ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

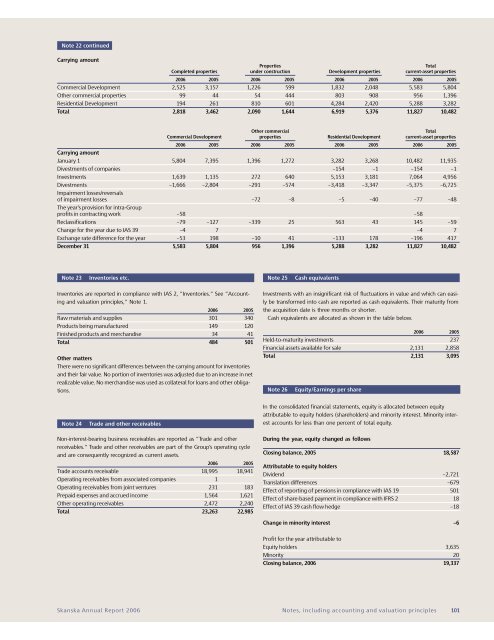

Note 22 continued<br />

Carrying amount<br />

Properties<br />

Total<br />

Completed properties under construction Development properties current-asset properties<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Commercial Development 2,525 3,157 1,226 599 1,832 2,048 5,583 5,804<br />

Other commercial properties 99 44 54 444 803 908 956 1,396<br />

Residential Development 194 261 810 601 4,284 2,420 5,288 3,282<br />

Total 2,818 3,462 2,090 1,644 6,919 5,376 11,827 10,482<br />

Other commercial<br />

Total<br />

Commercial Development properties Residential Development current-asset properties<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Carrying amount<br />

January 1 5,804 7,395 1,396 1,272 3,282 3,268 10,482 11,935<br />

Divestments of companies –154 –1 –154 –1<br />

Investments 1,639 1,135 272 640 5,153 3,181 7,064 4,956<br />

Divestments –1,666 –2,804 –291 –574 –3,418 –3,347 –5,375 –6,725<br />

Impairment losses/reversals<br />

of impairment losses –72 –8 –5 –40 –77 –48<br />

The year’s provision for intra-Group<br />

profits in contracting work –58 –58<br />

Reclassifications –79 –127 –339 25 563 43 145 –59<br />

Change for the year due to IAS 39 –4 7 –4 7<br />

Exchange rate difference for the year –53 198 –10 41 –133 178 –196 417<br />

December 31 5,583 5,804 956 1,396 5,288 3,282 11,827 10,482<br />

Note 23<br />

Inventories etc.<br />

Note 25<br />

Cash equivalents<br />

Inventories are reported in compliance with IAS 2, ”Inventories.” See ”Accounting<br />

and valuation principles,” Note 1.<br />

<strong>2006</strong> 2005<br />

Raw materials and supplies 301 340<br />

Products being manufactured 149 120<br />

Finished products and merchandise 34 41<br />

Total 484 501<br />

Investments with an insignificant risk of fluctuations in value and which can easily<br />

be transformed into cash are reported as cash equivalents. Their maturity from<br />

the acquisition date is three months or shorter.<br />

Cash equivalents are allocated as shown in the table below.<br />

<strong>2006</strong> 2005<br />

Held-to-maturity investments 237<br />

Financial assets available for sale 2,131 2,858<br />

Total 2,131 3,095<br />

Other matters<br />

There were no significant differences between the carrying amount for inventories<br />

and their fair value. No portion of inventories was adjusted due to an increase in net<br />

realizable value. No merchandise was used as collateral for loans and other obligations.<br />

Note 26 Equity/Earnings per share<br />

Note 24<br />

Trade and other receivables<br />

In the consolidated financial statements, equity is allocated between equity<br />

attributable to equity holders (shareholders) and minority interest. Minority interest<br />

accounts for less than one percent of total equity.<br />

Non-interest-bearing business receivables are reported as ”Trade and other<br />

receivables.” Trade and other receivables are part of the Group’s operating cycle<br />

and are consequently recognized as current assets.<br />

<strong>2006</strong> 2005<br />

Trade accounts receivable 18,995 18,941<br />

Operating receivables from associated companies 1<br />

Operating receivables from joint ventures 231 183<br />

Prepaid expenses and accrued income 1,564 1,621<br />

Other operating receivables 2,472 2,240<br />

Total 23,263 22,985<br />

During the year, equity changed as follows<br />

Closing balance, 2005 18,587<br />

Attributable to equity holders<br />

Dividend –2,721<br />

Translation differences –679<br />

Effect of reporting of pensions in compliance with IAS 19 501<br />

Effect of share-based payment in compliance with IFRS 2 18<br />

Effect of IAS 39 cash flow hedge –18<br />

Change in minority interest –6<br />

Profit for the year attributable to<br />

Equity holders 3,635<br />

Minority 20<br />

Closing balance, <strong>2006</strong> 19,337<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Notes, including accounting and valuation principles 101