ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Skanska</strong>’s Series B shares are also included in<br />

the Dow Jones Sustainability Index and the<br />

Dow Jones Stoxx 600.<br />

Ownership changes<br />

At the close of <strong>2004</strong>, the number of shareholders<br />

totaled 80,685 (80,468). The proportion<br />

of market capitalization owned by<br />

Swedish shareholders declined during the<br />

year from 83.0 percent to 73.5 percent, and<br />

their share of voting power from 89.6 percent<br />

to 83.5 percent. Of foreign shareolders,<br />

U.S. residents made up the largest group,<br />

with about 57 million shares representing<br />

some 14 percent of market capitalization.<br />

Of Swedish shareholders, institutional<br />

owners accounted for 69 percent, while 31<br />

percent was owned directly by individuals.<br />

As the table on page 28 indicates, AB Industrivärden<br />

is the Company’s largest owner,<br />

with 27.9 percent of voting power.<br />

The “free float” in <strong>Skanska</strong>’s shares is<br />

regarded as making up about 375 million<br />

shares, equivalent to 96 percent of the number<br />

of Series B shares outstanding.<br />

Dividend policy<br />

Future earnings are expected to support the<br />

growth in operations as well as growth in the<br />

regular dividend. It is expected that the payout<br />

ratio can be at least 50 percent.<br />

Dividend<br />

The Board of Directors proposes a dividend<br />

of SEK 4.00 (3.00) per share for <strong>2004</strong>, for a<br />

total payout of SEK 1,674 M (1,256).<br />

Total return<br />

The total return on a share is calculated as<br />

the change in share price, together with the<br />

value of dividends. During <strong>2004</strong>, the total<br />

return on a <strong>Skanska</strong> share amounted to 32<br />

percent. Stockholmsbörsen’s SIX Return<br />

Index rose by 21 percent during the year.<br />

During the five year period January 1,<br />

2000 to December 31, <strong>2004</strong>, the total return<br />

on a <strong>Skanska</strong> share was 25 percent. During<br />

the same period, the SIX Return Index had a<br />

negative return of 21 percent.<br />

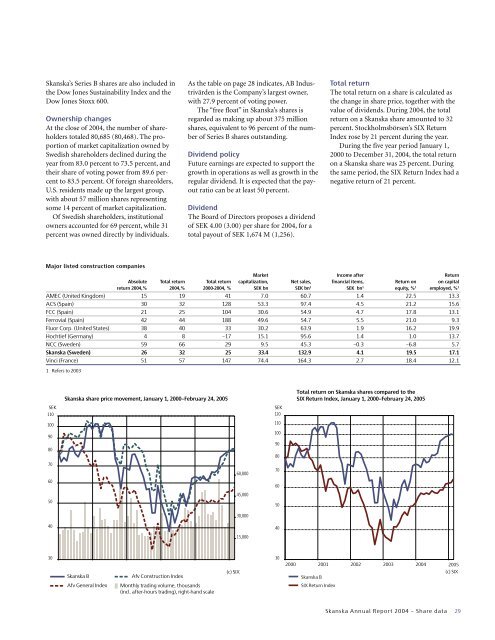

Major listed construction companies<br />

Market Income after Return<br />

Absolute Total return Total return capitalization, Net sales, financial items, Return on on capital<br />

return <strong>2004</strong>,% <strong>2004</strong>,% 2000-<strong>2004</strong>, % SEK bn SEK bn 1 SEK bn 1 equity, % 1 employed, % 1<br />

AMEC (United Kingdom) 15 19 41 7.0 60.7 1.4 22.5 13.3<br />

ACS (Spain) 30 32 128 53.3 97.4 4.5 21.2 15.6<br />

FCC (Spain) 21 25 104 30.6 54.9 4.7 17.8 13.1<br />

Ferrovial (Spain) 42 44 188 49.6 54.7 5.5 21.0 9.3<br />

Fluor Corp. (United States) 38 40 33 30.2 63.9 1.9 16.2 19.9<br />

Hochtief (Germany) 4 8 –17 15.1 95.6 1.4 1.0 13.7<br />

NCC (Sweden) 59 66 29 9.5 45.3 –0.3 –6.8 5.7<br />

<strong>Skanska</strong> (Sweden) 26 32 25 33.4 132.9 4.1 19.5 17.1<br />

Vinci (France) 51 57 147 74.4 164.3 2.7 18.4 12.1<br />

1 Refers to 2003<br />

<strong>Skanska</strong> share price movement, January 1, 2000–February 24, 2005<br />

Total return on <strong>Skanska</strong> shares compared to the<br />

SIX Return Index, January 1, 2000–February 24, 2005<br />

SEK<br />

110<br />

100<br />

SEK<br />

120<br />

110<br />

90<br />

100<br />

80<br />

90<br />

80<br />

70<br />

60,000<br />

70<br />

60<br />

60<br />

45,000<br />

50<br />

50<br />

30,000<br />

40<br />

40<br />

15,000<br />

30<br />

30<br />

2000 2001 2002 2003 <strong>2004</strong><br />

2005<br />

(c) SIX<br />

<strong>Skanska</strong> B<br />

Afv General Index<br />

Afv Construction Index<br />

Monthly trading volume, thousands<br />

(incl. after-hours trading), right-hand scale<br />

(c) SIX<br />

<strong>Skanska</strong> B<br />

SIX Return Index<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Share data<br />

29