ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

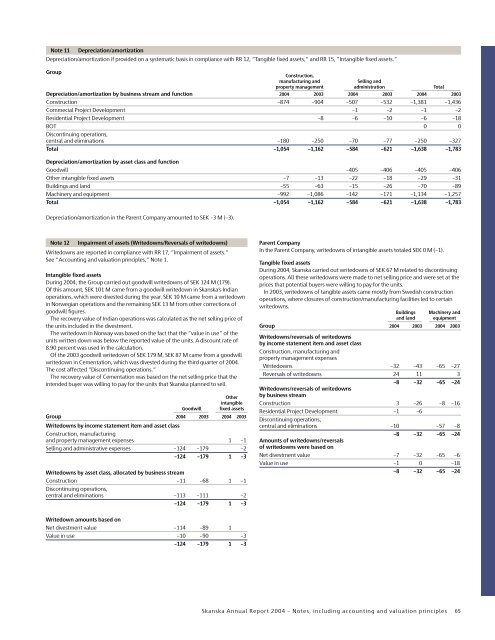

Note 11<br />

Depreciation/amortization<br />

Depreciation/amortization if provided on a systematic basis in compliance with RR 12, ”Tangible fixed assets,” and RR 15, ”Intangible fixed assets.”<br />

Group<br />

Construction,<br />

manufacturing and<br />

Selling and<br />

property management administration Total<br />

Depreciation/amortization by business stream and function <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Construction –874 –904 –507 –532 –1,381 –1,436<br />

Commecial Project Development –1 –2 –1 –2<br />

Residential Project Development –8 –6 –10 –6 –18<br />

BOT 0 0<br />

Discontinuing operations,<br />

central and eliminations –180 –250 –70 –77 –250 –327<br />

Total –1,054 –1,162 –584 –621 –1,638 –1,783<br />

Depreciation/amortization by asset class and function<br />

Goodwill –405 –406 –405 –406<br />

Other intangible fixed assets –7 –13 –22 –18 –29 –31<br />

Buildings and land –55 –63 –15 –26 –70 –89<br />

Machinery and equipment –992 –1,086 –142 –171 –1,134 –1,257<br />

Total –1,054 –1,162 –584 –621 –1,638 –1,783<br />

Depreciation/amortization in the Parent Company amounted to SEK –3 M (–3).<br />

Note 12 Impairment of assets (Writedowns/Reversals of writedowns)<br />

Writedowns are reported in compliance with RR 17, ”Impairment of assets.”<br />

See ”Accounting and valuation principles,” Note 1.<br />

Intangible fixed assets<br />

During <strong>2004</strong>, the Group carried out goodwill writedowns of SEK 124 M (179).<br />

Of this amount, SEK 101 M came from a goodwill writedown in <strong>Skanska</strong>’s Indian<br />

operations, which were divested during the year. SEK 10 M came from a writedown<br />

in Norwegian operations and the remaining SEK 13 M from other corrections of<br />

goodwill figures.<br />

The recovery value of Indian operations was calculated as the net selling price of<br />

the units included in the divestment.<br />

The writedown in Norway was based on the fact that the ”value in use” of the<br />

units written down was below the reported value of the units. A discount rate of<br />

8.90 percent was used in the calculation.<br />

Of the 2003 goodwill writedown of SEK 179 M, SEK 87 M came from a goodwill<br />

writedown in Cementation, which was divested during the third quarter of <strong>2004</strong>.<br />

The cost affected ”Discontinuing operations.”<br />

The recovery value of Cementation was based on the net selling price that the<br />

intended buyer was willing to pay for the units that <strong>Skanska</strong> planned to sell.<br />

Other<br />

intangible<br />

Goodwill fixed assets<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Writedowns by income statement item and asset class<br />

Construction, manufacturing<br />

and property management expenses 1 –1<br />

Selling and administrative expenses –124 –179 –2<br />

–124 –179 1 –3<br />

Writedowns by asset class, allocated by business stream<br />

Construction –11 –68 1 –1<br />

Discontinuing operations,<br />

central and eliminations –113 –111 –2<br />

–124 –179 1 –3<br />

Parent Company<br />

In the Parent Company, writedowns of intangible assets totaled SEK 0 M (–1).<br />

Tangible fixed assets<br />

During <strong>2004</strong>, <strong>Skanska</strong> carried out writedowns of SEK 67 M related to discontinuing<br />

operations. All these writedowns were made to net selling price and were set at the<br />

prices that potential buyers were willing to pay for the units.<br />

In 2003, writedowns of tangible assets came mostly from Swedish construction<br />

operations, where closures of construction/manufacturing facilities led to certain<br />

writedowns.<br />

Buildings Machinery and<br />

and land equipment<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Writedowns/reversals of writedowns<br />

by income statement item and asset class<br />

Construction, manufacturing and<br />

property management expenses<br />

Writedowns –32 –43 –65 –27<br />

Reversals of writedowns 24 11 3<br />

–8 –32 –65 –24<br />

Writedowns/reversals of writedowns<br />

by business stream<br />

Construction 3 –26 –8 –16<br />

Residential Project Development –1 –6<br />

Discontinuing operations,<br />

central and eliminations –10 –57 –8<br />

–8 –32 –65 –24<br />

Amounts of writedowns/reversals<br />

of writedowns were based on<br />

Net divestment value –7 –32 –65 –6<br />

Value in use –1 0 –18<br />

–8 –32 –65 –24<br />

Writedown amounts based on<br />

Net divestment value –114 –89 1<br />

Value in use –10 –90 –3<br />

–124 –179 1 –3<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Notes, including accounting and valuation principles<br />

65