ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

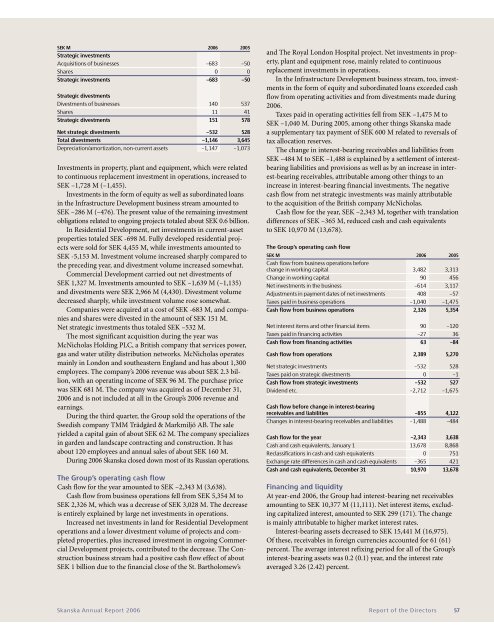

SEK M <strong>2006</strong> 2005<br />

Strategic investments<br />

Acquisitions of businesses –683 –50<br />

Shares 0 0<br />

Strategic investments –683 –50<br />

Strategic divestments<br />

Divestments of businesses 140 537<br />

Shares 11 41<br />

Strategic divestments 151 578<br />

Net strategic divestments –532 528<br />

Total divestments –1,146 3,645<br />

Depreciation/amortization, non-current assets –1,147 –1,073<br />

Investments in property, plant and equipment, which were related<br />

to continuous replacement investment in operations, increased to<br />

SEK –1,728 M (–1,455).<br />

Investments in the form of equity as well as subordinated loans<br />

in the Infrastructure Development business stream amounted to<br />

SEK –286 M (–476). The present value of the remaining investment<br />

obligations related to ongoing projects totaled about SEK 0.6 billion.<br />

In Residential Development, net investments in current-asset<br />

properties totaled SEK -698 M. Fully developed residential projects<br />

were sold for SEK 4,455 M, while investments amounted to<br />

SEK -5,153 M. Investment volume increased sharply compared to<br />

the preceding year, and divestment volume increased somewhat.<br />

Commercial Development carried out net divestments of<br />

SEK 1,327 M. Investments amounted to SEK –1,639 M (–1,135)<br />

and divestments were SEK 2,966 M (4,430). Divestment volume<br />

decreased sharply, while investment volume rose somewhat.<br />

Companies were acquired at a cost of SEK -683 M, and companies<br />

and shares were divested in the amount of SEK 151 M.<br />

Net strategic investments thus totaled SEK –532 M.<br />

The most significant acquisition during the year was<br />

McNicholas Holding PLC, a British company that services power,<br />

gas and water utility distribution networks. McNicholas operates<br />

mainly in London and southeastern England and has about 1,300<br />

employees. The company’s <strong>2006</strong> revenue was about SEK 2.3 billion,<br />

with an operating income of SEK 96 M. The purchase price<br />

was SEK 681 M. The company was acquired as of December 31,<br />

<strong>2006</strong> and is not included at all in the Group’s <strong>2006</strong> revenue and<br />

earnings.<br />

During the third quarter, the Group sold the operations of the<br />

Swedish company TMM Trädgård & Markmiljö AB. The sale<br />

yielded a capital gain of about SEK 62 M. The company specializes<br />

in garden and landscape contracting and construction. It has<br />

about 120 employees and annual sales of about SEK 160 M.<br />

During <strong>2006</strong> <strong>Skanska</strong> closed down most of its Russian operations.<br />

The Group’s operating cash flow<br />

Cash flow for the year amounted to SEK –2,343 M (3,638).<br />

Cash flow from business operations fell from SEK 5,354 M to<br />

SEK 2,326 M, which was a decrease of SEK 3,028 M. The decrease<br />

is entirely explained by large net investments in operations.<br />

Increased net investments in land for Residential Development<br />

operations and a lower divestment volume of projects and completed<br />

properties, plus increased investment in ongoing Commercial<br />

Development projects, contributed to the decrease. The Construction<br />

business stream had a positive cash flow effect of about<br />

SEK 1 billion due to the financial close of the St. Bartholomew’s<br />

and The Royal London Hospital project. Net investments in property,<br />

plant and equipment rose, mainly related to continuous<br />

replacement investments in operations.<br />

In the Infrastructure Development business stream, too, investments<br />

in the form of equity and subordinated loans exceeded cash<br />

flow from operating activities and from divestments made during<br />

<strong>2006</strong>.<br />

Taxes paid in operating activities fell from SEK –1,475 M to<br />

SEK –1,040 M. During 2005, among other things <strong>Skanska</strong> made<br />

a supplementary tax payment of SEK 600 M related to reversals of<br />

tax allocation reserves.<br />

The change in interest-bearing receivables and liabilities from<br />

SEK –484 M to SEK –1,488 is explained by a settlement of interestbearing<br />

liabilities and provisions as well as by an increase in interest-bearing<br />

receivables, attributable among other things to an<br />

increase in interest-bearing financial investments. The negative<br />

cash flow from net strategic investments was mainly attributable<br />

to the acquisition of the British company McNicholas.<br />

Cash flow for the year, SEK –2,343 M, together with translation<br />

differences of SEK –365 M, reduced cash and cash equivalents<br />

to SEK 10,970 M (13,678).<br />

The Group’s operating cash flow<br />

SEK M <strong>2006</strong> 2005<br />

Cash flow from business operations before<br />

change in working capital 3,482 3,313<br />

Change in working capital 90 456<br />

Net investments in the business –614 3,117<br />

Adjustments in payment dates of net investments 408 –57<br />

Taxes paid in business operations –1,040 –1,475<br />

Cash flow from business operations 2,326 5,354<br />

Net interest items and other financial items 90 –120<br />

Taxes paid in financing activities –27 36<br />

Cash flow from financing activities 63 –84<br />

Cash flow from operations 2,389 5,270<br />

Net strategic investments –532 528<br />

Taxes paid on strategic divestments 0 –1<br />

Cash flow from strategic investments –532 527<br />

Dividend etc. –2,712 –1,675<br />

Cash flow before change in interest-bearing<br />

receivables and liabilities –855 4,122<br />

Changes in interest-bearing receivables and liabilities –1,488 –484<br />

Cash flow for the year –2,343 3,638<br />

Cash and cash equivalents, January 1 13,678 8,868<br />

Reclassifications in cash and cash equivalents 0 751<br />

Exchange rate differences in cash and cash equivalents –365 421<br />

Cash and cash equivalents, December 31 10,970 13,678<br />

Financing and liquidity<br />

At year-end <strong>2006</strong>, the Group had interest-bearing net receivables<br />

amounting to SEK 10,377 M (11,111). Net interest items, excluding<br />

capitalized interest, amounted to SEK 299 (171). The change<br />

is mainly attributable to higher market interest rates.<br />

Interest-bearing assets decreased to SEK 15,441 M (16,975).<br />

Of these, receivables in foreign currencies accounted for 61 (61)<br />

percent. The average interest refixing period for all of the Group’s<br />

interest-bearing assets was 0.2 (0.1) year, and the interest rate<br />

averaged 3.26 (2.42) percent.<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Report of the Directors 57