ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

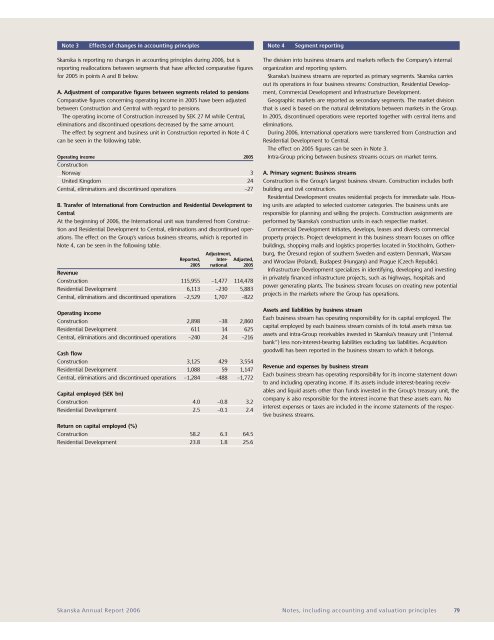

Note 3<br />

Effects of changes in accounting principles<br />

Note 4<br />

Segment reporting<br />

<strong>Skanska</strong> is reporting no changes in accounting principles during <strong>2006</strong>, but is<br />

reporting reallocations between segments that have affected comparative figures<br />

for 2005 in points A and B below.<br />

A. Adjustment of comparative figures between segments related to pensions<br />

Comparative figures concerning operating income in 2005 have been adjusted<br />

between Construction and Central with regard to pensions.<br />

The operating income of Construction increased by SEK 27 M while Central,<br />

eliminations and discontinued operations decreased by the same amount.<br />

The effect by segment and business unit in Construction reported in Note 4 C<br />

can be seen in the following table.<br />

Operating income 2005<br />

Construction<br />

Norway 3<br />

United Kingdom 24<br />

Central, eliminations and discontinued operations –27<br />

B. Transfer of International from Construction and Residential Development to<br />

Central<br />

At the beginning of <strong>2006</strong>, the International unit was transferred from Construction<br />

and Residential Development to Central, eliminations and discontinued operations.<br />

The effect on the Group’s various business streams, which is reported in<br />

Note 4, can be seen in the following table.<br />

Adjustment,<br />

Reported, Inter- Adjusted,<br />

2005 national 2005<br />

Revenue<br />

Construction 115,955 –1,477 114,478<br />

Residential Development 6,113 –230 5,883<br />

Central, eliminations and discontinued operations –2,529 1,707 –822<br />

Operating income<br />

Construction 2,898 –38 2,860<br />

Residential Development 611 14 625<br />

Central, eliminations and discontinued operations –240 24 –216<br />

Cash flow<br />

Construction 3,125 429 3,554<br />

Residential Development 1,088 59 1,147<br />

Central, eliminations and discontinued operations –1,284 –488 –1,772<br />

Capital employed (SEK bn)<br />

Construction 4.0 –0.8 3.2<br />

Residential Development 2.5 –0.1 2.4<br />

The division into business streams and markets reflects the Company’s internal<br />

organization and reporting system.<br />

<strong>Skanska</strong>’s business streams are reported as primary segments. <strong>Skanska</strong> carries<br />

out its operations in four business streams: Construction, Residential Development,<br />

Commercial Development and Infrastructure Development.<br />

Geographic markets are reported as secondary segments. The market division<br />

that is used is based on the natural delimitations between markets in the Group.<br />

In 2005, discontinued operations were reported together with central items and<br />

eliminations.<br />

During <strong>2006</strong>, International operations were transferred from Construction and<br />

Residential Development to Central.<br />

The effect on 2005 figures can be seen in Note 3.<br />

Intra-Group pricing between business streams occurs on market terms.<br />

A. Primary segment: Business streams<br />

Construction is the Group’s largest business stream. Construction includes both<br />

building and civil construction.<br />

Residential Development creates residential projects for immediate sale. Housing<br />

units are adapted to selected customer categories. The business units are<br />

responsible for planning and selling the projects. Construction assignments are<br />

performed by <strong>Skanska</strong>’s construction units in each respective market.<br />

Commercial Development initiates, develops, leases and divests commercial<br />

property projects. Project development in this business stream focuses on office<br />

buildings, shopping malls and logistics properties located in Stockholm, Gothenburg,<br />

the Öresund region of southern Sweden and eastern Denmark, Warsaw<br />

and Wroclaw (Poland), Budapest (Hungary) and Prague (Czech Republic).<br />

Infrastructure Development specializes in identifying, developing and investing<br />

in privately financed infrastructure projects, such as highways, hospitals and<br />

power generating plants. The business stream focuses on creating new potential<br />

projects in the markets where the Group has operations.<br />

Assets and liabilities by business stream<br />

Each business stream has operating responsibility for its capital employed. The<br />

capital employed by each business stream consists of its total assets minus tax<br />

assets and intra-Group receivables invested in <strong>Skanska</strong>’s treasury unit (”internal<br />

bank”) less non-interest-bearing liabilities excluding tax liabilities. Acquisition<br />

goodwill has been reported in the business stream to which it belongs.<br />

Revenue and expenses by business stream<br />

Each business stream has operating responsibility for its income statement down<br />

to and including operating income. If its assets include interest-bearing receivables<br />

and liquid assets other than funds invested in the Group’s treasury unit, the<br />

company is also responsible for the interest income that these assets earn. No<br />

interest expenses or taxes are included in the income statements of the respective<br />

business streams.<br />

Return on capital employed (%)<br />

Construction 58.2 6.3 64.5<br />

Residential Development 23.8 1.8 25.6<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Notes, including accounting and valuation principles 79