ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

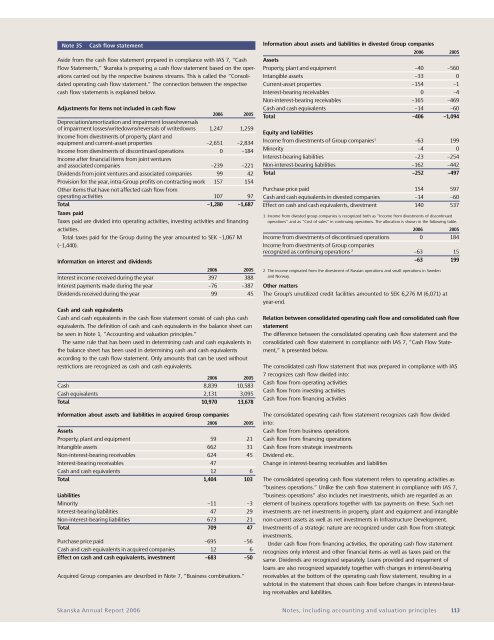

Note 35<br />

Cash flow statement<br />

Aside from the cash flow statement prepared in compliance with IAS 7, ”Cash<br />

Flow Statements,” <strong>Skanska</strong> is preparing a cash flow statement based on the operations<br />

carried out by the respective business streams. This is called the ”Consolidated<br />

operating cash flow statement.” The connection between the respective<br />

cash flow statements is explained below.<br />

Adjustments for items not included in cash flow<br />

<strong>2006</strong> 2005<br />

Depreciation/amortization and impairment losses/reversals<br />

of impairment losses/writedowns/reversals of writedowns 1,247 1,259<br />

Income from divestments of property, plant and<br />

equipment and current-asset properties –2,651 –2,834<br />

Income from divestments of discontinued operations 0 –184<br />

Income after financial items from joint ventures<br />

and associated companies –239 –221<br />

Dividends from joint ventures and associated companies 99 42<br />

Provision for the year, intra-Group profits on contracting work 157 154<br />

Other items that have not affected cash flow from<br />

operating activities 107 97<br />

Total –1,280 –1,687<br />

Taxes paid<br />

Taxes paid are divided into operating activities, investing activities and financing<br />

activities.<br />

Total taxes paid for the Group during the year amounted to SEK –1,067 M<br />

(–1,440).<br />

Information on interest and dividends<br />

<strong>2006</strong> 2005<br />

Interest income received during the year 397 388<br />

Interest payments made during the year –76 –387<br />

Dividends received during the year 99 45<br />

Cash and cash equivalents<br />

Cash and cash equivalents in the cash flow statement consist of cash plus cash<br />

equivalents. The definition of cash and cash equivalents in the balance sheet can<br />

be seen in Note 1, ”Accounting and valuation principles.”<br />

The same rule that has been used in determining cash and cash equivalents in<br />

the balance sheet has been used in determining cash and cash equivalents<br />

according to the cash flow statement. Only amounts that can be used without<br />

restrictions are recognized as cash and cash equivalents.<br />

<strong>2006</strong> 2005<br />

Cash 8,839 10,583<br />

Cash equivalents 2,131 3,095<br />

Total 10,970 13,678<br />

Information about assets and liabilities in acquired Group companies<br />

<strong>2006</strong> 2005<br />

Assets<br />

Property, plant and equipment 59 21<br />

Intangible assets 662 31<br />

Non-interest-bearing receivables 624 45<br />

Interest-bearing receivables 47<br />

Cash and cash equivalents 12 6<br />

Total 1,404 103<br />

Liabilities<br />

Minority –11 –3<br />

Interest-bearing liabilities 47 29<br />

Non-interest-bearing liabilities 673 21<br />

Total 709 47<br />

Purchase price paid –695 –56<br />

Cash and cash equivalents in acquired companies 12 6<br />

Effect on cash and cash equivalents, investment –683 –50<br />

Acquired Group companies are described in Note 7, ”Business combinations.”<br />

Information about assets and liabilities in divested Group companies<br />

<strong>2006</strong> 2005<br />

Assets<br />

Property, plant and equipment –40 –560<br />

Intangible assets –33 0<br />

Current-asset properties –154 –1<br />

Interest-bearing receivables 0 –4<br />

Non-interest-bearing receivables –165 –469<br />

Cash and cash equivalents –14 –60<br />

Total –406 –1,094<br />

Equity and liabilities<br />

Income from divestments of Group companies 1 –63 199<br />

Minority –4 0<br />

Interest-bearing liabilities –23 –254<br />

Non-interest-bearing liabilities –162 –442<br />

Total –252 –497<br />

Purchase price paid 154 597<br />

Cash and cash equivalents in divested companies –14 –60<br />

Effect on cash and cash equivalents, divestment 140 537<br />

1 Income from divested group companies is recognized both as ”Income from divestments of discontinued<br />

operations” and as ”Cost of sales” in continuing operations. The allocation is shown in the following table.<br />

<strong>2006</strong> 2005<br />

Income from divestments of discontinued operations 0 184<br />

Income from divestments of Group companies<br />

recognized as continuing operations 2 –63 15<br />

–63 199<br />

2 The income originated from the divestment of Russian operations and small operations in Sweden<br />

and Norway.<br />

Other matters<br />

The Group’s unutilized credit facilities amounted to SEK 6,276 M (6,071) at<br />

year-end.<br />

Relation between consolidated operating cash flow and consolidated cash flow<br />

statement<br />

The difference between the consolidated operating cash flow statement and the<br />

consolidated cash flow statement in compliance with IAS 7, ”Cash Flow Statement,”<br />

is presented below.<br />

The consolidated cash flow statement that was prepared in compliance with IAS<br />

7 recognizes cash flow divided into:<br />

Cash flow from operating activities<br />

Cash flow from investing activities<br />

Cash flow from financing activities<br />

The consolidated operating cash flow statement recognizes cash flow divided<br />

into:<br />

Cash flow from business operations<br />

Cash flow from financing operations<br />

Cash flow from strategic investments<br />

Dividend etc.<br />

Change in interest-bearing receivables and liabilities<br />

The consolidated operating cash flow statement refers to operating activities as<br />

”business operations.” Unlike the cash flow statement in compliance with IAS 7,<br />

”business operations” also includes net investments, which are regarded as an<br />

element of business operations together with tax payments on these. Such net<br />

investments are net investments in property, plant and equipment and intangible<br />

non-current assets as well as net investments in Infrastructure Development.<br />

Investments of a strategic nature are recognized under cash flow from strategic<br />

investments.<br />

Under cash flow from financing activities, the operating cash flow statement<br />

recognizes only interest and other financial items as well as taxes paid on the<br />

same. Dividends are recognized separately. Loans provided and repayment of<br />

loans are also recognized separately together with changes in interest-bearing<br />

receivables at the bottom of the operating cash flow statement, resulting in a<br />

subtotal in the statement that shows cash flow before changes in interest-bearing<br />

receivables and liabilities.<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Notes, including accounting and valuation principles 113