ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

ANNUAL REPORT 2006 - Skanska

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

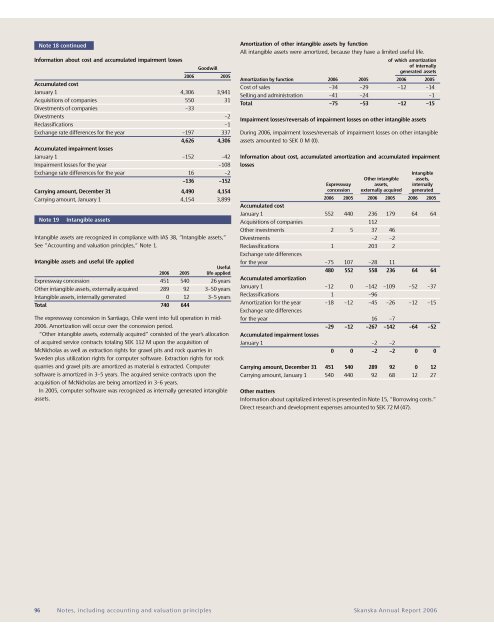

Note 18 continued<br />

Information about cost and accumulated impairment losses<br />

Goodwill<br />

<strong>2006</strong> 2005<br />

Accumulated cost<br />

January 1 4,306 3,941<br />

Acquisitions of companies 550 31<br />

Divestments of companies –33<br />

Divestments –2<br />

Reclassifications –1<br />

Exchange rate differences for the year –197 337<br />

4,626 4,306<br />

Accumulated impairment losses<br />

January 1 –152 –42<br />

Impairment losses for the year –108<br />

Exchange rate differences for the year 16 –2<br />

–136 –152<br />

Carrying amount, December 31 4,490 4,154<br />

Carrying amount, January 1 4,154 3,899<br />

Note 19<br />

Intangible assets<br />

Intangible assets are recognized in compliance with IAS 38, ”Intangible assets,”<br />

See ”Accounting and valuation principles,” Note 1.<br />

Intangible assets and useful life applied<br />

Useful<br />

<strong>2006</strong> 2005 life applied<br />

Expressway concession 451 540 26 years<br />

Other intangible assets, externally acquired 289 92 3–50 years<br />

Intangible assets, internally generated 0 12 3–5 years<br />

Total 740 644<br />

The expressway concession in Santiago, Chile went into full operation in mid-<br />

<strong>2006</strong>. Amortization will occur over the concession period.<br />

”Other intangible assets, externally acquired” consisted of the year’s allocation<br />

of acquired service contracts totaling SEK 112 M upon the acquisition of<br />

McNicholas as well as extraction rights for gravel pits and rock quarries in<br />

Sweden plus utilization rights for computer software. Extraction rights for rock<br />

quarries and gravel pits are amortized as material is extracted. Computer<br />

software is amortized in 3–5 years. The acquired service contracts upon the<br />

acquisition of McNicholas are being amortized in 3–6 years.<br />

In 2005, computer software was recognized as internally generated intangible<br />

assets.<br />

Amortization of other intangible assets by function<br />

All intangible assets were amortized, because they have a limited useful life.<br />

of which amortization<br />

of internally<br />

generated assets<br />

Amortization by function <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Cost of sales –34 –29 –12 –14<br />

Selling and administration –41 –24 –1<br />

Total –75 –53 –12 –15<br />

Impairment losses/reversals of impairment losses on other intangible assets<br />

During <strong>2006</strong>, impairment losses/reversals of impairment losses on other intangible<br />

assets amounted to SEK 0 M (0).<br />

Information about cost, accumulated amortization and accumulated impairment<br />

losses<br />

Intangible<br />

Other intangible assets,<br />

Expressway assets, internally<br />

concession externally acquired generated<br />

<strong>2006</strong> 2005 <strong>2006</strong> 2005 <strong>2006</strong> 2005<br />

Accumulated cost<br />

January 1 552 440 236 179 64 64<br />

Acquisitions of companies 112<br />

Other investments 2 5 37 46<br />

Divestments –2 –2<br />

Reclassifications 1 203 2<br />

Exchange rate differences<br />

for the year –75 107 –28 11<br />

480 552 558 236 64 64<br />

Accumulated amortization<br />

January 1 –12 0 –142 –109 –52 –37<br />

Reclassifications 1 –96<br />

Amortization for the year –18 –12 –45 –26 –12 –15<br />

Exchange rate differences<br />

for the year 16 –7<br />

–29 –12 –267 –142 –64 –52<br />

Accumulated impairment losses<br />

January 1 –2 –2<br />

0 0 –2 –2 0 0<br />

Carrying amount, December 31 451 540 289 92 0 12<br />

Carrying amount, January 1 540 440 92 68 12 27<br />

Other matters<br />

Information about capitalized interest is presented in Note 15, ”Borrowing costs.”<br />

Direct research and development expenses amounted to SEK 72 M (47).<br />

96 Notes, including accounting and valuation principles<br />

<strong>Skanska</strong> Annual Report <strong>2006</strong>