ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

ANNUAL REPORT 2004 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Note 6 continued<br />

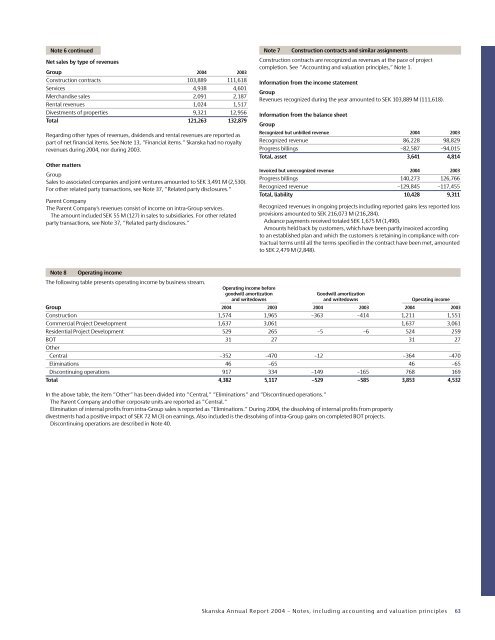

Net sales by type of revenues<br />

Group <strong>2004</strong> 2003<br />

Construction contracts 103,889 111,618<br />

Services 4,938 4,601<br />

Merchandise sales 2,091 2,187<br />

Rental revenues 1,024 1,517<br />

Divestments of properties 9,321 12,956<br />

Total 121,263 132,879<br />

Regarding other types of revenues, dividends and rental revenues are reported as<br />

part of net financial items. See Note 13, ”Financial items.” <strong>Skanska</strong> had no royalty<br />

revenues during <strong>2004</strong>, nor during 2003.<br />

Other matters<br />

Group<br />

Sales to associated companies and joint ventures amounted to SEK 3,491 M (2,530).<br />

For other related party transactions, see Note 37, ”Related party disclosures.”<br />

Parent Company<br />

The Parent Company’s revenues consist of income on intra-Group services.<br />

The amount included SEK 55 M (127) in sales to subsidiaries. For other related<br />

party transactions, see Note 37, ”Related party disclosures.”<br />

Note 7 Construction contracts and similar assignments<br />

Construction contracts are recognized as revenues at the pace of project<br />

completion. See ”Accounting and valuation principles,” Note 1.<br />

Information from the income statement<br />

Group<br />

Revenues recognized during the year amounted to SEK 103,889 M (111,618).<br />

Information from the balance sheet<br />

Group<br />

Recognized but unbilled revenue <strong>2004</strong> 2003<br />

Recognized revenue 86,228 98,829<br />

Progress billings –82,587 –94,015<br />

Total, asset 3,641 4,814<br />

Invoiced but unrecognized revenue <strong>2004</strong> 2003<br />

Progress billings 140,273 126,766<br />

Recognized revenue –129,845 –117,455<br />

Total, liability 10,428 9,311<br />

Recognized revenues in ongoing projects including reported gains less reported loss<br />

provisions amounted to SEK 216,073 M (216,284).<br />

Advance payments received totaled SEK 1,675 M (1,490).<br />

Amounts held back by customers, which have been partly invoiced according<br />

to an established plan and which the customers is retaining in compliance with contractual<br />

terms until all the terms specified in the contract have been met, amounted<br />

to SEK 2,479 M (2,848).<br />

Note 8 Operating income<br />

The following table presents operating income by business stream.<br />

Operating income before<br />

goodwill amortization<br />

Goodwill amortization<br />

and writedowns and writedowns Operating income<br />

Group <strong>2004</strong> 2003 <strong>2004</strong> 2003 <strong>2004</strong> 2003<br />

Construction 1,574 1,965 –363 –414 1,211 1,551<br />

Commercial Project Development 1,637 3,061 1,637 3,061<br />

Residential Project Development 529 265 –5 –6 524 259<br />

BOT 31 27 31 27<br />

Other<br />

Central –352 –470 –12 –364 –470<br />

Eliminations 46 –65 46 –65<br />

Discontinuing operations 917 334 –149 –165 768 169<br />

Total 4,382 5,117 –529 –585 3,853 4,532<br />

In the above table, the item ”Other” has been divided into ”Central,” ”Eliminations” and ”Discontinued operations.”<br />

The Parent Company and other corporate units are reported as ”Central.”<br />

Elimination of internal profits from intra-Group sales is reported as ”Eliminations.” During <strong>2004</strong>, the dissolving of internal profits from property<br />

divestments had a positive impact of SEK 72 M (3) on earnings. Also included is the dissolving of intra-Group gains on completed BOT projects.<br />

Discontinuing operations are described in Note 40.<br />

<strong>Skanska</strong> Annual Report <strong>2004</strong> – Notes, including accounting and valuation principles<br />

63