Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

convince new account openers to obtain<br />

life insurance services, which are provided<br />

by FINO in collaboration with HDFC<br />

ERGO. On an average, they are able to<br />

undertake 50 remittances in a day and open<br />

8-10 NFAs.<br />

Mode of functioning: Initially, they<br />

were allowed to operate from the bank<br />

premises for about a month, but after that<br />

they had to make their own arrangements.<br />

The RBI circular on BC does not allow<br />

them to operate from a bank’s premises,<br />

but in this case FINO has an arrangement<br />

with the bank for temporary use (up to<br />

one month) of their premises by the agents.<br />

The remitters can approach BC agents in a<br />

pre-determined location and pay in either<br />

cash or get their account debited to transfer<br />

money to the beneficiary.<br />

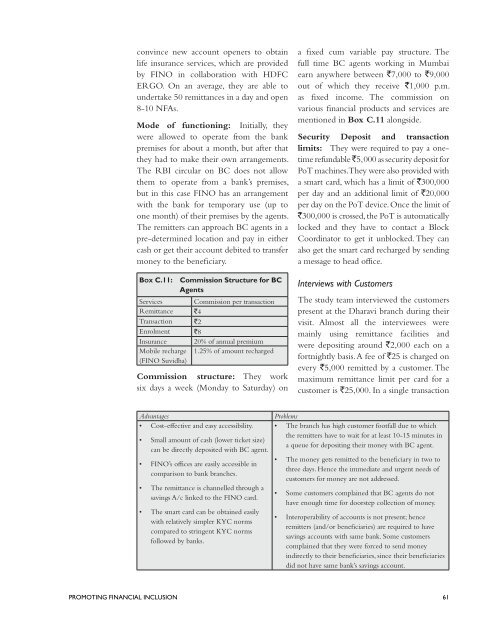

BOX C.11: Commission Structure for BC<br />

Agents<br />

Services Commission per transaction<br />

Remittance `4<br />

Transaction `2<br />

Enrolment `8<br />

Insurance 20% of annual premium<br />

Mobile recharge 1.25% of amount recharged<br />

(FINO Suvidha)<br />

Commission structure: They work<br />

six days a week (Monday to Saturday) on<br />

a fixed cum variable pay structure. The<br />

full time BC agents working in Mumbai<br />

earn anywhere between `7,000 to `9,000<br />

out of which they receive `1,000 p.m.<br />

as fixed income. The commission on<br />

various financial products and services are<br />

mentioned in Box C.11 alongside.<br />

Security Deposit and transaction<br />

limits: They were required to pay a onetime<br />

refundable `5, 000 as security deposit for<br />

PoT machines. They were also provided with<br />

a smart card, which has a limit of `300,000<br />

per day and an additional limit of `20,000<br />

per day on the PoT device. Once the limit of<br />

`300,000 is crossed, the PoT is automatically<br />

locked and they have to contact a Block<br />

Coordinator to get it unblocked. They can<br />

also get the smart card recharged by sending<br />

a message to head office.<br />

Interviews with Customers<br />

The study team interviewed the customers<br />

present at the Dharavi branch during their<br />

visit. Almost all the interviewees were<br />

mainly using remittance facilities and<br />

were depositing around `2,000 each on a<br />

fortnightly basis. A fee of `25 is charged on<br />

every `5,000 remitted by a customer. The<br />

maximum remittance limit per card for a<br />

customer is `25,000. In a single transaction<br />

Advantages<br />

• Cost-effective and easy accessibility.<br />

• Small amount of cash (lower ticket size)<br />

can be directly deposited with BC agent.<br />

• FINO’s offices are easily accessible in<br />

comparison to bank branches.<br />

• The remittance is channelled through a<br />

savings A/c linked to the FINO card.<br />

• The smart card can be obtained easily<br />

with relatively simpler KYC norms<br />

compared to stringent KYC norms<br />

followed by banks.<br />

Problems<br />

• The branch has high customer footfall due to which<br />

the remitters have to wait for at least 10-15 minutes in<br />

a queue for depositing their money with BC agent.<br />

• The money gets remitted to the beneficiary in two to<br />

three days. Hence the immediate and urgent needs of<br />

customers for money are not addressed.<br />

• Some customers complained that BC agents do not<br />

have enough time for doorstep collection of money.<br />

• Interoperability of accounts is not present; hence<br />

remitters (and/or beneficiaries) are required to have<br />

savings accounts with same bank. Some customers<br />

complained that they were forced to send money<br />

indirectly to their beneficiaries, since their beneficiaries<br />

did not have same bank’s savings account.<br />

PROMOTING FINANCIAL INCLUSION 61