Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

The concerned government department<br />

communicates the list of social security<br />

benefits to ensure that all intended<br />

beneficiaries in a specific locality are<br />

brought under inclusive banking. The BC<br />

gets data about the NREGA beneficiaries<br />

from National Informatics Centre (NIC).<br />

The BC then organizes enrolment camps<br />

at village level and collects information<br />

of the ‘would be account holders’ as also<br />

their biometric identification. After due<br />

diligence of ‘no-frills accounts’ (NFA),<br />

banks open the accounts in their books. The<br />

government decides the fee for delivery<br />

(2%) and mandates that it must go through<br />

a bank, which takes a cut (0.25%). Every<br />

account holder is issued a smart card, which<br />

contains the basic data of the account<br />

holder along with the biometric data and<br />

photograph.<br />

The BCs have hand held devices which<br />

facilitates connecting to bank’s database and<br />

carry out cash-in and cash-out function on<br />

behalf of the bank. A day or two before the<br />

due date of payment, government gives an<br />

invoice to the bank along with the details<br />

of the beneficiaries. The bank credits the<br />

accounts of the beneficiaries enabling the<br />

BC to access the account balance through<br />

a mobile access device and disburse cash<br />

at gram panchayat level. The Bank/BC<br />

receives advance payment of the services<br />

that it provides in respect of G2P from the<br />

government department.<br />

G2P payments of FINO are in operation<br />

with the tie up of state governments of<br />

Andhra Pradesh (AP), Haryana, Gujarat,<br />

Chhattisgarh, Jharkhand, Karnataka,<br />

Maharashtra, Madhya Pradesh (MP) and<br />

Uttar Pradesh (UP). The highest numbers<br />

of FINO bandhus, about 3,000 of them<br />

are in AP, which accounts for the highest<br />

number of beneficiaries for G2P payments.<br />

• Banking Services: NFA accounts, Deposits,<br />

P2P payments/Remittance<br />

FINO works as a TSP to banks in providing<br />

technology solutions for remote banking.<br />

This could be both back end and front end.<br />

The relationship with banks can be in two<br />

ways:<br />

a. As a TSP to banks and this technology is<br />

then provided to a BC.<br />

b. FINO as a TSP and FFF as a BC.<br />

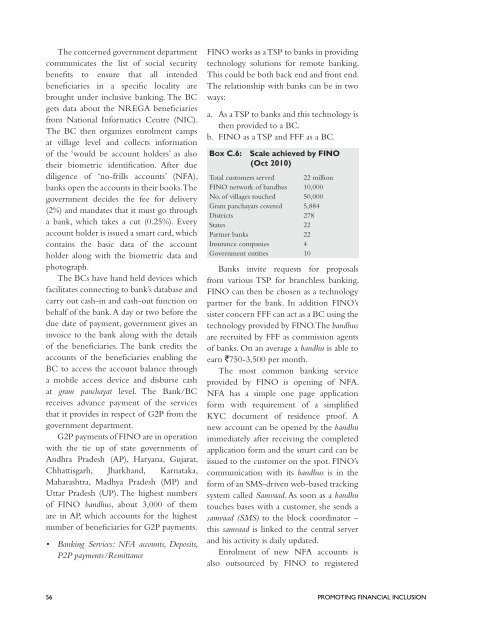

BOX C.6: Scale achieved by FINO<br />

(Oct 2010)<br />

Total customers served 22 million<br />

FINO network of bandhus 10,000<br />

No. of villages touched 50,000<br />

Gram panchayats covered 5,884<br />

Districts 278<br />

States 22<br />

Partner banks 22<br />

Insurance companies 4<br />

Government entities 10<br />

Banks invite requests for proposals<br />

from various TSP for branchless banking.<br />

FINO can then be chosen as a technology<br />

partner for the bank. In addition FINO’s<br />

sister concern FFF can act as a BC using the<br />

technology provided by FINO. The bandhus<br />

are recruited by FFF as commission agents<br />

of banks. On an average a bandhu is able to<br />

earn `750-3,500 per month.<br />

The most common banking service<br />

provided by FINO is opening of NFA.<br />

NFA has a simple one page application<br />

form with requirement of a simplified<br />

KYC document of residence proof. A<br />

new account can be opened by the bandhu<br />

immediately after receiving the completed<br />

application form and the smart card can be<br />

issued to the customer on the spot. FINO’s<br />

communication with its bandhus is in the<br />

form of an SMS-driven web-based tracking<br />

system called Samvaad. As soon as a bandhu<br />

touches bases with a customer, she sends a<br />

samvaad (SMS) to the block coordinator –<br />

this samvaad is linked to the central server<br />

and his activity is daily updated.<br />

Enrolment of new NFA accounts is<br />

also outsourced by FINO to registered<br />

56 PROMOTING FINANCIAL INCLUSION