Islj 2009 3-4 - TMC Asser Instituut

Islj 2009 3-4 - TMC Asser Instituut

Islj 2009 3-4 - TMC Asser Instituut

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

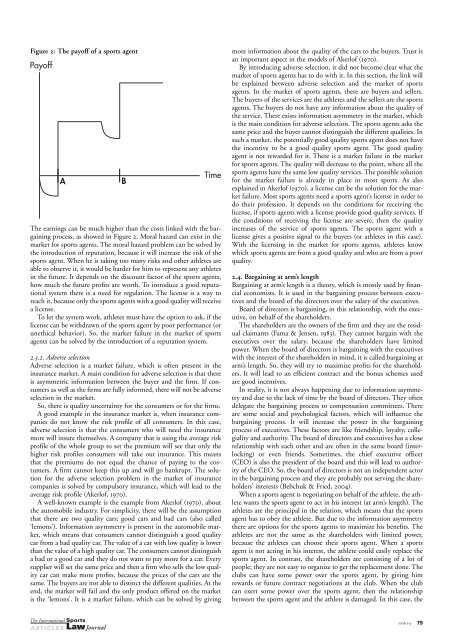

Figure 2: The payoff of a sports agent<br />

The earnings can be much higher than the costs linked with the bargaining<br />

process, as showed in Figure 2. Moral hazard can exist in the<br />

market for sports agents. The moral hazard problem can be solved by<br />

the introduction of reputation, because it will increase the risk of the<br />

sports agent. When he is taking too many risks and other athletes are<br />

able to observe it, it would be harder for him to represent any athletes<br />

in the future. It depends on the discount factor of the sports agents,<br />

how much the future profits are worth. To introduce a good reputational<br />

system there is a need for regulation. The license is a way to<br />

reach it, because only the sports agents with a good quality will receive<br />

a license.<br />

To let the system work, athletes must have the option to ask, if the<br />

license can be withdrawn of the sports agent by poor performance (or<br />

unethical behavior). So, the market failure in the market of sports<br />

agents can be solved by the introduction of a reputation system.<br />

2.3.2. Adverse selection<br />

Adverse selection is a market failure, which is often present in the<br />

insurance market. A main condition for adverse selection is that there<br />

is asymmetric information between the buyer and the firm. If consumers<br />

as well as the firms are fully informed, there will not be adverse<br />

selection in the market.<br />

So, there is quality uncertainty for the consumers or for the firms.<br />

A good example in the insurance market is, when insurance companies<br />

do not know the risk profile of all consumers. In this case,<br />

adverse selection is that the consumers who will need the insurance<br />

more will insure themselves. A company that is using the average risk<br />

profile of the whole group to set the premium will see that only the<br />

higher risk profiles consumers will take out insurance. This means<br />

that the premiums do not equal the chance of paying to the costumers.<br />

A firm cannot keep this up and will go bankrupt. The solution<br />

for the adverse selection problem in the market of insurance<br />

companies is solved by compulsory insurance, which will lead to the<br />

average risk profile (Akerlof, 1970).<br />

A well-known example is the example from Akerlof (1970), about<br />

the automobile industry. For simplicity, there will be the assumption<br />

that there are two quality cars: good cars and bad cars (also called<br />

‘lemons’). Information asymmetry is present in the automobile market,<br />

which means that consumers cannot distinguish a good quality<br />

car from a bad quality car. The value of a car with low quality is lower<br />

than the value of a high quality car. The consumers cannot distinguish<br />

a bad or a good car and they do not want to pay more for a car. Every<br />

supplier will set the same price and then a firm who sells the low quality<br />

car can make more profits, because the prices of the cars are the<br />

same. The buyers are not able to distinct the different qualities. At the<br />

end, the market will fail and the only product offered on the market<br />

is the ‘lemons’. It is a market failure, which can be solved by giving<br />

more information about the quality of the cars to the buyers. Trust is<br />

an important aspect in the models of Akerlof (1970).<br />

By introducing adverse selection, it did not become clear what the<br />

market of sports agents has to do with it. In this section, the link will<br />

be explained between adverse selection and the market of sports<br />

agents. In the market of sports agents, there are buyers and sellers.<br />

The buyers of the services are the athletes and the sellers are the sports<br />

agents. The buyers do not have any information about the quality of<br />

the service. There exists information asymmetry in the market, which<br />

is the main condition for adverse selection. The sports agents asks the<br />

same price and the buyer cannot distinguish the different qualities. In<br />

such a market, the potentially good quality sports agent does not have<br />

the incentive to be a good quality sports agent. The good quality<br />

agent is not rewarded for it. There is a market failure in the market<br />

for sports agents. The quality will decrease to the point, where all the<br />

sports agents have the same low quality services. The possible solution<br />

for the market failure is already in place in most sports. As also<br />

explained in Akerlof (1970), a license can be the solution for the market<br />

failure. Most sports agents need a sports agent’s license in order to<br />

do their profession. It depends on the conditions for receiving the<br />

license, if sports agents with a license provide good quality services. If<br />

the conditions of receiving the license are severe, then the quality<br />

increases of the service of sports agents. The sports agent with a<br />

license gives a positive signal to the buyers (or athletes in this case).<br />

With the licensing in the market for sports agents, athletes know<br />

which sports agents are from a good quality and who are from a poor<br />

quality.<br />

2.4. Bargaining at arm’s length<br />

Bargaining at arm’s length is a theory, which is mostly used by financial<br />

economists. It is used in the bargaining process between executives<br />

and the board of the directors over the salary of the executives.<br />

Board of directors is bargaining, in this relationship, with the executive,<br />

on behalf of the shareholders.<br />

The shareholders are the owners of the firm and they are the residual<br />

claimants (Fama & Jensen, 1983). They cannot bargain with the<br />

executives over the salary, because the shareholders have limited<br />

power. When the board of directors is bargaining with the executives<br />

with the interest of the shareholders in mind, it is called bargaining at<br />

arm’s length. So, they will try to maximize profits for the shareholders.<br />

It will lead to an efficient contract and the bonus schemes used<br />

are good incentives.<br />

In reality, it is not always happening due to information asymmetry<br />

and due to the lack of time by the board of directors. They often<br />

delegate the bargaining process to compensation committees. There<br />

are some social and psychological factors, which will influence the<br />

bargaining process. It will increase the power in the bargaining<br />

process of executives. These factors are like friendship, loyalty, collegiality<br />

and authority. The board of directors and executives has a close<br />

relationship with each other and are often in the same board (interlocking)<br />

or even friends. Sometimes, the chief executive officer<br />

(CEO) is also the president of the board and this will lead to authority<br />

of the CEO. So, the board of directors is not an independent actor<br />

in the bargaining process and they are probably not serving the shareholders’<br />

interests (Bebchuk & Fried, 2004).<br />

When a sports agent is negotiating on behalf of the athlete, the athlete<br />

wants the sports agent to act in his interest (at arm’s length). The<br />

athletes are the principal in the relation, which means that the sports<br />

agent has to obey the athlete. But due to the information asymmetry<br />

there are options for the sports agents to maximize his benefits. The<br />

athletes are not the same as the shareholders with limited power,<br />

because the athletes can choose their sports agent. When a sports<br />

agent is not acting in his interest, the athlete could easily replace the<br />

sports agent. In contrast, the shareholders are consisting of a lot of<br />

people; they are not easy to organize to get the replacement done. The<br />

clubs can have some power over the sports agent, by giving him<br />

rewards or future contract negotiations at the club. When the club<br />

can exert some power over the sports agent, then the relationship<br />

between the sports agent and the athlete is damaged. In this case, the<br />

A RT I C L E S<br />

<strong>2009</strong>/3-4 79