Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

Promoting Financial Inclusion - United Nations Development ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• Prior to sale: Customers are given adequate time (at least 1 week) to review the terms and conditions<br />

of the product and have an opportunity to ask questions and receive information prior to signing<br />

contracts.<br />

• At the point of sale: Loan contracts show the repayment schedule that separates principal, interest, fees<br />

and define the amount, and number and due dates of instalment payments.<br />

• After the point of sale: The client regularly receives clear and accurate information regarding the<br />

account.<br />

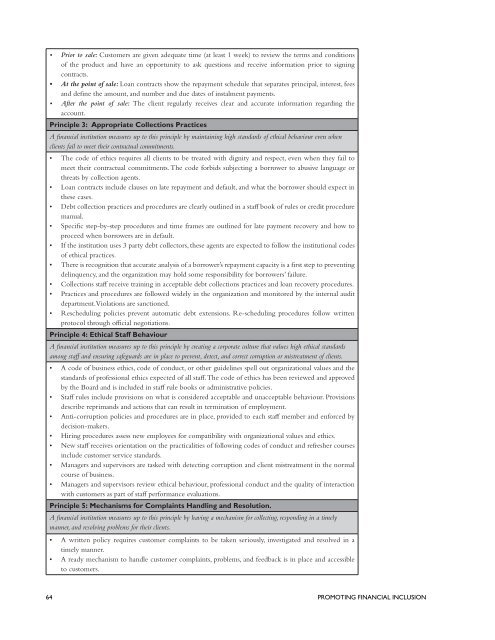

Principle 3: Appropriate Collections Practices<br />

A fi nancial institution measures up to this principle by maintaining high standards of ethical behaviour even when<br />

clients fail to meet their contractual commitments.<br />

• The code of ethics requires all clients to be treated with dignity and respect, even when they fail to<br />

meet their contractual commitments. The code forbids subjecting a borrower to abusive language or<br />

threats by collection agents.<br />

• Loan contracts include clauses on late repayment and default, and what the borrower should expect in<br />

these cases.<br />

• Debt collection practices and procedures are clearly outlined in a staff book of rules or credit procedure<br />

manual.<br />

• Specific step-by-step procedures and time frames are outlined for late payment recovery and how to<br />

proceed when borrowers are in default.<br />

• If the institution uses 3 party debt collectors, these agents are expected to follow the institutional codes<br />

of ethical practices.<br />

• There is recognition that accurate analysis of a borrower’s repayment capacity is a first step to preventing<br />

delinquency, and the organization may hold some responsibility for borrowers’ failure.<br />

• Collections staff receive training in acceptable debt collections practices and loan recovery procedures.<br />

• Practices and procedures are followed widely in the organization and monitored by the internal audit<br />

department. Violations are sanctioned.<br />

• Rescheduling policies prevent automatic debt extensions. Re-scheduling procedures follow written<br />

protocol through official negotiations.<br />

Principle 4: Ethical Staff Behaviour<br />

A fi nancial institution measures up to this principle by creating a corporate culture that values high ethical standards<br />

among staff and ensuring safeguards are in place to prevent, detect, and correct corruption or mistreatment of clients.<br />

• A code of business ethics, code of conduct, or other guidelines spell out organizational values and the<br />

standards of professional ethics expected of all staff. The code of ethics has been reviewed and approved<br />

by the Board and is included in staff rule books or administrative policies.<br />

• Staff rules include provisions on what is considered acceptable and unacceptable behaviour. Provisions<br />

describe reprimands and actions that can result in termination of employment.<br />

• Anti-corruption policies and procedures are in place, provided to each staff member and enforced by<br />

decision-makers.<br />

• Hiring procedures assess new employees for compatibility with organizational values and ethics.<br />

• New staff receives orientation on the practicalities of following codes of conduct and refresher courses<br />

include customer service standards.<br />

• Managers and supervisors are tasked with detecting corruption and client mistreatment in the normal<br />

course of business.<br />

• Managers and supervisors review ethical behaviour, professional conduct and the quality of interaction<br />

with customers as part of staff performance evaluations.<br />

Principle 5: Mechanisms for Complaints Handling and Resolution.<br />

A fi nancial institution measures up to this principle by having a mechanism for collecting, responding in a timely<br />

manner, and resolving problems for their clients.<br />

• A written policy requires customer complaints to be taken seriously, investigated and resolved in a<br />

timely manner.<br />

• A ready mechanism to handle customer complaints, problems, and feedback is in place and accessible<br />

to customers.<br />

64 PROMOTING FINANCIAL INCLUSION