ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

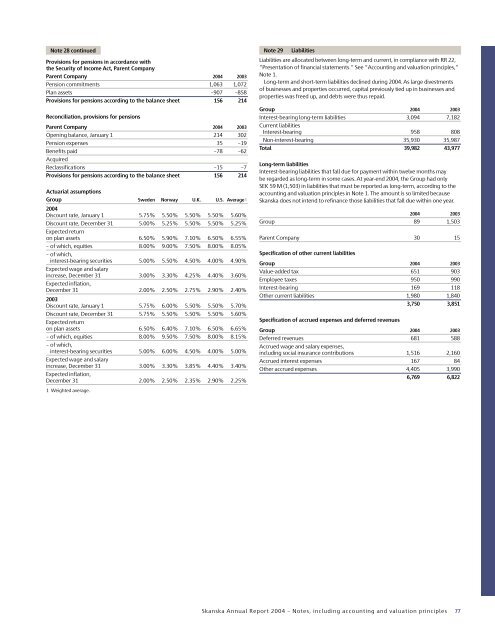

Note 28 continued<br />

Provisions for pensions in accordance with<br />

the Security of Income Act, Parent Company<br />

Parent Company <strong>2004</strong> 2003<br />

Pension commitments 1,063 1,072<br />

Plan assets –907 –858<br />

Provisions for pensions according to the balance sheet 156 214<br />

Reconciliation, provisions for pensions<br />

Parent Company <strong>2004</strong> 2003<br />

Opening balance, January 1 214 302<br />

Pension expenses 35 –19<br />

Benefits paid –78 –62<br />

Acquired<br />

Reclassifications –15 –7<br />

Provisions for pensions according to the balance sheet 156 214<br />

Actuarial assumptions<br />

Group Sweden Norway U.K. U.S. Average 1<br />

<strong>2004</strong><br />

Discount rate, January 1 5.75% 5.50% 5.50% 5.50% 5.60%<br />

Discount rate, December 31 5.00% 5.25% 5.50% 5.50% 5.25%<br />

Expected return<br />

on plan assets 6.50% 5.90% 7.10% 6.50% 6.55%<br />

– of which, equities 8.00% 9.00% 7.50% 8.00% 8.05%<br />

– of which,<br />

interest-bearing securities 5.00% 5.50% 4.50% 4.00% 4.90%<br />

Expected wage and salary<br />

increase, December 31 3.00% 3.30% 4.25% 4.40% 3.60%<br />

Expected inflation,<br />

December 31 2.00% 2.50% 2.75% 2.90% 2.40%<br />

2003<br />

Discount rate, January 1 5.75% 6.00% 5.50% 5.50% 5.70%<br />

Discount rate, December 31 5.75% 5.50% 5.50% 5.50% 5.60%<br />

Expected return<br />

on plan assets 6.50% 6.40% 7.10% 6.50% 6.65%<br />

– of which, equities 8.00% 9.50% 7.50% 8.00% 8.15%<br />

– of which,<br />

interest-bearing securities 5.00% 6.00% 4.50% 4.00% 5.00%<br />

Expected wage and salary<br />

increase, December 31 3.00% 3.30% 3.85% 4.40% 3.40%<br />

Expected inflation,<br />

December 31 2.00% 2.50% 2.35% 2.90% 2.25%<br />

1 Weighted average.<br />

Note 29 Liabilities<br />

Liabilities are allocated between long-term and current, in compliance with RR 22,<br />

”Presentation of financial statements.” See ”Accounting and valuation principles,”<br />

Note 1.<br />

Long-term and short-term liabilities declined during <strong>2004</strong>. As large divestments<br />

of businesses and properties occurred, capital previously tied up in businesses and<br />

properties was freed up, and debts were thus repaid.<br />

Group <strong>2004</strong> 2003<br />

Interest-bearing long-term liabilities 3,094 7,182<br />

Current liabilities<br />

Interest-bearing 958 808<br />

Non-interest-bearing 35,930 35,987<br />

Total 39,982 43,977<br />

Long-term liabilities<br />

Interest-bearing liabilities that fall due for payment within twelve months may<br />

be regarded as long-term in some cases. At year-end <strong>2004</strong>, the Group had only<br />

SEK 59 M (1,503) in liabilities that must be reported as long-term, according to the<br />

accounting and valuation principles in Note 1. The amount is so limited because<br />

<strong>Skanska</strong> does not intend to refinance those liabilities that fall due within one year.<br />

<strong>2004</strong> 2003<br />

Group 89 1,503<br />

Parent Company 30 15<br />

Specification of other current liabilities<br />

Group <strong>2004</strong> 2003<br />

Value-added tax 651 903<br />

Employee taxes 950 990<br />

Interest-bearing 169 118<br />

Other current liabilities 1,980 1,840<br />

3,750 3,851<br />

Specification of accrued expenses and deferred revenues<br />

Group <strong>2004</strong> 2003<br />

Deferred revenues 681 588<br />

Accrued wage and salary expenses,<br />

including social insurance contributions 1,516 2,160<br />

Accrued interest expenses 167 84<br />

Other accrued expenses 4,405 3,990<br />

6,769 6,822<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Notes, including accounting and valuation principles<br />

77