due to the appreciation of the Brazilian real against the euro. The negative impact of changes in the<br />

scope of continuing operations amounted to €14 million.<br />

The growth in our net sales in <strong>20</strong>05 was driven essentially by price increases totaling €347 million and representing a 7.4% increase<br />

in net sales, excluding the negative impact of transactional currency fluctuations of €100 million. Demand levels remained generally<br />

favorable throughout <strong>20</strong>05, except in the phosphorous derivatives and adipic acid markets.<br />

The table below sets forth our estimates of the effects of changes in the scope of consolidation, exchange rates, price and volume<br />

on our consolidated net sales by enterprise for the years ended December 31, <strong>20</strong>04 and <strong>20</strong>05. See “Presentation of Financial and<br />

Other Information”.<br />

(in millions of euros, unaudited)<br />

<strong>20</strong>05<br />

net sales Structure (2) Exchange<br />

rate Volume<br />

Selling<br />

price<br />

<strong>20</strong>04<br />

net sales<br />

Novecare 935 (42) 2 (15) 62 928<br />

Silcea 810 (15) 8 37 32 748<br />

Coatis 582 26 28 13 33 482<br />

Polyamide 1,749 16 95 (9) 89 1,558<br />

Acetow 410 4 8 7 (4) 395<br />

Eco services <strong>20</strong>9 2 6 <strong>20</strong>1<br />

Organics 349 3 1 (13) 21 337<br />

RPS 172 (1) 1 (10) 6 176<br />

Other (1) (131) (5) (8) 12 2 (132)<br />

Total 5,085 (14) 135 24 247 4,693<br />

(1) Includes the sales of other activities, sales on behalf of non-Group companies and the elimination of inter-company sales.<br />

(2) Presents the impact of changes in scope of continuing operations not classified as discontinued operations and the reclassifications of inter-company activities.<br />

42 <strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia