ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

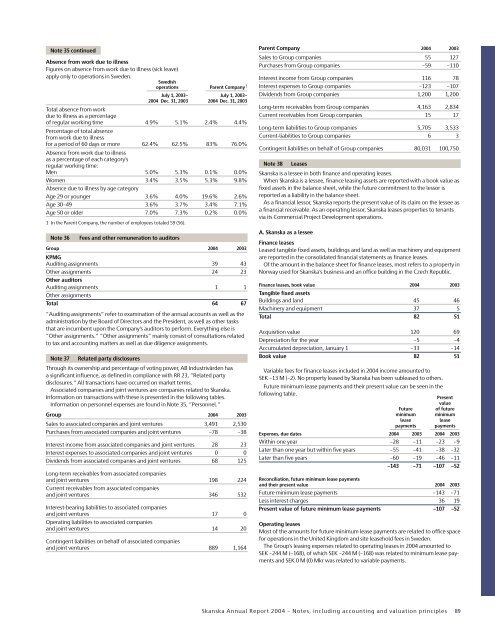

Note 35 continued<br />

Absence from work due to illness<br />

Figures on absence from work due to illness (sick leave)<br />

apply only to operations in Sweden.<br />

Swedish<br />

operations Parent Company 1<br />

July 1, 2003– July 1, 2003–<br />

<strong>2004</strong> Dec. 31, 2003 <strong>2004</strong> Dec. 31, 2003<br />

Total absence from work<br />

due to illness as a percentage<br />

of regular working time 4.9% 5.1% 2.4% 4.4%<br />

Percentage of total absence<br />

from work due to illness<br />

for a period of 60 days or more 62.4% 62.5% 83% 76.0%<br />

Absence from work due to illness<br />

as a percentage of each category’s<br />

regular working time:<br />

Men 5.0% 5.3% 0.1% 0.0%<br />

Women 3.4% 3.5% 5.3% 9.8%<br />

Absence due to illness by age category<br />

Age 29 or younger 3.6% 4.0% 19.6% 2.6%<br />

Age 30–49 3.6% 3.7% 3.4% 7.1%<br />

Age 50 or older 7.0% 7.3% 0.2% 0.0%<br />

1 In the Parent Company, the number of employees totaled 59 (56).<br />

Note 36<br />

Fees and other remuneration to auditors<br />

Group <strong>2004</strong> 2003<br />

KPMG<br />

Auditing assignments 39 43<br />

Other assignments 24 23<br />

Other auditors<br />

Auditing assignments 1 1<br />

Other assignments<br />

Total 64 67<br />

”Auditing assignments” refer to examination of the annual accounts as well as the<br />

administration by the Board of Directors and the President, as well as other tasks<br />

that are incumbent upon the Company’s auditors to perform. Everything else is<br />

”Other assignments.” ”Other assignments” mainly consist of consultations related<br />

to tax and accounting matters as well as due diligence assignments.<br />

Note 37 Related party disclosures<br />

Through its ownership and percentage of voting power, AB Industrivärden has<br />

a significant influence, as defined in compliance with RR 23, ”Related party<br />

disclosures.” All transactions have occurred on market terms.<br />

Associated companies and joint ventures are companies related to <strong>Skanska</strong>.<br />

Information on transactions with these is presented in the following tables.<br />

Information on personnel expenses are found in Note 35, ”Personnel.”<br />

Group <strong>2004</strong> 2003<br />

Sales to associated companies and joint ventures 3,491 2,530<br />

Purchases from associated companies and joint ventures –78 –38<br />

Interest income from associated companies and joint ventures 28 23<br />

Interest expenses to associated companies and joint ventures 0 0<br />

Dividends from associated companies and joint ventures 68 125<br />

Long-term receivables from associated companies<br />

and joint ventures 198 224<br />

Current receivables from associated companies<br />

and joint ventures 346 532<br />

Interest-bearing liabilities to associated companies<br />

and joint ventures 17 0<br />

Operating liabilities to associated companies<br />

and joint ventures 14 20<br />

Contingent liabilities on behalf of associated companies<br />

and joint ventures 889 1,164<br />

Parent Company <strong>2004</strong> 2003<br />

Sales to Group companies 55 127<br />

Purchases from Group companies –59 –110<br />

Interest income from Group companies 116 78<br />

Interest expenses to Group companies –123 –107<br />

Dividends from Group companies 1,200 1,200<br />

Long-term receivables from Group companies 4,163 2,834<br />

Current receivables from Group companies 15 17<br />

Long-term liabilities to Group companies 5,705 3,533<br />

Current-liabilities to Group companies 6 3<br />

Contingent liabilities on behalf of Group companies 80,031 100,750<br />

Note 38 Leases<br />

<strong>Skanska</strong> is a lessee in both finance and operating leases.<br />

When <strong>Skanska</strong> is a lessee, finance leasing assets are reported with a book value as<br />

fixed assets in the balance sheet, while the future commitment to the lessor is<br />

reported as a liability in the balance sheet.<br />

As a financial lessor, <strong>Skanska</strong> reports the present value of its claim on the lessee as<br />

a financial receivable. As an operating lessor, <strong>Skanska</strong> leases properties to tenants<br />

via its Commercial Project Development operations.<br />

A. <strong>Skanska</strong> as a lessee<br />

Finance leases<br />

Leased tangible fixed assets, buildings and land as well as machinery and equipment<br />

are reported in the consolidated financial statements as finance leases.<br />

Of the amount in the balance sheet for finance leases, most refers to a property in<br />

Norway used for <strong>Skanska</strong>’s business and an office building in the Czech Republic.<br />

Finance leases, book value <strong>2004</strong> 2003<br />

Tangible fixed assets<br />

Buildings and land 45 46<br />

Machinery and equipment 37 5<br />

Total 82 51<br />

Acquisition value 120 69<br />

Depreciation for the year –5 –4<br />

Accumulated depreciation, January 1 –33 –14<br />

Book value 82 51<br />

Variable fees for finance leases included in <strong>2004</strong> income amounted to<br />

SEK –13 M (–2). No property leased by <strong>Skanska</strong> has been subleased to others.<br />

Future minimum lease payments and their present value can be seen in the<br />

following table.<br />

Present<br />

value<br />

Future of future<br />

minimum minimum<br />

lease<br />

lease<br />

payments payments<br />

Expenses, due dates <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Within one year –28 –11 –23 –9<br />

Later than one year but within five years –55 –41 –38 –32<br />

Later than five years –60 –19 –46 –11<br />

–143 –71 –107 –52<br />

Reconciliation, future minimum lease payments<br />

and their present value <strong>2004</strong> 2003<br />

Future minimum lease payments –143 –71<br />

Less interest charges 36 19<br />

Present value of future minimum lease payments –107 –52<br />

Operating leases<br />

Most of the amounts for future minimum lease payments are related to office space<br />

for operations in the United Kingdom and site leasehold fees in Sweden.<br />

The Group’s leasing expenses related to operating leases in <strong>2004</strong> amounted to<br />

SEK –244 M (–168), of which SEK –244 M (–168) was related to minimum lease payments<br />

and SEK 0 M (0) Mkr was related to variable payments.<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Notes, including accounting and valuation principles<br />

89