Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

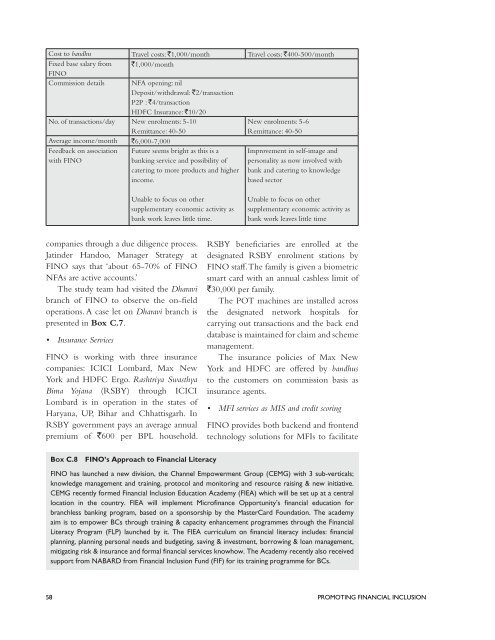

Cost to bandhu Travel costs: `1,000/month Travel costs: `400-500/month<br />

Fixed base salary from `1,000/month<br />

FINO<br />

Commission details NFA opening: nil<br />

Deposit/withdrawal: `2/transaction<br />

P2P : `4/transaction<br />

HDFC Insurance: `10/20<br />

No. of transactions/day New enrolments: 5-10<br />

Remittance: 40-50<br />

New enrolments: 5-6<br />

Remittance: 40-50<br />

Average income/month `6,000-7,000<br />

Feedback on association<br />

with FINO<br />

Future seems bright as this is a<br />

banking service and possibility of<br />

catering to more products and higher<br />

income.<br />

Improvement in self-image and<br />

personality as now involved with<br />

bank and catering to knowledge<br />

based sector<br />

Unable to focus on other<br />

supplementary economic activity as<br />

bank work leaves little time.<br />

Unable to focus on other<br />

supplementary economic activity as<br />

bank work leaves little time<br />

companies through a due diligence process.<br />

Jatinder Handoo, Manager Strategy at<br />

FINO says that ‘about 65-70% of FINO<br />

NFAs are active accounts.’<br />

The study team had visited the Dharavi<br />

branch of FINO to observe the on-field<br />

operations. A case let on Dharavi branch is<br />

presented in Box C.7.<br />

• Insurance Services<br />

FINO is working with three insurance<br />

companies: ICICI Lombard, Max New<br />

York and HDFC Ergo. Rashtriya Swasthya<br />

Bima Yojana (RSBY) through ICICI<br />

Lombard is in operation in the states of<br />

Haryana, UP, Bihar and Chhattisgarh. In<br />

RSBY government pays an average annual<br />

premium of `600 per BPL household.<br />

RSBY beneficiaries are enrolled at the<br />

designated RSBY enrolment stations by<br />

FINO staff. The family is given a biometric<br />

smart card with an annual cashless limit of<br />

`30,000 per family.<br />

The POT machines are installed across<br />

the designated network hospitals for<br />

carrying out transactions and the back end<br />

database is maintained for claim and scheme<br />

management.<br />

The insurance policies of Max New<br />

York and HDFC are offered by bandhus<br />

to the customers on commission basis as<br />

insurance agents.<br />

• MFI services as MIS and credit scoring<br />

FINO provides both backend and frontend<br />

technology solutions for MFIs to facilitate<br />

BOX C.8 FINO’s Approach to <strong>Financial</strong> Literacy<br />

FINO has launched a new division, the Channel Empowerment Group (CEMG) with 3 sub-verticals;<br />

knowledge management and training, protocol and monitoring and resource raising & new initiative.<br />

CEMG recently formed <strong>Financial</strong> <strong>Inclusion</strong> Education Academy (FIEA) which will be set up at a central<br />

location in the country. FIEA will implement Microfinance Opportunity’s financial education for<br />

branchless banking program, based on a sponsorship by the MasterCard Foundation. The academy<br />

aim is to empower BCs through training & capacity enhancement programmes through the <strong>Financial</strong><br />

Literacy Program (FLP) launched by it. The FIEA curriculum on financial literacy includes: financial<br />

planning, planning personal needs and budgeting, saving & investment, borrowing & loan management,<br />

mitigating risk & insurance and formal financial services knowhow. The Academy recently also received<br />

support from NABARD from <strong>Financial</strong> <strong>Inclusion</strong> Fund (FIF) for its training programme for BCs.<br />

58 PROMOTING FINANCIAL INCLUSION