ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

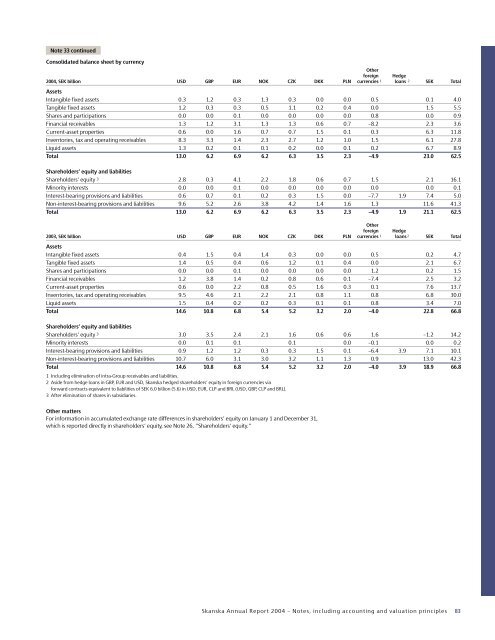

Note 33 continued<br />

Consolidated balance sheet by currency<br />

Other<br />

foreign Hedge<br />

<strong>2004</strong>, SEK billion USD GBP EUR NOK CZK DKK PLN currencies 1 loans 2 SEK Total<br />

Assets<br />

Intangible fixed assets 0.3 1.2 0.3 1.3 0.3 0.0 0.0 0.5 0.1 4.0<br />

Tangible fixed assets 1.2 0.3 0.3 0.5 1.1 0.2 0.4 0.0 1.5 5.5<br />

Shares and participations 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.8 0.0 0.9<br />

Financial receivables 1.3 1.2 3.1 1.3 1.3 0.6 0.7 –8.2 2.3 3.6<br />

Current-asset properties 0.6 0.0 1.6 0.7 0.7 1.5 0.1 0.3 6.3 11.8<br />

Inventories, tax and operating receivables 8.3 3.3 1.4 2.3 2.7 1.2 1.0 1.5 6.1 27.8<br />

Liquid assets 1.3 0.2 0.1 0.1 0.2 0.0 0.1 0.2 6.7 8.9<br />

Total 13.0 6.2 6.9 6.2 6.3 3.5 2.3 –4.9 23.0 62.5<br />

Shareholders’ equity and liabilities<br />

Shareholders’ equity 3 2.8 0.3 4.1 2.2 1.8 0.6 0.7 1.5 2.1 16.1<br />

Minority interests 0.0 0.0 0.1 0.0 0.0 0.0 0.0 0.0 0.0 0.1<br />

Interest-bearing provisions and liabilities 0.6 0.7 0.1 0.2 0.3 1.5 0.0 –7.7 1.9 7.4 5.0<br />

Non-interest-bearing provisions and liabilities 9.6 5.2 2.6 3.8 4.2 1.4 1.6 1.3 11.6 41.3<br />

Total 13.0 6.2 6.9 6.2 6.3 3.5 2.3 –4.9 1.9 21.1 62.5<br />

Other<br />

foreign Hedge<br />

2003, SEK billion USD GBP EUR NOK CZK DKK PLN currencies 1 loans 2 SEK Total<br />

Assets<br />

Intangible fixed assets 0.4 1.5 0.4 1.4 0.3 0.0 0.0 0.5 0.2 4.7<br />

Tangible fixed assets 1.4 0.5 0.4 0.6 1.2 0.1 0.4 0.0 2.1 6.7<br />

Shares and participations 0.0 0.0 0.1 0.0 0.0 0.0 0.0 1.2 0.2 1.5<br />

Financial receivables 1.2 3.8 1.4 0.2 0.8 0.6 0.1 –7.4 2.5 3.2<br />

Current-asset properties 0.6 0.0 2.2 0.8 0.5 1.6 0.3 0.1 7.6 13.7<br />

Inventories, tax and operating receivables 9.5 4.6 2.1 2.2 2.1 0.8 1.1 0.8 6.8 30.0<br />

Liquid assets 1.5 0.4 0.2 0.2 0.3 0.1 0.1 0.8 3.4 7.0<br />

Total 14.6 10.8 6.8 5.4 5.2 3.2 2.0 –4.0 22.8 66.8<br />

Shareholders’ equity and liabilities<br />

Shareholders’ equity 3 3.0 3.5 2.4 2.1 1.6 0.6 0.6 1.6 –1.2 14.2<br />

Minority interests 0.0 0.1 0.1 0.1 0.0 –0.1 0.0 0.2<br />

Interest-bearing provisions and liabilities 0.9 1.2 1.2 0.3 0.3 1.5 0.1 –6.4 3.9 7.1 10.1<br />

Non-interest-bearing provisions and liabilities 10.7 6.0 3.1 3.0 3.2 1.1 1.3 0.9 13.0 42.3<br />

Total 14.6 10.8 6.8 5.4 5.2 3.2 2.0 –4.0 3.9 18.9 66.8<br />

1 Including elimination of intra-Group receivables and liabilities.<br />

2 Aside from hedge loans in GBP, EUR and USD, <strong>Skanska</strong> hedged shareholders’ equity in foreign currencies via<br />

forward contracts equivalent to liabilities of SEK 6.0 billion (5.6) in USD, EUR, CLP and BRL (USD, GBP, CLP and BRL).<br />

3 After elimination of shares in subsidiaries.<br />

Other matters<br />

For information in accumulated exchange rate differences in shareholders’ equity on January 1 and December 31,<br />

which is reported directly in shareholders’ equity, see Note 26, ”Shareholders’ equity.”<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Notes, including accounting and valuation principles<br />

83