ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

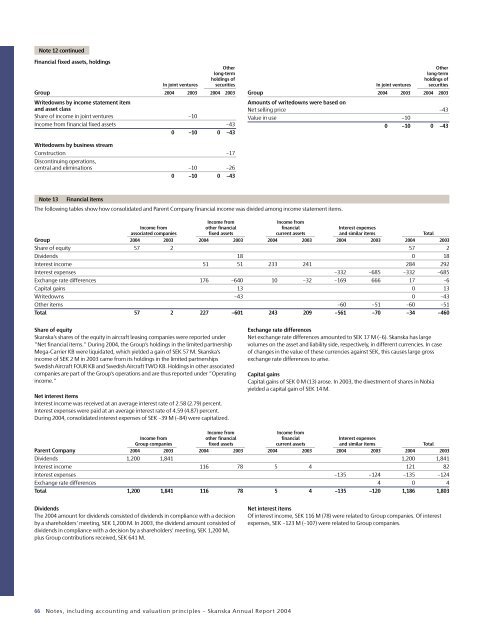

Note 12 continued<br />

Financial fixed assets, holdings<br />

Other<br />

long-term<br />

holdings of<br />

In joint ventures securities<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Writedowns by income statement item<br />

and asset class<br />

Share of income in joint ventures –10<br />

Income from financial fixed assets –43<br />

0 –10 0 –43<br />

Other<br />

long-term<br />

holdings of<br />

In joint ventures securities<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Amounts of writedowns were based on<br />

Net selling price –43<br />

Value in use –10<br />

0 –10 0 –43<br />

Writedowns by business stream<br />

Construction –17<br />

Discontinuing operations,<br />

central and eliminations –10 –26<br />

0 –10 0 –43<br />

Note 13<br />

Financial items<br />

The following tables show how consolidated and Parent Company financial income was divided among income statement items.<br />

Income from<br />

Income from<br />

Income from other financial financial Interest expenses<br />

associated companies fixed assets current assets and similar items Total<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Share of equity 57 2 57 2<br />

Dividends 18 0 18<br />

Interest income 51 51 233 241 284 292<br />

Interest expenses –332 –685 –332 –685<br />

Exchange rate differences 176 –640 10 –32 –169 666 17 –6<br />

Capital gains 13 0 13<br />

Writedowns –43 0 –43<br />

Other items –60 –51 –60 –51<br />

Total 57 2 227 –601 243 209 –561 –70 –34 –460<br />

Share of equity<br />

<strong>Skanska</strong>’s shares of the equity in aircraft leasing companies were reported under<br />

”Net financial items.” During <strong>2004</strong>, the Group’s holdings in the limited partnership<br />

Mega-Carrier KB were liquidated, which yielded a gain of SEK 57 M. <strong>Skanska</strong>’s<br />

income of SEK 2 M in 2003 came from its holdings in the limited partnerships<br />

Swedish Aircraft FOUR KB and Swedish Aircraft TWO KB. Holdings in other associated<br />

companies are part of the Group’s operations and are thus reported under ”Operating<br />

income.”<br />

Net interest items<br />

Interest income was received at an average interest rate of 2.58 (2.79) percent.<br />

Interest expenses were paid at an average interest rate of 4.59 (4.87) percent.<br />

During <strong>2004</strong>, consolidated interest expenses of SEK –39 M (–84) were capitalized.<br />

Exchange rate differences<br />

Net exchange rate differences amounted to SEK 17 M (–6). <strong>Skanska</strong> has large<br />

volumes on the asset and liability side, respectively, in different currencies. In case<br />

of changes in the value of these currencies against SEK, this causes large gross<br />

exchange rate differences to arise.<br />

Capital gains<br />

Capital gains of SEK 0 M (13) arose. In 2003, the divestment of shares in Nobia<br />

yielded a capital gain of SEK 14 M.<br />

Income from<br />

Income from<br />

Income from other financial financial Interest expenses<br />

Group companies fixed assets current assets and similar items Total<br />

Parent Company <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Dividends 1,200 1,841 1,200 1,841<br />

Interest income 116 78 5 4 121 82<br />

Interest expenses –135 –124 –135 –124<br />

Exchange rate differences 4 0 4<br />

Total 1,200 1,841 116 78 5 4 –135 –120 1,186 1,803<br />

Dividends<br />

The <strong>2004</strong> amount for dividends consisted of dividends in compliance with a decision<br />

by a shareholders’ meeting, SEK 1,200 M. In 2003, the dividend amount consisted of<br />

dividends in compliance with a decision by a shareholders’ meeting, SEK 1,200 M,<br />

plus Group contributions received, SEK 641 M.<br />

Net interest items<br />

Of interest income, SEK 116 M (78) were related to Group companies. Of interest<br />

expenses, SEK –123 M (–107) were related to Group companies.<br />

66 Notes, including accounting and valuation principles – <strong>Skanska</strong> Annual Report <strong>2004</strong>