ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Divestments of a number of properties<br />

and the completion of a BOT project meant<br />

that eliminations of internal profits carried<br />

out earlier in construction operations<br />

were dissolved, yielding positive income<br />

of SEK 45 M (–65).<br />

Discontinuing operations showed an<br />

operating income of SEK 768 M (169).<br />

Operating income includes SEK 1,378 M<br />

in capital gains from divestments of businesses.<br />

Operating income also includes<br />

65 percent of the writedown on a large<br />

loss-making project in the U.K.<br />

Income after financial items<br />

Net financial items totaled SEK –34 M<br />

(– 460). As a consequence of lower average<br />

debt, net interest items improved from SEK<br />

–393 M to SEK – 48 M. During the year,<br />

<strong>Skanska</strong> also capitalized SEK 39 M (84) in<br />

interest on project development for its own<br />

account. Other financial items amounted<br />

to SEK 14 M (–67) and included currency<br />

hedging and currency exchange loss expenses<br />

as well as the gain on the liquidation of an<br />

aircraft leasing company.<br />

Net profit for the year<br />

After subtracting the year’s tax expenses of<br />

SEK 1,158 M (1,303) and minority interests<br />

of SEK –13 M (–8), net profit for the year<br />

amounted to SEK 2,648 M (2,761). The<br />

effective tax rate amounted to 30 percent,<br />

which is somewhat lower than the aggregate<br />

statutory tax rate for the Group. Among the<br />

reasons for this were losses in U.S. operations<br />

as well as certain divestments of properties<br />

and businesses with low taxation or<br />

none at all.<br />

Earnings per share totaled SEK 6.33<br />

(6.60).<br />

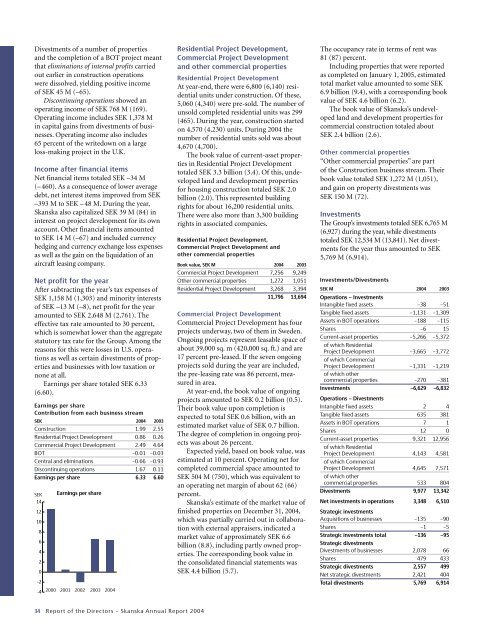

Earnings per share<br />

Contribution from each business stream<br />

SEK <strong>2004</strong> 2003<br />

Construction 1.99 2.55<br />

Residential Project Development 0.86 0.26<br />

Commercial Project Development 2.49 4.64<br />

BOT –0.01 –0.03<br />

Central and eliminations –0.66 –0.93<br />

Discontinuing operations 1.67 0.11<br />

Earnings per share 6.33 6.60<br />

SEK<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

Earnings per share<br />

-2<br />

-4 2000 2001 2002 2003 <strong>2004</strong><br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

Residential Project Development,<br />

Commercial Project Development<br />

and other commercial properties<br />

Residential Project Development<br />

At year-end, there were 6,800 (6,140) residential<br />

units under construction. Of these,<br />

5,060 (4,340) were pre-sold. The number of<br />

unsold completed residential units was 299<br />

(465). During the year, construction started<br />

on 4,570 (4,230) units. During <strong>2004</strong> the<br />

number of residential units sold was about<br />

4,670 (4,700).<br />

The book value of current-asset properties<br />

in Residential Project Development<br />

totaled SEK 3.3 billion (3.4). Of this, undeveloped<br />

land and development properties<br />

for housing construction totaled SEK 2.0<br />

billion (2.0). This represented building<br />

rights for about 16,200 residential units.<br />

There were also more than 3,300 building<br />

rights in associated companies.<br />

Residential Project Development,<br />

Commercial Project Development and<br />

other commercial properties<br />

Book value, SEK M <strong>2004</strong> 2003<br />

Commercial Project Development 7,256 9,249<br />

Other commercial properties 1,272 1,051<br />

Residential Project Development 3,268 3,394<br />

11,796 13,694<br />

Commercial Project Development<br />

Commercial Project Development has four<br />

projects underway, two of them in Sweden.<br />

Ongoing projects represent leasable space of<br />

about 39,000 sq. m (420,000 sq. ft.) and are<br />

17 percent pre-leased. If the seven ongoing<br />

projects sold during the year are included,<br />

the pre-leasing rate was 86 percent, measured<br />

in area.<br />

At year-end, the book value of ongoing<br />

projects amounted to SEK 0.2 billion (0.5).<br />

Their book value upon completion is<br />

expected to total SEK 0.6 billion, with an<br />

estimated market value of SEK 0.7 billion.<br />

The degree of completion in ongoing projects<br />

was about 26 percent.<br />

Expected yield, based on book value, was<br />

estimated at 10 percent. Operating net for<br />

completed commercial space amounted to<br />

SEK 504 M (750), which was equivalent to<br />

an operating net margin of about 62 (66)<br />

percent.<br />

<strong>Skanska</strong>’s estimate of the market value of<br />

finished properties on December 31, <strong>2004</strong>,<br />

which was partially carried out in collaboration<br />

with external appraisers, indicated a<br />

market value of approximately SEK 6.6<br />

billion (8.8), including partly owned properties.<br />

The corresponding book value in<br />

the consolidated financial statements was<br />

SEK 4.4 billion (5.7).<br />

The occupancy rate in terms of rent was<br />

81 (87) percent.<br />

Including properties that were reported<br />

as completed on January 1, 2005, estimated<br />

total market value amounted to some SEK<br />

6.9 billion (9.4), with a corresponding book<br />

value of SEK 4.6 billion (6.2).<br />

The book value of <strong>Skanska</strong>’s undeveloped<br />

land and development properties for<br />

commercial construction totaled about<br />

SEK 2.4 billion (2.6).<br />

Other commercial properties<br />

“Other commercial properties” are part<br />

of the Construction business stream. Their<br />

book value totaled SEK 1,272 M (1,051),<br />

and gain on property divestments was<br />

SEK 150 M (72).<br />

Investments<br />

The Group’s investments totaled SEK 6,765 M<br />

(6,927) during the year, while divestments<br />

totaled SEK 12,534 M (13,841). Net divestments<br />

for the year thus amounted to SEK<br />

5,769 M (6,914).<br />

Investments/Divestments<br />

SEK M <strong>2004</strong> 2003<br />

Operations − Investments<br />

Intangible fixed assets –38 –51<br />

Tangible fixed assets –1,131 –1,309<br />

Assets in BOT operations –188 –115<br />

Shares –6 15<br />

Current-asset properties –5,266 –5,372<br />

of which Residential<br />

Project Development –3,665 –3,772<br />

of which Commercial<br />

Project Development –1,331 –1,219<br />

of which other<br />

commercial properties –270 –381<br />

Investments –6,629 –6,832<br />

Operations − Divestments<br />

Intangible fixed assets 2 4<br />

Tangible fixed assets 635 381<br />

Assets in BOT operations 7 1<br />

Shares 12 0<br />

Current-asset properties 9,321 12,956<br />

of which Residential<br />

Project Development 4,143 4,581<br />

of which Commercial<br />

Project Development 4,645 7,571<br />

of which other<br />

commercial properties 533 804<br />

Divestments 9,977 13,342<br />

Net investments in operations 3,348 6,510<br />

Strategic investments<br />

Acquisitions of businesses –135 –90<br />

Shares –1 –5<br />

Strategic investments total –136 –95<br />

Strategic divestments<br />

Divestments of businesses 2,078 66<br />

Shares 479 433<br />

Strategic divestments 2,557 499<br />

Net strategic divestments 2,421 404<br />

Total divestments 5,769 6,914<br />

34<br />

Report of the Directors – <strong>Skanska</strong> Annual Report <strong>2004</strong>