ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note 23 continued<br />

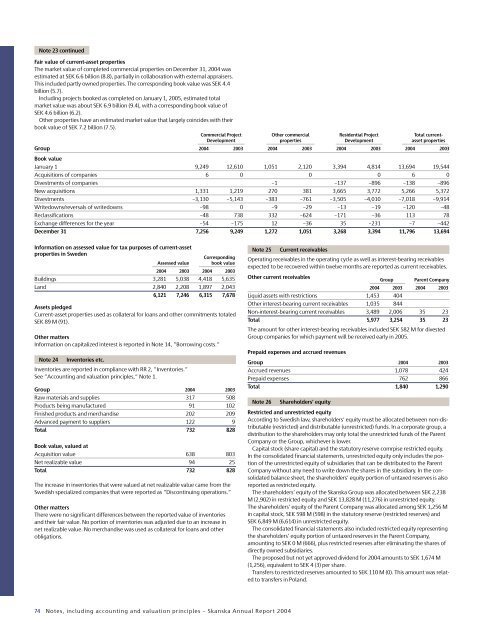

Fair value of current-asset properties<br />

The market value of completed commercial properties on December 31, <strong>2004</strong> was<br />

estimated at SEK 6.6 billion (8.8), partially in collaboration with external appraisers.<br />

This included partly owned properties. The corresponding book value was SEK 4.4<br />

billion (5.7).<br />

Including projects booked as completed on January 1, 2005, estimated total<br />

market value was about SEK 6.9 billion (9.4), with a corresponding book value of<br />

SEK 4.6 billion (6.2).<br />

Other properties have an estimated market value that largely coincides with their<br />

book value of SEK 7.2 billion (7.5).<br />

Commercial Project Other commercial Residential Project Total current-<br />

Development properties Development asset properties<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Book value<br />

January 1 9,249 12,610 1,051 2,120 3,394 4,814 13,694 19,544<br />

Acquisitions of companies 6 0 0 0 6 0<br />

Divestments of companies –1 –137 –896 –138 –896<br />

New acquisitions 1,331 1,219 270 381 3,665 3,772 5,266 5,372<br />

Divestments –3,130 –5,143 –383 –761 –3,505 –4,010 –7,018 –9,914<br />

Writedowns/reversals of writedowns –98 0 –9 –29 –13 –19 –120 –48<br />

Reclassifications –48 738 332 –624 –171 –36 113 78<br />

Exchange differences for the year –54 –175 12 –36 35 –231 –7 –442<br />

December 31 7,256 9,249 1,272 1,051 3,268 3,394 11,796 13,694<br />

Information on assessed value for tax purposes of current-asset<br />

properties in Sweden<br />

Corresponding<br />

Assessed value book value<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Buildings 3,281 5,038 4,418 5,635<br />

Land 2,840 2,208 1,897 2,043<br />

6,121 7,246 6,315 7,678<br />

Assets pledged<br />

Current-asset properties used as collateral for loans and other commitments totaled<br />

SEK 89 M (91).<br />

Other matters<br />

Information on capitalized interest is reported in Note 14, ”Borrowing costs.”<br />

Note 24 Inventories etc.<br />

Inventories are reported in compliance with RR 2, ”Inventories.”<br />

See ”Accounting and valuation principles,” Note 1.<br />

Group <strong>2004</strong> 2003<br />

Raw materials and supplies 317 508<br />

Products being manufactured 91 102<br />

Finished products and merchandise 202 209<br />

Advanced payment to suppliers 122 9<br />

Total 732 828<br />

Book value, valued at<br />

Acquisition value 638 803<br />

Net realizable value 94 25<br />

Total 732 828<br />

The increase in inventories that were valued at net realizable value came from the<br />

Swedish specialized companies that were reported as ”Discontinuing operations.”<br />

Other matters<br />

There were no significant differences between the reported value of inventories<br />

and their fair value. No portion of inventories was adjusted due to an increase in<br />

net realizable value. No merchandise was used as collateral for loans and other<br />

obligations.<br />

Note 25 Current receivables<br />

Operating receivables in the operating cycle as well as interest-bearing receivables<br />

expected to be recovered within twelve months are reported as current receivables.<br />

Other current receivables<br />

Group Parent Company<br />

<strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Liquid assets with restrictions 1,453 404<br />

Other interest-bearing current receivables 1,035 844<br />

Non-interest-bearing current receivables 3,489 2,006 35 23<br />

Total 5,977 3,254 35 23<br />

The amount for other interest-bearing receivables included SEK 582 M for divested<br />

Group companies for which payment will be received early in 2005.<br />

Prepaid expenses and accrued revenues<br />

Group <strong>2004</strong> 2003<br />

Accrued revenues 1,078 424<br />

Prepaid expenses 762 866<br />

Total 1,840 1,290<br />

Note 26 Shareholders’ equity<br />

Restricted and unrestricted equity<br />

According to Swedish law, shareholders’ equity must be allocated between non-distributable<br />

(restricted) and distributable (unrestricted) funds. In a corporate group, a<br />

distribution to the shareholders may only total the unrestricted funds of the Parent<br />

Company or the Group, whichever is lower.<br />

Capital stock (share capital) and the statutory reserve comrpise restricted equity.<br />

In the consolidated financial statements, unrestricted equity only includes the portion<br />

of the unrestricted equity of subsidiaries that can be distributed to the Parent<br />

Company without any need to write down the shares in the subsidiary. In the consolidated<br />

balance sheet, the shareholders’ equity portion of untaxed reserves is also<br />

reported as restricted equity.<br />

The shareholders’ equity of the <strong>Skanska</strong> Group was allocated between SEK 2,238<br />

M (2,902) in restricted equity and SEK 13,828 M (11,276) in unrestricted equity.<br />

The shareholders’ equity of the Parent Company was allocated among SEK 1,256 M<br />

in capital stock, SEK 598 M (598) in the statutory reserve (restricted reserves) and<br />

SEK 6,849 M (6,614) in unrestricted equity.<br />

The consolidated financial statements also included restricted equity representing<br />

the shareholders’ equity portion of untaxed reserves in the Parent Company,<br />

amounting to SEK 0 M (666), plus restricted reserves after eliminating the shares of<br />

directly owned subsidiaries.<br />

The proposed but not yet approved dividend for <strong>2004</strong> amounts to SEK 1,674 M<br />

(1,256), equivalent to SEK 4 (3) per share.<br />

Transfers to restricted reserves amounted to SEK 110 M (0). This amount was related<br />

to transfers in Poland.<br />

74<br />

Notes, including accounting and valuation principles – <strong>Skanska</strong> Annual Report <strong>2004</strong>