ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

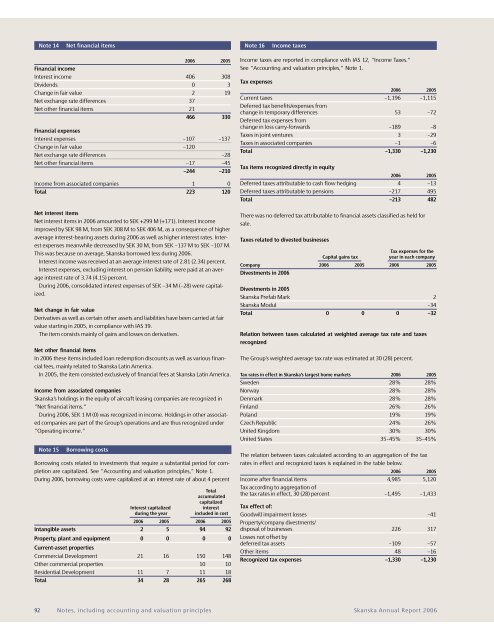

Note 14<br />

Net financial items<br />

Note 16<br />

Income taxes<br />

<strong>2006</strong> 2005<br />

Financial income<br />

Interest income 406 308<br />

Dividends 0 3<br />

Change in fair value 2 19<br />

Net exchange rate differences 37<br />

Net other financial items 21<br />

466 330<br />

Financial expenses<br />

Interest expenses –107 –137<br />

Change in fair value –120<br />

Net exchange rate differences –28<br />

Net other financial items –17 –45<br />

–244 –210<br />

Income from associated companies 1 0<br />

Total 223 120<br />

Net interest items<br />

Net interest items in <strong>2006</strong> amounted to SEK +299 M (+171). Interest income<br />

improved by SEK 98 M, from SEK 308 M to SEK 406 M, as a consequence of higher<br />

average interest-bearing assets during <strong>2006</strong> as well as higher interest rates. Interest<br />

expenses meanwhile decreased by SEK 30 M, from SEK –137 M to SEK –107 M.<br />

This was because on average, <strong>Skanska</strong> borrowed less during <strong>2006</strong>.<br />

Interest income was received at an average interest rate of 2.81 (2.34) percent.<br />

Interest expenses, excluding interest on pension liability, were paid at an average<br />

interest rate of 3.74 (4.15) percent.<br />

During <strong>2006</strong>, consolidated interest expenses of SEK –34 M (–28) were capitalized.<br />

Net change in fair value<br />

Derivatives as well as certain other assets and liabilities have been carried at fair<br />

value starting in 2005, in compliance with IAS 39.<br />

The item consists mainly of gains and losses on derivatives.<br />

Net other financial items<br />

In <strong>2006</strong> these items included loan redemption discounts as well as various financial<br />

fees, mainly related to <strong>Skanska</strong> Latin America.<br />

In 2005, the item consisted exclusively of financial fees at <strong>Skanska</strong> Latin America.<br />

Income from associated companies<br />

<strong>Skanska</strong>’s holdings in the equity of aircraft leasing companies are recognized in<br />

”Net financial items.”<br />

During <strong>2006</strong>, SEK 1 M (0) was recognized in income. Holdings in other associated<br />

companies are part of the Group’s operations and are thus recognized under<br />

”Operating income.”<br />

Note 15<br />

Borrowing costs<br />

Borrowing costs related to investments that require a substantial period for completion<br />

are capitalized. See ”Accounting and valuation principles,” Note 1.<br />

During <strong>2006</strong>, borrowing costs were capitalized at an interest rate of about 4 percent<br />

Interest capitalized<br />

during the year<br />

Total<br />

accumulated<br />

capitalized<br />

interest<br />

included in cost<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Intangible assets 2 5 94 92<br />

Property, plant and equipment 0 0 0 0<br />

Current-asset properties<br />

Commercial Development 21 16 150 148<br />

Other commercial properties 10 10<br />

Residential Development 11 7 11 18<br />

Total 34 28 265 268<br />

Income taxes are reported in compliance with IAS 12, ”Income Taxes.”<br />

See ”Accounting and valuation principles,” Note 1.<br />

Tax expenses<br />

<strong>2006</strong> 2005<br />

Current taxes –1,196 –1,115<br />

Deferred tax benefits/expenses from<br />

change in temporary differences 53 –72<br />

Deferred tax expenses from<br />

change in loss carry-forwards –189 –8<br />

Taxes in joint ventures 3 –29<br />

Taxes in associated companies –1 –6<br />

Total –1,330 –1,230<br />

Tax items recognized directly in equity<br />

<strong>2006</strong> 2005<br />

Deferred taxes attributable to cash flow hedging 4 –13<br />

Deferred taxes attributable to pensions –217 495<br />

Total –213 482<br />

There was no deferred tax attributable to financial assets classified as held for<br />

sale.<br />

Taxes related to divested businesses<br />

Capital gains tax<br />

Tax expenses for the<br />

year in each company<br />

Company <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Divestments in <strong>2006</strong><br />

Divestments in 2005<br />

<strong>Skanska</strong> Prefab Mark 2<br />

<strong>Skanska</strong> Modul –34<br />

Total 0 0 0 –32<br />

Relation between taxes calculated at weighted average tax rate and taxes<br />

recognized<br />

The Group’s weighted average tax rate was estimated at 30 (28) percent.<br />

Tax rates in effect in <strong>Skanska</strong>’s largest home markets <strong>2006</strong> 2005<br />

Sweden 28% 28%<br />

Norway 28% 28%<br />

Denmark 28% 28%<br />

Finland 26% 26%<br />

Poland 19% 19%<br />

Czech Republic 24% 26%<br />

United Kingdom 30% 30%<br />

United States 35–45% 35–45%<br />

The relation between taxes calculated according to an aggregation of the tax<br />

rates in effect and recognized taxes is explained in the table below.<br />

<strong>2006</strong> 2005<br />

Income after financial items 4,985 5,120<br />

Tax according to aggregation of<br />

the tax rates in effect, 30 (28) percent –1,495 –1,433<br />

Tax effect of:<br />

Goodwill impairment losses –41<br />

Property/company divestments/<br />

disposal of businesses 226 317<br />

Losses not offset by<br />

deferred tax assets –109 –57<br />

Other items 48 –16<br />

Recognized tax expenses –1,330 –1,230<br />

92 Notes, including accounting and valuation principles<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong>