Form 20-F 2005

Form 20-F 2005

Form 20-F 2005

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

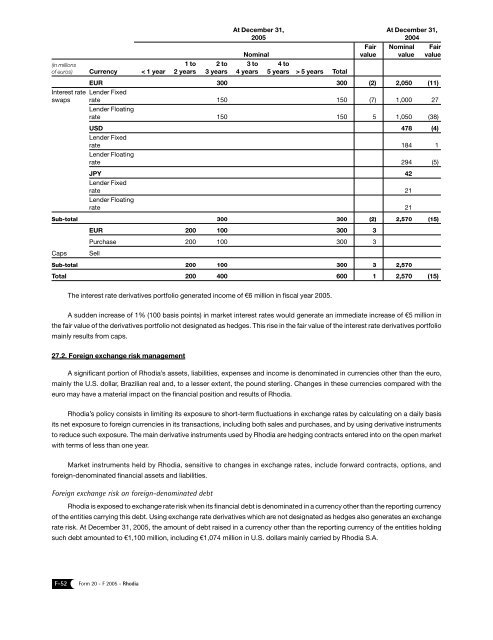

At December 31,<br />

<strong>20</strong>05<br />

At December 31,<br />

<strong>20</strong>04<br />

Nominal<br />

Fair<br />

value<br />

Nominal<br />

value<br />

Fair<br />

value<br />

(in millions<br />

of euros) Currency < 1 year<br />

1 to<br />

2 years<br />

2 to<br />

3 years<br />

3 to<br />

4 years<br />

4 to<br />

5 years > 5 years Total<br />

Interest rate<br />

swaps<br />

EUR 300 300 (2) 2,050 (11)<br />

Lender Fixed<br />

rate 150 150 (7) 1,000 27<br />

Lender Floating<br />

rate 150 150 5 1,050 (38)<br />

USD 478 (4)<br />

Lender Fixed<br />

rate 184 1<br />

Lender Floating<br />

rate 294 (5)<br />

JPY 42<br />

Lender Fixed<br />

rate 21<br />

Lender Floating<br />

rate 21<br />

Sub-total 300 300 (2) 2,570 (15)<br />

EUR <strong>20</strong>0 100 300 3<br />

Purchase <strong>20</strong>0 100 300 3<br />

Caps<br />

Sell<br />

Sub-total <strong>20</strong>0 100 300 3 2,570<br />

Total <strong>20</strong>0 400 600 1 2,570 (15)<br />

The interest rate derivatives portfolio generated income of €6 million in fiscal year <strong>20</strong>05.<br />

A sudden increase of 1% (100 basis points) in market interest rates would generate an immediate increase of €5 million in<br />

the fair value of the derivatives portfolio not designated as hedges. This rise in the fair value of the interest rate derivatives portfolio<br />

mainly results from caps.<br />

27.2. Foreign exchange risk management<br />

A significant portion of Rhodia’s assets, liabilities, expenses and income is denominated in currencies other than the euro,<br />

mainly the U.S. dollar, Brazilian real and, to a lesser extent, the pound sterling. Changes in these currencies compared with the<br />

euro may have a material impact on the financial position and results of Rhodia.<br />

Rhodia’s policy consists in limiting its exposure to short-term fluctuations in exchange rates by calculating on a daily basis<br />

its net exposure to foreign currencies in its transactions, including both sales and purchases, and by using derivative instruments<br />

to reduce such exposure. The main derivative instruments used by Rhodia are hedging contracts entered into on the open market<br />

with terms of less than one year.<br />

Market instruments held by Rhodia, sensitive to changes in exchange rates, include forward contracts, options, and<br />

foreign-denominated financial assets and liabilities.<br />

Foreign exchange risk on foreign-denominated debt<br />

Rhodia is exposed to exchange rate risk when its financial debt is denominated in a currency other than the reporting currency<br />

of the entities carrying this debt. Using exchange rate derivatives which are not designated as hedges also generates an exchange<br />

rate risk. At December 31, <strong>20</strong>05, the amount of debt raised in a currency other than the reporting currency of the entities holding<br />

such debt amounted to €1,100 million, including €1,074 million in U.S. dollars mainly carried by Rhodia S.A.<br />

F-52 <strong>Form</strong> <strong>20</strong> - F <strong>20</strong>05 - Rhodia