ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

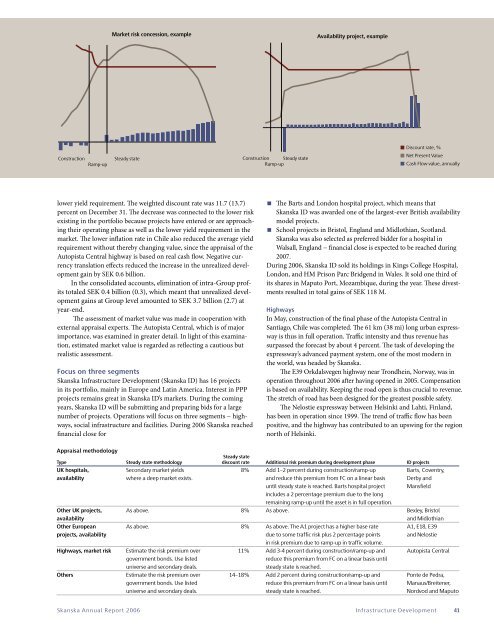

Market risk concession, example<br />

Availability project, example<br />

Construction<br />

Ramp-up<br />

Steady state<br />

Construction Steady state<br />

Ramp-up<br />

Discount rate, %<br />

Net Present Value<br />

•<br />

Cash Flow value, annually<br />

lower yield requirement. The weighted discount rate was 11.7 (13.7)<br />

percent on December 31. The decrease was connected to the lower risk<br />

existing in the portfolio because projects have entered or are approaching<br />

their operating phase as well as the lower yield requirement in the<br />

market. The lower inflation rate in Chile also reduced the average yield<br />

requirement without thereby changing value, since the appraisal of the<br />

Autopista Central highway is based on real cash flow. Negative currency<br />

translation effects reduced the increase in the unrealized development<br />

gain by SEK 0.6 billion.<br />

In the consolidated accounts, elimination of intra-Group profits<br />

totaled SEK 0.4 billion (0.3), which meant that unrealized development<br />

gains at Group level amounted to SEK 3.7 billion (2.7) at<br />

year-end.<br />

The assessment of market value was made in cooperation with<br />

external appraisal experts. The Autopista Central, which is of major<br />

importance, was examined in greater detail. In light of this examination,<br />

estimated market value is regarded as reflecting a cautious but<br />

realistic assessment.<br />

Focus on three segments<br />

<strong>Skanska</strong> Infrastructure Development (<strong>Skanska</strong> ID) has 16 projects<br />

in its portfolio, mainly in Europe and Latin America. Interest in PPP<br />

projects remains great in <strong>Skanska</strong> ID’s markets. During the coming<br />

years, <strong>Skanska</strong> ID will be submitting and preparing bids for a large<br />

number of projects. Operations will focus on three segments − highways,<br />

social infrastructure and facilities. During <strong>2006</strong> <strong>Skanska</strong> reached<br />

financial close for<br />

• The Barts and London hospital project, which means that<br />

<strong>Skanska</strong> ID was awarded one of the largest-ever British availability<br />

model projects.<br />

• School projects in Bristol, England and Midlothian, Scotland.<br />

<strong>Skanska</strong> was also selected as preferred bidder for a hospital in<br />

Walsall, England − financial close is expected to be reached during<br />

2007.<br />

During <strong>2006</strong>, <strong>Skanska</strong> ID sold its holdings in Kings College Hospital,<br />

London, and HM Prison Parc Bridgend in Wales. It sold one third of<br />

its shares in Maputo Port, Mozambique, during the year. These divestments<br />

resulted in total gains of SEK 118 M.<br />

Highways<br />

In May, construction of the final phase of the Autopista Central in<br />

Santiago, Chile was completed. The 61 km (38 mi) long urban expressway<br />

is thus in full operation. Traffic intensity and thus revenue has<br />

surpassed the forecast by about 4 percent. The task of developing the<br />

expressway’s advanced payment system, one of the most modern in<br />

the world, was headed by <strong>Skanska</strong>.<br />

The E39 Orkdalsvegen highway near Trondhein, Norway, was in<br />

operation throughout <strong>2006</strong> after having opened in 2005. Compensation<br />

is based on availability. Keeping the road open is thus crucial to revenue.<br />

The stretch of road has been designed for the greatest possible safety.<br />

The Nelostie expressway between Helsinki and Lahti, Finland,<br />

has been in operation since 1999. The trend of traffic flow has been<br />

positive, and the highway has contributed to an upswing for the region<br />

north of Helsinki.<br />

Appraisal methodology<br />

Steady state<br />

Type Steady state methodology discount rate Additional risk premium during development phase ID projects<br />

UK hospitals, Secondary market yields 8% Add 1–2 percent during construction/ramp-up Barts, Coventry,<br />

availability where a deep market exists. and reduce this premium from FC on a linear basis Derby and<br />

until steady state is reached. Barts hospital project Mansfield<br />

includes a 2 percentage premium due to the long<br />

remaining ramp-up until the asset is in full operation.<br />

Other UK projects, As above. 8% As above. Bexley, Bristol<br />

availability<br />

and Midlothian<br />

Other European As above. 8% As above. The A1 project has a higher base rate A1, E18, E39<br />

projects, availability due to some traffic risk plus 2 percentage points and Nelostie<br />

in risk premium due to ramp-up in traffic volume.<br />

Highways, market risk Estimate the risk premium over 11% Add 3-4 percent during construction/ramp-up and Autopista Central<br />

government bonds. Use listed<br />

reduce this premium from FC on a linear basis until<br />

universe and secondary deals.<br />

steady state is reached.<br />

Others Estimate the risk premium over 14–18% Add 2 percent during construction/ramp-up and Ponte de Pedra,<br />

government bonds. Use listed reduce this premium from FC on a linear basis until Manaus/Breitener,<br />

universe and secondary deals. steady state is reached. Nordvod and Maputo<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong> Infrastructure Development 41