ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

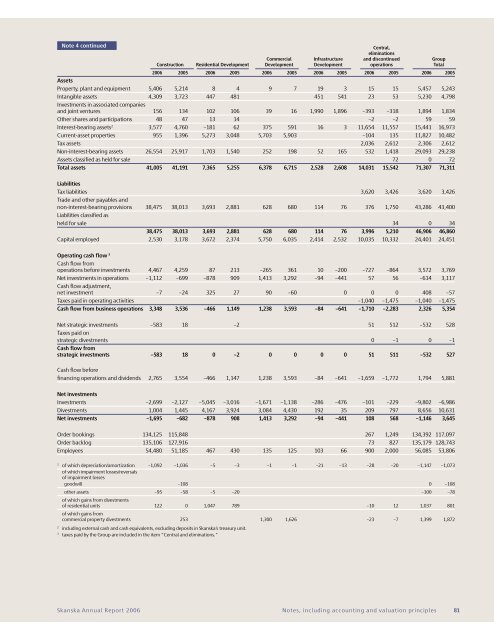

Note 4 continued<br />

Central,<br />

eliminations<br />

Commercial Infrastructure and discontinued Group<br />

Construction Residential Development Development Development operations Total<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Assets<br />

Property, plant and equipment 5,406 5,214 8 4 9 7 19 3 15 15 5,457 5,243<br />

Intangible assets 4,309 3,723 447 481 451 541 23 53 5,230 4,798<br />

Investments in associated companies<br />

and joint ventures 156 134 102 106 39 16 1,990 1,896 –393 –318 1,894 1,834<br />

Other shares and participations 48 47 13 14 –2 –2 59 59<br />

Interest-bearing assets 2 3,577 4,760 –181 62 375 591 16 3 11,654 11,557 15,441 16,973<br />

Current-asset properties 955 1,396 5,273 3,048 5,703 5,903 –104 135 11,827 10,482<br />

Tax assets 2,036 2,612 2,306 2,612<br />

Non-interest-bearing assets 26,554 25,917 1,703 1,540 252 198 52 165 532 1,418 29,093 29,238<br />

Assets classified as held for sale 72 0 72<br />

Total assets 41,005 41,191 7,365 5,255 6,378 6,715 2,528 2,608 14,031 15,542 71,307 71,311<br />

Liabilities<br />

Tax liabilities 3,620 3,426 3,620 3,426<br />

Trade and other payables and<br />

non-interest-bearing provisions 38,475 38,013 3,693 2,881 628 680 114 76 376 1,750 43,286 43,400<br />

Liabilities classified as<br />

held for sale 34 0 34<br />

38,475 38,013 3,693 2,881 628 680 114 76 3,996 5,210 46,906 46,860<br />

Capital employed 2,530 3,178 3,672 2,374 5,750 6,035 2,414 2,532 10,035 10,332 24,401 24,451<br />

Operating cash flow 3<br />

Cash flow from<br />

operations before investments 4,467 4,259 87 213 –265 361 10 –200 –727 –864 3,572 3,769<br />

Net investments in operations –1,112 –699 –878 909 1,413 3,292 –94 –441 57 56 –614 3,117<br />

Cash flow adjustment,<br />

net investment –7 –24 325 27 90 –60 0 0 0 408 –57<br />

Taxes paid in operating activities –1,040 –1,475 –1,040 –1,475<br />

Cash flow from business operations 3,348 3,536 –466 1,149 1,238 3,593 –84 –641 –1,710 –2,283 2,326 5,354<br />

Net strategic investments –583 18 –2 51 512 –532 528<br />

Taxes paid on<br />

strategic divestments 0 –1 0 –1<br />

Cash flow from<br />

strategic investments –583 18 0 –2 0 0 0 0 51 511 –532 527<br />

Cash flow before<br />

financing operations and dividends 2,765 3,554 –466 1,147 1,238 3,593 –84 –641 –1,659 –1,772 1,794 5,881<br />

Net investments<br />

Investments –2,699 –2,127 –5,045 –3,016 –1,671 –1,138 –286 –476 –101 –229 –9,802 –6,986<br />

Divestments 1,004 1,445 4,167 3,924 3,084 4,430 192 35 209 797 8,656 10,631<br />

Net investments –1,695 –682 –878 908 1,413 3,292 –94 –441 108 568 –1,146 3,645<br />

Order bookings 134,125 115,848 267 1,249 134,392 117,097<br />

Order backlog 135,106 127,916 73 827 135,179 128,743<br />

Employees 54,480 51,185 467 430 135 125 103 66 900 2,000 56,085 53,806<br />

1<br />

of which depreciation/amortization –1,092 –1,036 –5 –3 –1 –1 –21 –13 –28 –20 –1,147 –1,073<br />

of which impairment losses/reversals<br />

of impairment losses<br />

goodwill –108 0 –108<br />

other assets –95 –58 –5 –20 –100 –78<br />

of which gains from divestments<br />

of residential units 122 0 1,047 789 –10 12 1,037 801<br />

of which gains from<br />

commercial property divestments 253 1,300 1,626 –23 –7 1,399 1,872<br />

2<br />

including external cash and cash equivalents, excluding deposits in <strong>Skanska</strong>’s treasury unit.<br />

3<br />

taxes paid by the Group are included in the item ”Central and eliminations.”<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Notes, including accounting and valuation principles 81