ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Credit risk<br />

Credit and counterparty risk is defined as the risk that the Group will suffer a loss<br />

because a counterparty does not fulfill its contractual commitments toward <strong>Skanska</strong>.<br />

Financial credit and counterparty risk is identified, managed and reported according<br />

to limits defined in the Financial Policy and the risk instruction established for<br />

<strong>Skanska</strong> Financial Services.<br />

To ensure a systematic and uniform assessment of construction projects, <strong>Skanska</strong><br />

uses its Operational Risk Assessment (ORA) model throughout the Group.<br />

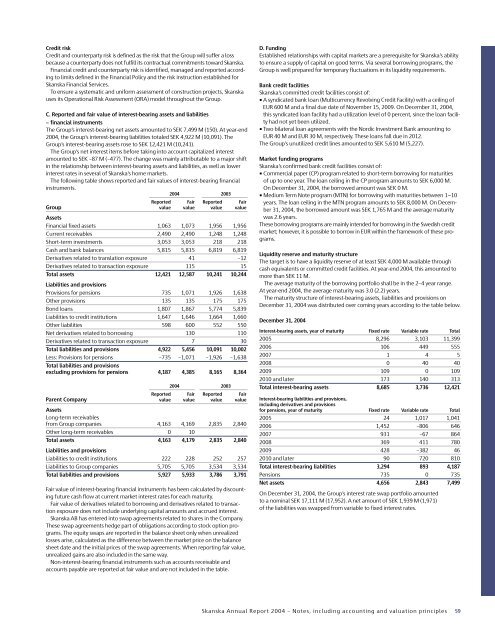

C. Reported and fair value of interest-bearing assets and liabilities<br />

− financial instruments<br />

The Group’s interest-bearing net assets amounted to SEK 7,499 M (150). At year-end<br />

<strong>2004</strong>, the Group’s interest-bearing liabilities totaled SEK 4,922 M (10,091). The<br />

Group’s interest-bearing assets rose to SEK 12,421 M (10,241).<br />

The Group’s net interest items before taking into account capitalized interest<br />

amounted to SEK –87 M (–477). The change was mainly attributable to a major shift<br />

in the relationship between interest-bearing assets and liabilities, as well as lower<br />

interest rates in several of <strong>Skanska</strong>’s home markets.<br />

The following table shows reported and fair values of interest-bearing financial<br />

instruments.<br />

<strong>2004</strong> 2003<br />

Reported Fair Reported Fair<br />

Group value value value value<br />

Assets<br />

Financial fixed assets 1,063 1,073 1,956 1,956<br />

Current receivables 2,490 2,490 1,248 1,248<br />

Short-term investments 3,053 3,053 218 218<br />

Cash and bank balances 5,815 5,815 6,819 6,819<br />

Derivatives related to translation exposure 41 –12<br />

Derivatives related to transaction exposure 115 15<br />

Total assets 12,421 12,587 10,241 10,244<br />

Liabilities and provisions<br />

Provisions for pensions 735 1,071 1,926 1,638<br />

Other provisions 135 135 175 175<br />

Bond loans 1,807 1,867 5,774 5,839<br />

Liabilities to credit institutions 1,647 1,646 1,664 1,660<br />

Other liabilities 598 600 552 550<br />

Net derivatives related to borrowing 130 110<br />

Derivatives related to transaction exposure 7 30<br />

Total liabilities and provisions 4,922 5,456 10,091 10,002<br />

Less: Provisions for pensions –735 –1,071 –1,926 –1,638<br />

Total liabilities and provisions<br />

excluding provisions for pensions 4,187 4,385 8,165 8,364<br />

<strong>2004</strong> 2003<br />

Reported Fair Reported Fair<br />

Parent Company value value value value<br />

Assets<br />

Long-term receivables<br />

from Group companies 4,163 4,169 2,835 2,840<br />

Other long-term receivables 0 10<br />

Total assets 4,163 4,179 2,835 2,840<br />

Liabilities and provisions<br />

Liabilities to credit institutions 222 228 252 257<br />

Liabilities to Group companies 5,705 5,705 3,534 3,534<br />

Total liabilities and provisions 5,927 5,933 3,786 3,791<br />

Fair value of interest-bearing financial instruments has been calculated by discounting<br />

future cash flow at current market interest rates for each maturity.<br />

Fair value of derivatives related to borrowing and derivatives related to transaction<br />

exposure does not include underlying capital amounts and accrued interest.<br />

<strong>Skanska</strong> AB has entered into swap agreements related to shares in the Company.<br />

These swap agreements hedge part of obligations according to stock option programs.<br />

The equity swaps are reported in the balance sheet only when unrealized<br />

losses arise, calculated as the difference between the market price on the balance<br />

sheet date and the initial prices of the swap agreements. When reporting fair value,<br />

unrealized gains are also included in the same way.<br />

Non-interest-bearing financial instruments such as accounts receivable and<br />

accounts payable are reported at fair value and are not included in the table.<br />

D. Funding<br />

Established relationships with capital markets are a prerequisite for <strong>Skanska</strong>’s ability<br />

to ensure a supply of capital on good terms. Via several borrowing programs, the<br />

Group is well prepared for temporary fluctuations in its liquidity requirements.<br />

Bank credit facilities<br />

<strong>Skanska</strong>’s committed credit facilities consist of:<br />

• A syndicated bank loan (Multicurrency Revolving Credit Facility) with a ceiling of<br />

EUR 600 M and a final due date of November 15, 2009. On December 31, <strong>2004</strong>,<br />

this syndicated loan facility had a utilization level of 0 percent, since the loan facility<br />

had not yet been utilized.<br />

• Two bilateral loan agreements with the Nordic Investment Bank amounting to<br />

EUR 40 M and EUR 30 M, respectively. These loans fall due in 2012.<br />

The Group’s unutilized credit lines amounted to SEK 5,610 M (5,227).<br />

Market funding programs<br />

<strong>Skanska</strong>’s confirmed bank credit facilities consist of:<br />

• Commercial paper (CP) program related to short-term borrowing for maturities<br />

of up to one year. The loan ceiling in the CP program amounts to SEK 6,000 M.<br />

On December 31, <strong>2004</strong>, the borrowed amount was SEK 0 M.<br />

• Medium Term Note program (MTN) for borrowing with maturities between 1−10<br />

years. The loan ceiling in the MTN program amounts to SEK 8,000 M. On December<br />

31, <strong>2004</strong>, the borrowed amount was SEK 1,765 M and the average maturity<br />

was 2.6 years.<br />

These borrowing programs are mainly intended for borrowing in the Swedish credit<br />

market; however, it is possible to borrow in EUR within the framework of these programs.<br />

Liquidity reserve and maturity structure<br />

The target is to have a liquidity reserve of at least SEK 4,000 M available through<br />

cash equivalents or committed credit facilities. At year-end <strong>2004</strong>, this amounted to<br />

more than SEK 11 M.<br />

The average maturity of the borrowing portfolio shall be in the 2–4 year range.<br />

At year-end <strong>2004</strong>, the average maturity was 3.0 (2.2) years.<br />

The maturity structure of interest-bearing assets, liabilities and provisions on<br />

December 31, <strong>2004</strong> was distributed over coming years according to the table below.<br />

December 31, <strong>2004</strong><br />

Interest-bearing assets, year of maturity Fixed rate Variable rate Total<br />

2005 8,296 3,103 11,399<br />

2006 106 449 555<br />

2007 1 4 5<br />

2008 0 40 40<br />

2009 109 0 109<br />

2010 and later 173 140 313<br />

Total interest-bearing assets 8,685 3,736 12,421<br />

Interest-bearing liabilities and provisions,<br />

including derivatives and provisions<br />

for pensions, year of maturity Fixed rate Variable rate Total<br />

2005 24 1,017 1,041<br />

2006 1,452 –806 646<br />

2007 931 –67 864<br />

2008 369 411 780<br />

2009 428 –382 46<br />

2010 and later 90 720 810<br />

Total interest-bearing liabilities 3,294 893 4,187<br />

Pensions 735 0 735<br />

Net assets 4,656 2,843 7,499<br />

On December 31, <strong>2004</strong>, the Group’s interest rate swap portfolio amounted<br />

to a nominal SEK 17,111 M (17,952). A net amount of SEK 1,939 M (1,971)<br />

of the liabilities was swapped from variable to fixed interest rates.<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Notes, including accounting and valuation principles<br />

59