ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

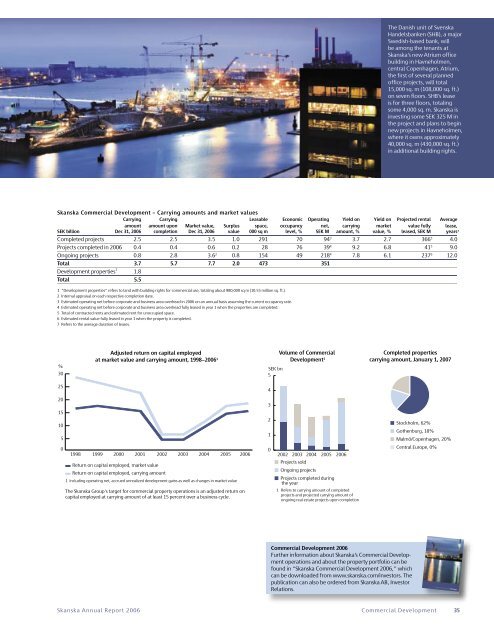

The Danish unit of Svenska<br />

Handelsbanken (SHB), a major<br />

Swedish-based bank, will<br />

be among the tenants at<br />

<strong>Skanska</strong>’s new Atrium office<br />

building in Havneholmen,<br />

central Copenhagen. Atrium,<br />

the first of several planned<br />

office projects, will total<br />

15,000 sq. m (108,000 sq. ft.)<br />

on seven floors. SHB’s lease<br />

is for three floors, totaling<br />

some 4,000 sq. m. <strong>Skanska</strong> is<br />

investing some SEK 325 M in<br />

the project and plans to begin<br />

new projects in Havneholmen,<br />

where it owns approximately<br />

40,000 sq. m (430,000 sq. ft.)<br />

in additional building rights.<br />

%<br />

30<br />

Justerad avkastning på sysselsatt kapital<br />

till marknadsvärde och bokfört värde 1998−<strong>2006</strong> 1)<br />

Volym i projektutveckling<br />

av kommersiella fastigheter 1)<br />

Färdigställda fastigheter<br />

bokfört värde, 1 januari 2007<br />

<strong>Skanska</strong> 25 Commercial Development – Carrying amounts and market values<br />

Carrying Carrying Leasable 4 Economic Operating Yield on Yield on Projected rental Average<br />

20<br />

amount amount upon Market value, Surplus space, occupancy net, carrying market value fully lease,<br />

SEK billion Dec 31, <strong>2006</strong> completion Dec 31, <strong>2006</strong> value 000 sq m level, % SEK M amount, % value, % leased, SEK M years7<br />

3<br />

10<br />

0.2<br />

Stockholm, 62%<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Commercial Development 35<br />

Gothenburg, 18%<br />

5<br />

0.1<br />

Malmö/Copenhagen, 20%<br />

0<br />

0<br />

• Central Europe, 0%<br />

Completed 15 projects 2.5 2.5 3.5 2 1.0 291 70 94 3 3.7 2.7 366 5 4.0<br />

Projects completed in <strong>2006</strong> 0.4 0.4 0.6 2 0.2 28 2<br />

76 39 4 9.2 6.8 41 5 9.0<br />

Ongoing 10 projects 0.8 2.8 3.6 2 0.8 154 49 218 4 7.8 6.1 Stockholm, 62%<br />

237 6 12.0<br />

Total 3.7 5.7 7.7 2 2.0 473 351 Göteborg, 18%<br />

1<br />

4<br />

5<br />

Development properties 1 1.8<br />

Malmö/Köpenhamn, 20%<br />

0<br />

Total 5.5<br />

0<br />

•<br />

Centraleuropa, 0%<br />

1998 1999 2000 2001 2002 2003 2004 2005 <strong>2006</strong><br />

2002 2003 2004 2005 <strong>2006</strong><br />

1 “Development properties” refers to land with building rights for commercial use, totaling about 980,000 sq m (10.55 million sq. ft.).<br />

Avkastning på sysselsatt kapital, marknadsvärde<br />

Sålda projekt<br />

2 Internal appraisal on each respective completion date.<br />

3 Estimated Avkastning operating på net sysselsatt before corporate kapital, and bokfört business värde area overhead in <strong>2006</strong> on an annual basis assuming the current occupancy Pågående projekt<br />

rate.<br />

4 Estimated operating net before corporate and business area overhead fully leased in year 1 when the properties are completed.<br />

1) Inklusive driftnetto, upparbetade orealiserade utvecklingsvinster och förändringar i marknadsvärde •<br />

Projekt färdigställda under året<br />

5 Total of contracted rents and estimated rent for unoccupied space.<br />

1) Avser bokfört värde i färdigställda<br />

6 Estimated rental value fully leased in year 1 when the property is completed.<br />

<strong>Skanska</strong>koncernens mål för den kommersiella fastighetsverksamheten är en justerad<br />

projekt och bedömt bokfört värde vid<br />

7 Refers to the average duration of leases.<br />

färdigställande i pågående fastighetsprojekt<br />

avkastning på sysselsatt kapital till bokfört värde om minst 15% över en konjunkturcykel.<br />

Adjusted return on capital employed<br />

Volume of Commercial<br />

Completed properties<br />

at market value and carrying amount, 1998−<strong>2006</strong> 1<br />

Development 1<br />

carrying amount, January 1, 2007<br />

%<br />

SEK bn<br />

30<br />

5<br />

25<br />

4<br />

20<br />

3<br />

15<br />

2<br />

10<br />

Stockholm, 62%<br />

Gothenburg, 18%<br />

1<br />

5<br />

Malmö/Copenhagen, 20%<br />

0<br />

•<br />

Central Europe, 0%<br />

0<br />

1998 1999 2000 2001 2002 2003 2004 2005 <strong>2006</strong><br />

2002 2003 2004 2005 <strong>2006</strong><br />

Return on capital employed, market value<br />

Projects sold<br />

Return on capital employed, carrying amount<br />

Ongoing projects<br />

1 Including operating net, accrued unrealized development gains as well as changes in market value •<br />

Projects completed during<br />

the year<br />

The <strong>Skanska</strong> Group's target for commercial property operations is an adjusted return on<br />

1 Refers to carrying amount of completed<br />

projects and projected carrying amount of<br />

capital employed at carrying amount of at least 15 percent over a business cycle.<br />

ongoing real estate projects upon completion<br />

Adjusted return on capital employed<br />

Volume of Commercial<br />

Completed properties<br />

at market value and carrying amount, 1998−<strong>2006</strong> 1<br />

Development 1<br />

carrying amount, January 1, 2007<br />

%<br />

USD<br />

Commercial<br />

bn<br />

Development <strong>2006</strong><br />

30<br />

Further information about <strong>Skanska</strong>’s Commercial Development<br />

operations and about the property portfolio can be<br />

0.6<br />

25<br />

0.5 found in “<strong>Skanska</strong> Commercial Development <strong>2006</strong>,” which<br />

can be downloaded from www.skanska.com/investors. The<br />

20<br />

0.4 publication can also be ordered from <strong>Skanska</strong> AB, Investor<br />

Relations.<br />

15<br />

0.3<br />

1998 1999 2000 2001 2002 2003 2004 2005 <strong>2006</strong><br />

2002 2003 2004 2005 <strong>2006</strong><br />

Mdr kr<br />

5