housing developments in european countries - Department of ...

housing developments in european countries - Department of ...

housing developments in european countries - Department of ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Section 1<br />

Introduction and Summary<br />

Introduction and Summary Section 1<br />

Table<br />

1.4.6<br />

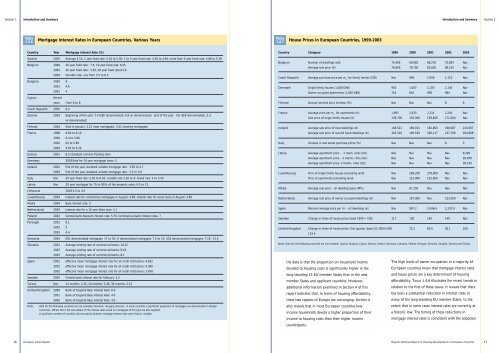

Mortgage Interest Rates <strong>in</strong> European Countries, Various Years<br />

Table<br />

1.4.7<br />

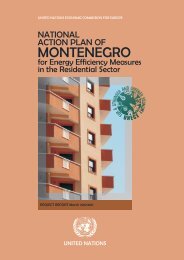

House Prices <strong>in</strong> European Countries, 1999-2003<br />

Country Year Mortgage Interest Rate (%)<br />

Austria 2002 Average 5.13; 1 year fixed rate: 5.16 to 5.92; 1 to 5 year fixed rate: 4.58 to 4.94; more than 5 year fixed rate: 4.86 to 5.39<br />

Belgium 1999 20 year fixed rate: 7.4; 10 year fixed rate: 6.55<br />

2002 20 year fixed rate: 5.62; 10 year fixed rate:6.10<br />

2004 Variable rate: vary from 3.5 to 6.5<br />

Bulgaria 2000 4<br />

2001 4.6<br />

2001 4<br />

Cyprus<br />

Recent<br />

years From 6 to 8<br />

Czech Republic 2002 6.2<br />

Estonia 2003 Beg<strong>in</strong>n<strong>in</strong>g <strong>of</strong> the year: 7.4 (EEK denom<strong>in</strong>ated), 6.8 (€ denom<strong>in</strong>ated). End <strong>of</strong> the year: 4.6 (EEK denom<strong>in</strong>ated), 5.3<br />

(€ denom<strong>in</strong>ated)<br />

F<strong>in</strong>land 2004 Rate <strong>in</strong> January: 3.21 (new mortgages), 3.51 (exist<strong>in</strong>g mortgages)<br />

France 1998 6.60 to 6.10<br />

2000 6.4 to 5.90<br />

2002 62 to 5.89<br />

2003 3.55 to 5.20<br />

Greece 2001 6.5 (standard nom<strong>in</strong>al float<strong>in</strong>g rate)<br />

Germany 2003 Rate for 10 year mortgage loans: 5<br />

Ireland 2002 End <strong>of</strong> the year, standard variable mortgage rate: 3.85 to 4.7<br />

2003 End <strong>of</strong> the year, standard variable mortgage rate: 3.3 to 3.6<br />

Italy Nav 20 year fixed rate: 5.50 to 6.50; variable rate 3.30 to 4; mixed rate: 4 to 5.50<br />

Latvia Nav 20 year mortgage for 75 to 85% <strong>of</strong> the property value: 6.5 to 12.<br />

Lithuania 2003 3.5 to 4.5<br />

Luxembourg 2003 Interest rate for commercial mortgages <strong>in</strong> August: 3.85; <strong>in</strong>terest rate for social loans <strong>in</strong> August: 2.85<br />

Malta 2004 Base <strong>in</strong>terest rate: 3<br />

Netherlands 2003 Interest rate for a 10 year State loan: 4.1<br />

Poland 2002 Central bank discount <strong>in</strong>terest rate: 5.75; Commercial bank <strong>in</strong>terest rates: 7<br />

Portugal 2001 6.1<br />

2002 5<br />

2003 4.4<br />

Romania 2004 ROL denom<strong>in</strong>ated mortgages: 17 to 35; € denom<strong>in</strong>ated mortgages: 7.5 to 14; US$ denom<strong>in</strong>ated mortgages: 7.18 –12.5<br />

Slovakia 2001 Average lend<strong>in</strong>g rate <strong>of</strong> commercial banks: 10.22<br />

Country Category 1999 2000 2001 2002 2003<br />

Belgium Number <strong>of</strong> dwell<strong>in</strong>gs sold 75,469 69,082 68,276 70,893 Nav<br />

Average sale price (€) 76,800 79,700 83,600 89,100 Nav<br />

Czech Republic Average purchase price per m_ for family homes (CZK) Nav 948 1,006 1,110 Nav<br />

Denmark S<strong>in</strong>gle family houses (1,000 DKK) 955 1,047 1,105 1,144 Nav<br />

Owner occupied apartments (1,000 DKK) 716 810 908 984 Nav<br />

F<strong>in</strong>land Annual nom<strong>in</strong>al price <strong>in</strong>crease (%) Nav Nav Nav 8 6<br />

France Average price per m_ for apartments (€) 1,965 2,025 2,114 2,245 Nav<br />

Sale price <strong>of</strong> s<strong>in</strong>gle family houses (€) 136,700 154,300 159,600 172,000 Nav<br />

Ireland Average sale price <strong>of</strong> new dwell<strong>in</strong>gs (€) 148,521 169,191 182,863 198,087 224,567<br />

Average sale price <strong>of</strong> second hand dwell<strong>in</strong>gs (€) 163,316 190,550 206,117 227,799 264,898<br />

Italy Increase <strong>in</strong> real estate purchase prices (%) Nav Nav Nav 8 3<br />

Latvia Average apartment price – 1 room, cities (LVL) Nav Nav Nav Nav 9,200<br />

Average apartment price – 2 rooms, cities (LVL) Nav Nav Nav Nav 20,450<br />

Average apartment price, 3 rooms, cities (LVL) Nav Nav Nav Nav 28,150<br />

Luxembourg Price <strong>of</strong> s<strong>in</strong>gle family houses (exclud<strong>in</strong>g land) Nav 269,200 279,900 Nav Nav<br />

Price <strong>of</strong> apartments (exclud<strong>in</strong>g land) Nav 122,000 125,800 Nav Nav<br />

Malta Average sale price – all dwell<strong>in</strong>g types (MTL) Nav 67,250 Nav Nav Nav<br />

Netherlands Average sale price <strong>of</strong> owner occupied dwell<strong>in</strong>gs (€) Nav 197,000 Nav 223,000 Nav<br />

Spa<strong>in</strong> National average price per m 2 – all dwell<strong>in</strong>gs (€) Nav 907.2 1,046.9 1,220.9 Nav<br />

Sweden Change <strong>in</strong> <strong>in</strong>dex <strong>of</strong> house prices (base 1990 = 100) 117 130 140 149 Nav<br />

United K<strong>in</strong>gdom Change <strong>in</strong> <strong>in</strong>dex <strong>of</strong> house prices, first quarter (base Q1 2000=100) 72.1 83.6 92.1 100<br />

123.4<br />

Note: Data for the follow<strong>in</strong>g <strong>countries</strong> are not available: Austria, Bulgaria, Cyprus, Estonia, Greece, Germany, Lithuania, Poland, Portugal, Romania, Slovakia, Slovenia and Turkey.<br />

2002 Average lend<strong>in</strong>g rate <strong>of</strong> commercial banks: 9.43<br />

2003 Average lend<strong>in</strong>g rate <strong>of</strong> commercial banks: 8.1<br />

Spa<strong>in</strong> 2001 effective mean mortgage <strong>in</strong>terest rate for all credit <strong>in</strong>stitutions: 4.852<br />

2002 effective mean mortgage <strong>in</strong>terest rate for all credit <strong>in</strong>stitutions: 4.380<br />

2002 effective mean mortgage <strong>in</strong>terest rate for all credit <strong>in</strong>stitutions: 3.458<br />

Sweden 2002 Central bank <strong>in</strong>terest rate for February: 2.5<br />

Turkey Nav 12 months: 2.25; 24 months: 2.45; 36 months: 2.15<br />

United K<strong>in</strong>gdom 2000 Bank <strong>of</strong> England Base Interest Rate: 6.0<br />

2001 Bank <strong>of</strong> England Base Interest Rate: 4.0<br />

2002 Bank <strong>of</strong> England Base Interest Rate: 4.0<br />

Note: Data for the follow<strong>in</strong>g <strong>countries</strong> are not available: Denmark, Hungary, Slovenia. In some <strong>countries</strong> a significant proportion <strong>of</strong> mortgages are denom<strong>in</strong>ated <strong>in</strong> foreign<br />

currencies. Where this is the case details <strong>of</strong> the <strong>in</strong>terest rates levied on mortgages <strong>of</strong> this type are also supplied.<br />

A significant number <strong>of</strong> <strong>countries</strong> did not specify whether mortgage <strong>in</strong>terest rates were fixed or variable.<br />

the data is that the proportion on household <strong>in</strong>come<br />

devoted to <strong>hous<strong>in</strong>g</strong> costs is significantly higher <strong>in</strong> the<br />

long-stand<strong>in</strong>g 15 EU member States than <strong>in</strong> the new<br />

member States and applicant <strong>countries</strong>. However,<br />

additional <strong>in</strong>formation exam<strong>in</strong>ed <strong>in</strong> Section 4 <strong>of</strong> this<br />

report <strong>in</strong>dicates that, <strong>in</strong> terms <strong>of</strong> <strong>hous<strong>in</strong>g</strong> affordability,<br />

these two regions <strong>of</strong> Europe are converg<strong>in</strong>g. Section 4<br />

also reveals that <strong>in</strong> most European <strong>countries</strong> low<strong>in</strong>come<br />

households devote a higher proportion <strong>of</strong> their<br />

<strong>in</strong>come to <strong>hous<strong>in</strong>g</strong> costs than their higher <strong>in</strong>come<br />

counterparts.<br />

The high levels <strong>of</strong> owner occupation <strong>in</strong> a majority <strong>of</strong><br />

European <strong>countries</strong> mean that mortgage <strong>in</strong>terest rates<br />

and house prices are a key determ<strong>in</strong>ant <strong>of</strong> <strong>hous<strong>in</strong>g</strong><br />

affordability. TABLE 1.4.6 illustrates the recent trends <strong>in</strong><br />

relation to the first <strong>of</strong> these issues. It reveals that there<br />

has been a substantial reduction <strong>in</strong> <strong>in</strong>terest rates <strong>in</strong><br />

many <strong>of</strong> the long-stand<strong>in</strong>g EU member States, to the<br />

extent that <strong>in</strong> some cases <strong>in</strong>terest rates are currently at<br />

a historic low. The tim<strong>in</strong>g <strong>of</strong> these reductions <strong>in</strong><br />

mortgage <strong>in</strong>terest rates is co<strong>in</strong>cident with the adoption<br />

16 European Union Report<br />

Regular National Report on Hous<strong>in</strong>g Developments <strong>in</strong> European Countries<br />

17