ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

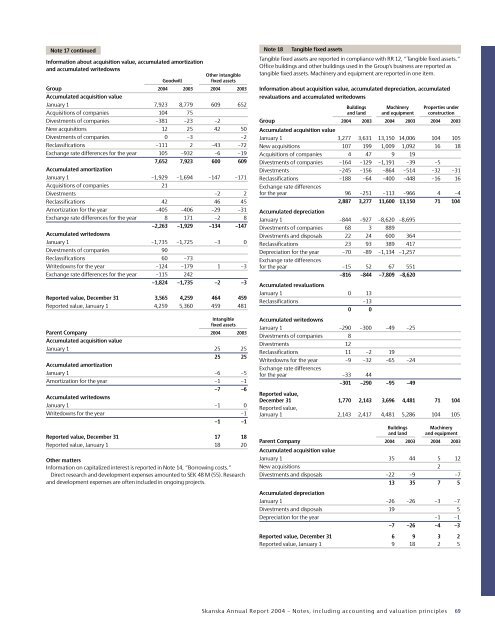

Note 17 continued<br />

Information about acquisition value, accumulated amortization<br />

and accumulated writedowns<br />

Goodwill<br />

Other intangible<br />

fixed assets<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Accumulated acquisition value<br />

January 1 7,923 8,779 609 652<br />

Acquisitions of companies 104 75<br />

Divestments of companies –381 –23 –2<br />

New acquisitions 12 25 42 50<br />

Divestments of companies 0 –3 –2<br />

Reclassifications –111 2 –43 –72<br />

Exchange rate differences for the year 105 –932 –6 –19<br />

7,652 7,923 600 609<br />

Accumulated amortization<br />

January 1 –1,929 –1,694 –147 –171<br />

Acquisitions of companies 21<br />

Divestments –2 2<br />

Reclassifications 42 46 45<br />

Amortization for the year –405 –406 –29 –31<br />

Exchange rate differences for the year 8 171 –2 8<br />

–2,263 –1,929 –134 –147<br />

Accumulated writedowns<br />

January 1 –1,735 –1,725 –3 0<br />

Divestments of companies 90<br />

Reclassifications 60 –73<br />

Writedowns for the year –124 –179 1 –3<br />

Exchange rate differences for the year –115 242<br />

–1,824 –1,735 –2 –3<br />

Reported value, December 31 3,565 4,259 464 459<br />

Reported value, January 1 4,259 5,360 459 481<br />

Intangible<br />

fixed assets<br />

Parent Company <strong>2004</strong> 2003<br />

Accumulated acquisition value<br />

January 1 25 25<br />

25 25<br />

Accumulated amortization<br />

January 1 –6 –5<br />

Amortization for the year –1 –1<br />

–7 –6<br />

Accumulated writedowns<br />

January 1 –1 0<br />

Writedowns for the year –1<br />

–1 –1<br />

Reported value, December 31 17 18<br />

Reported value, January 1 18 20<br />

Other matters<br />

Information on capitalized interest is reported in Note 14, ”Borrowing costs.”<br />

Direct research and development expenses amounted to SEK 48 M (55). Research<br />

and development expenses are often included in ongoing projects.<br />

Note 18<br />

Tangible fixed assets<br />

Tangible fixed assets are reported in compliance with RR 12, ”Tangible fixed assets.”<br />

Office buildings and other buildings used in the Group’s business are reported as<br />

tangible fixed assets. Machinery and equipment are reported in one item.<br />

Information about acquisition value, accumulated depreciation, accumulated<br />

revaluations and accumulated writedowns<br />

Buildings Machinery Properties under<br />

and land and equipment construction<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Accumulated acquisition value<br />

January 1 3,277 3,631 13,150 14,006 104 105<br />

New acquisitions 107 199 1,009 1,092 16 18<br />

Acquisitions of companies 4 47 9 19<br />

Divestments of companies –164 –129 –1,191 –39 –5<br />

Divestments –245 –156 –864 –514 –32 –31<br />

Reclassifications –188 –64 –400 –448 –16 16<br />

Exchange rate differences<br />

for the year 96 –251 –113 –966 4 –4<br />

2,887 3,277 11,600 13,150 71 104<br />

Accumulated depreciation<br />

January 1 –844 –927 –8,620 –8,695<br />

Divestments of companies 68 3 889<br />

Divestments and disposals 22 24 600 364<br />

Reclassifications 23 93 389 417<br />

Depreciation for the year –70 –89 –1,134 –1,257<br />

Exchange rate differences<br />

for the year –15 52 67 551<br />

–816 –844 –7,809 –8,620<br />

Accumulated revaluations<br />

January 1 0 13<br />

Reclassifications –13<br />

0 0<br />

Accumulated writedowns<br />

January 1 –290 –300 –49 –25<br />

Divestments of companies 8<br />

Divestments 12<br />

Reclassifications 11 –2 19<br />

Writedowns for the year –9 –32 –65 –24<br />

Exchange rate differences<br />

for the year –33 44<br />

–301 –290 –95 –49<br />

Reported value,<br />

December 31 1,770 2,143 3,696 4,481 71 104<br />

Reported value,<br />

January 1 2,143 2,417 4,481 5,286 104 105<br />

Buildings Machinery<br />

and land and equipment<br />

Parent Company <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Accumulated acquisition value<br />

January 1 35 44 5 12<br />

New acquisitions 2<br />

Divestments and disposals –22 –9 –7<br />

13 35 7 5<br />

Accumulated depreciation<br />

January 1 –26 –26 –3 –7<br />

Divestments and disposals 19 5<br />

Depreciation for the year –1 –1<br />

–7 –26 –4 –3<br />

Reported value, December 31 6 9 3 2<br />

Reported value, January 1 9 18 2 5<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Notes, including accounting and valuation principles<br />

69