ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

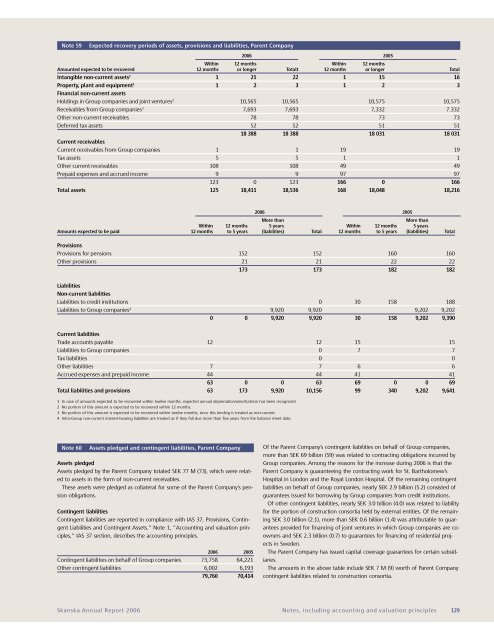

Note 59<br />

Expected recovery periods of assets, provisions and liabilities, Parent Company<br />

<strong>2006</strong> 2005<br />

Within 12 months Within 12 months<br />

Amounted expected to be recovered 12 months or longer Totalt 12 months or longer Total<br />

Intangible non-current assets 1 1 21 22 1 15 16<br />

Property, plant and equipment 1 1 2 3 1 2 3<br />

Financial non-current assets<br />

Holdings in Group companies and joint ventures 2 10,565 10,565 10,575 10,575<br />

Receivables from Group companies 3 7,693 7,693 7,332 7.332<br />

Other non-current receivables 78 78 73 73<br />

Deferred tax assets 52 52 51 51<br />

18 388 18 388 18 031 18 031<br />

Current receivables<br />

Current receivables from Group companies 1 1 19 19<br />

Tax assets 5 5 1 1<br />

Other current receivables 108 108 49 49<br />

Prepaid expenses and accrued income 9 9 97 97<br />

123 0 123 166 0 166<br />

Total assets 125 18,411 18,536 168 18,048 18,216<br />

<strong>2006</strong> 2005<br />

More than<br />

More than<br />

Within 12 months 5 years Within 12 months 5 years<br />

Amounts expected to be paid 12 months to 5 years (liabilities) Total 12 months to 5 years (liabilities) Total<br />

Provisions<br />

Provisions for pensions 152 152 160 160<br />

Other provisions 21 21 22 22<br />

173 173 182 182<br />

Liabilities<br />

Non-current liabilities<br />

Liabilities to credit institutions 0 30 158 188<br />

Liabilities to Group companies 4 9,920 9,920 9,202 9,202<br />

0 0 9,920 9,920 30 158 9,202 9,390<br />

Current liabilities<br />

Trade accounts payable 12 12 15 15<br />

Liabilities to Group companies 0 7 7<br />

Tax liabilities 0 0<br />

Other liabilities 7 7 6 6<br />

Accrued expenses and prepaid income 44 44 41 41<br />

63 0 0 63 69 0 0 69<br />

Total liabilities and provisions 63 173 9,920 10,156 99 340 9,202 9,641<br />

1 In case of amounts expected to be recovered within twelve months, expected annual depreciation/amortization has been recognized.<br />

2 No portion of this amount is expected to be recovered within 12 months.<br />

3 No portion of this amount is expected to be recovered within twelve months, since this lending is treated as non-current.<br />

4 Intra-Group non-current interest-bearing liabilities are treated as if they fall due more than five years from the balance sheet date.<br />

Note 60<br />

Assets pledged and contingent liabilities, Parent Company<br />

Assets pledged<br />

Assets pledged by the Parent Company totaled SEK 77 M (73), which were related<br />

to assets in the form of non-current receivables.<br />

These assets were pledged as collateral for some of the Parent Company’s pension<br />

obligations.<br />

Contingent liabilities<br />

Contingent liabilities are reported in compliance with IAS 37, Provisions, Contingent<br />

Liabilities and Contingent Assets.” Note 1, ”Accounting and valuation principles,”<br />

IAS 37 section, describes the accounting principles.<br />

<strong>2006</strong> 2005<br />

Contingent liabilities on behalf of Group companies 73,758 64,221<br />

Other contingent liabilities 6,002 6,193<br />

79,760 70,414<br />

Of the Parent Company’s contingent liabilities on behalf of Group companies,<br />

more than SEK 69 billion (59) was related to contracting obligations incurred by<br />

Group companies. Among the reasons for the increase during <strong>2006</strong> is that the<br />

Parent Company is guaranteeing the contracting work for St. Bartholomew’s<br />

Hospital in London and the Royal London Hospital. Of the remaining contingent<br />

liabilities on behalf of Group companies, nearly SEK 2.9 billion (5.2) consisted of<br />

guarantees issued for borrowing by Group companies from credit institutions.<br />

Of other contingent liabilities, nearly SEK 3.0 billion (4.0) was related to liability<br />

for the portion of construction consortia held by external entities. Of the remaining<br />

SEK 3.0 billion (2.1), more than SEK 0.6 billion (1.4) was attributable to guarantees<br />

provided for financing of joint ventures in which Group companies are coowners<br />

and SEK 2.3 billion (0.7) to guarantees for financing of residential projects<br />

in Sweden.<br />

The Parent Company has issued capital coverage guarantees for certain subsidiaries.<br />

The amounts in the above table include SEK 7 M (9) worth of Parent Company<br />

contingent liabilities related to construction consortia.<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Notes, including accounting and valuation principles 129